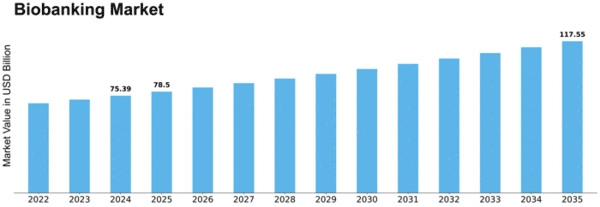

Biobanking Size

Biobanking Market Growth Projections and Opportunities

The Biobanking market is fundamentally affected by the developing accentuation on precision medicine. Biobanks act as stores for different natural samples, including tissues and hereditary materials, supporting exploration pointed toward appropriate clinical medicines to individual patient qualities. The ascent of precision medicine adds to the extending scope of biobanking. Continuous developments in genomic research and the rising significance of understanding hereditary elements in health and sickness add to the growth of the Biobanking market. Biobanks assume a significant part in putting away and giving admittance to genetic materials to enormous scope genomic studies, speeding up research results. The surge in drug disclosure and improvement exercises worldwide is a key market factor. Biobanks give fundamental assets to the ID and approval of potential medication targets, working with preclinical and clinical exploration. The interest for great organic samples drives the growth of the Biobanking market. The rising commonness of constant illnesses, like cancer, diabetes, and cardiovascular disorders, powers the requirement for huge scope organic example archives. Biobanks become essential in concentrating on the genetic and molecular parts of these illnesses, supporting endeavors to foster designated treatments and diagnostic devices. Progressing mechanical developments in specimen capacity and recovery frameworks improve the effectiveness and dependability of biobanking activities. Robotization, mechanical technology, and high-level following innovations further develop test uprightness, making biobanking more effective and interesting to scientists and drug organizations. The rising interest for customized medicine, driven by the longing for custom-made treatment draws near, impacts the Biobanking market. Biobanks give the important assets to specialists to distinguish biomarkers and genetic varieties related with individual reactions to medicines, supporting the improvement of customized treatments. Biobanks assume a significant part in rare disease research by giving admittance to interesting and novel organic samples. As the emphasis on understanding and treating interesting illnesses develops, the interest for specific biobanking administrations builds, adding to market extension.

Leave a Comment