Top Industry Leaders in the Bio Plasticizers Market

Bio-Plasticizers Market

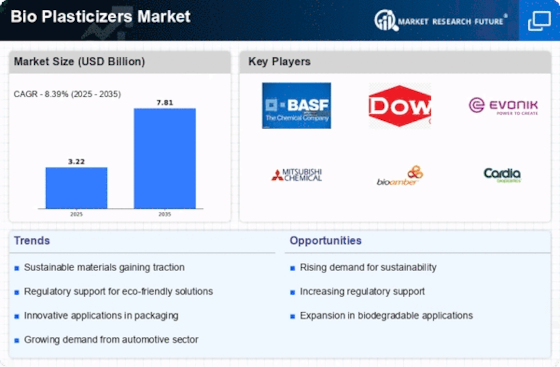

The bio-plasticizers market is experiencing a surge, driven by rising environmental consciousness and stringent regulations on traditional petroleum-based plasticizers. This burgeoning market presents a fertile ground for competition, with established players and innovative startups vying for dominance. Let's delve into the strategic landscape, key factors influencing market share, industry news, and recent developments in this dynamic sector.

Strategies Adopted by Market Players:

-

Product Diversification: Leading players are expanding their portfolios to cater to diverse application areas. Evonik, for instance, offers a range of bio-plasticizers for food packaging, medical devices, and automotive components. -

Sustainability Partnerships: Collaborations with bio-based feedstock suppliers and waste management companies are crucial for securing sustainable and cost-effective raw materials. Braskem, a Brazilian petrochemical giant, has partnered with several startups to develop bio-plasticizers from agricultural waste. -

Technological Advancements: Investing in research and development of new bio-plasticizers with superior properties is vital for differentiation. Myriant Corporation, a US bio-based materials company, has developed a novel bio-plasticizer with high heat resistance and improved biodegradability. -

Regional Expansion: Targeting high-growth markets like Asia-Pacific and Latin America is crucial for expanding market reach. NatureWorks, a leading producer of PLA bio-plasticizers, has established production facilities and distribution networks in China and India. -

Branding and Marketing: Building brand awareness and communicating the environmental benefits of bio-plasticizers is key to influencing consumer choices. BASF, a German chemical giant, has launched marketing campaigns highlighting the sustainability advantages of its bio-plasticizer portfolio.

Factors Influencing Market Share:

-

Production Cost: The cost competitiveness of bio-plasticizers compared to traditional plasticizers remains a critical factor. Advancements in production technologies and economies of scale are driving down costs, making bio-plasticizers more attractive. -

Feedstock Availability: Secure and sustainable access to bio-based feedstocks is crucial for ensuring consistent production and price stability. Partnerships with agricultural producers and investments in biorefineries are vital strategies in this regard. -

Government Regulations: Stringent regulations on the use of certain traditional plasticizers, particularly in food packaging and medical applications, are creating opportunities for bio-plasticizer adoption. -

Consumer Preferences: Growing consumer awareness of environmental issues and their preference for sustainable products are driving demand for bio-plasticizers, particularly in eco-conscious industries like cosmetics and personal care.

Key Players:

- DowDuPont (US),

- Evonik Industries AG (Germany),

- Vertellus Holdings LLC (US),

- Solvay (Belgium),

- Matrìca S.p.A. (Italy),

- Emery Oleochemicals (Malaysia),

- Bioamber Inc (US), PolyOne (US), Myriant Corporation (US),

- Lanxess AG (Germany).

Recent Developments:

Sep 2021 Cargill is purchasing Arkema's epoxides business, which will provide the company with end-to-end production capabilities in bio-based plasticizers and polyols. The move will better provide its industrial customers with nature-derived alternatives to typical petroleum-based additives. The acquisition agreement involves a plant in Minnesota, United States. The plant is known for producing epoxidized vegetable oils. These specialty oils, also known as epoxides, are important components of Cargill's existing bio-based plasticizers and polyols portfolio. Cargill expects to gain full control of the production process by converting its commodity soybean oil into epoxides. Eventually, creating the bio-based plasticizers and polyols used to make a wide range of products that support everyday conveniences, such as shower curtain liners, with the acquisition of Arkema's epoxides business.

Aug 2021 Lanxess, a specialty chemicals firm, has announced the completion of its acquisition of Emerald Kalama Chemical, a specialty chemicals manufacturer situated in the United States. Lanxess, situated in Cologne, Germany, used liquid cash to support the purchase price of around $1.04 billion (€870 million). This acquisition, the second-largest in Lanxess' history, broadens the company's portfolio of specialty chemicals for industrial applications, particularly in the plastics, paints, coatings, and adhesive industries. The K-Flex range of non-phthalate plasticizers and coalescents for adhesives, coatings, sealants, and vinyl applications is significant to the new Lanxess portfolio.

CEMEX, S.A.B. de C.V. declared in 2023 that it will be introducing a new line of bio-sourced admixtures with a lower carbon footprint. Compared to conventional oil-based admixtures, these admixtures may have a carbon footprint as low as 70% since they use natural, renewable, and locally derived raw materials. In order to improve properties including strength, workability, and water demand, as well as to lower associated carbon emissions and encourage more environmentally friendly building methods, additives are added to concrete mixtures.

Evonik introduced ELATUR DINCD, a new and revolutionary plasticizer, in 2022. ELATUR DINCD, a cyclohexanoate, possesses a number of highly desired qualities, such as strong UV resistance and exceptional low-temperature flexibility.