- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

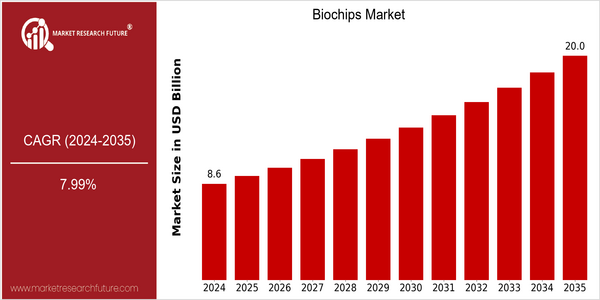

| Year | Value |

|---|---|

| 2024 | USD 8.59 Billion |

| 2035 | USD 20.0 Billion |

| CAGR (2025-2035) | 7.99 % |

Note – Market size depicts the revenue generated over the financial year

Biochips are a rapidly growing market, with a current market size of $ 8,590,902,020 in 2024, and a projected market size of $ 20,090,920,000 in 2035. The compound annual growth rate (CAGR) for this market is 7.89 % from 2025 to 2035. The demand for individualized medicine, the development of genomics and the increasing occurrence of chronic diseases are the main reasons for this growth. Also, the integration of biochips into the drug discovery and development process is making them more useful and thus increasing the market growth. The development of microarray and lab-on-a-chip technology is also transforming the biochip market and enabling faster and more accurate diagnosis. Companies such as Illumina, Agilent, and Thermo Fisher Scientific are at the forefront of this development and are engaging in strategic initiatives such as partnerships, R & D, and the launch of new products. These efforts are not only increasing their competitiveness, but also contribute to the overall growth of the biochip market.

Regional Market Size

Regional Deep Dive

The biochips market is experiencing significant growth in various regions, mainly due to the advancement in biotechnology, the increasing demand for individualized medicine, and the rising number of chronic diseases. Each region is characterized by its own characteristics, influenced by local regulations, technological innovations, and market dynamics. North America is the leader in technological innovation and research and development, while Europe focuses on regulations and ethical issues. Asia-Pacific is a rapidly emerging region, due to the large population and increasing investment in health care. Latin America and the Middle East and Africa are gradually adopting biochips, but at a lower speed, mainly due to the economic and infrastructural challenges.

Europe

- The European Union has implemented stringent regulations regarding data privacy and bioethics, which are shaping the development and application of biochips in clinical settings.

- Collaborative projects, such as the Horizon 2020 initiative, are funding research in biochip technologies, fostering innovation and cross-border partnerships among European biotech firms.

Asia Pacific

- China is rapidly advancing in biochip technology, with government initiatives like the 'Made in China 2025' plan promoting biotechnology as a key sector for economic growth.

- Companies such as BGI Genomics are leading the way in biochip development, focusing on applications in genomics and personalized medicine, which is expected to enhance healthcare outcomes in the region.

Latin America

- Brazil is investing in biotechnology research, with universities and research institutions collaborating on biochip projects aimed at improving disease diagnostics.

- Regulatory challenges and limited funding are still significant barriers in the region, but initiatives from organizations like the Brazilian Society of Biotechnology are working to address these issues.

North America

- The U.S. Food and Drug Administration (FDA) has recently streamlined the approval process for biochip technologies, encouraging innovation and faster market entry for new products.

- Key players like Illumina and Thermo Fisher Scientific are investing heavily in R&D to enhance biochip capabilities, particularly in genomics and proteomics, which is expected to drive market growth.

Middle East And Africa

- The UAE has launched several initiatives to promote biotechnology, including the establishment of research centers focused on biochip technology, which is expected to boost local innovation.

- Regulatory bodies in South Africa are beginning to develop frameworks for the use of biochips in diagnostics, which could lead to increased adoption in the healthcare sector.

Did You Know?

“Biochips can analyze thousands of genes simultaneously, making them a powerful tool for personalized medicine and disease diagnosis.” — National Institutes of Health (NIH)

Segmental Market Size

Biochips are currently a booming market, driven by the increasing demand for individualized medicine and the advancement of genomics. The rising incidence of chronic diseases and the need for quick diagnostics are also important growth drivers. Also driving the market are favorable regulations for the use of biochips in clinical settings, particularly in North America and Europe where health systems are increasingly integrating these technologies. The biochip market is currently in its deployment phase, with companies such as Illumina and Agilent Technologies leading the way. The main applications are in the fields of genomics, proteomics and diagnostics, where biochips are used for high-throughput screening and analysis. The H1N1 pandemic, which has highlighted the need for quick diagnostics, and the growing emphasis on sustainable development, which is encouraging the use of biochips in the area of environmental monitoring, are two notable trends that are accelerating growth. And the advent of newer, more powerful microarray and lab-on-a-chip platforms is enabling more precise and efficient analysis across a wide range of applications.

Future Outlook

Biochips are the most promising biotechnology tools for a variety of diagnostic and therapeutic applications. The market is expected to grow from $8.59 billion in 2024 to $20 billion by 2035, with a robust CAGR of 7.9 per cent. The demand for a more individualized approach to medicine, the advancement of genomics, and the growing prevalence of chronic diseases, all of which require more efficient diagnostic and therapeutic tools, will all contribute to this growth. As biochips become more widely used in drug discovery and development, their clinical applications will increase, further increasing their penetration into the health care industry. The main technological drivers will be the integration of artificial intelligence and machine learning into the design and analysis of biochips and their data. In addition, the availability of government support for research into biochips will foster innovation and the development of a wide range of new applications, including agriculture and the environment. And trends like the move to point-of-care testing and the emphasis on rapid diagnostics will also play a crucial role, making biochips an indispensable part of future health care solutions.

Biochips Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.