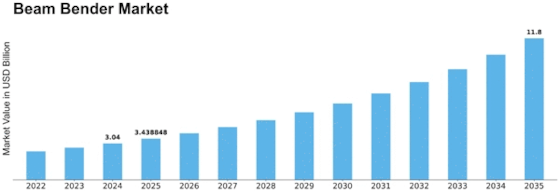

Beam Bender Size

Beam Bender Market Growth Projections and Opportunities

The Beam Bender market is influenced by a myriad of factors that collectively shape its dynamics and growth trajectory. One of the primary drivers is technological advancements. As innovations in beam bending technologies continue to emerge, market players strive to stay competitive by adopting and integrating these advancements into their products. The demand for more efficient and precise beam bending solutions is pushing manufacturers to invest in research and development, thereby fueling the market's expansion.

Global economic conditions also play a crucial role in shaping the Beam Bender market. The overall economic health of countries affects industries across the board, and the beam bending sector is no exception. Fluctuations in GDP, exchange rates, and consumer spending directly impact the demand for beam benders. During economic upturns, there is often increased construction and manufacturing activity, leading to a higher demand for beam bending equipment. Conversely, economic downturns may result in reduced capital expenditure, affecting the market negatively.

Regulatory factors are another significant influence on the Beam Bender market. Governments around the world implement various regulations and standards related to safety, emissions, and manufacturing processes. Compliance with these regulations is mandatory, and manufacturers need to invest in ensuring that their beam bending equipment meets the required standards. Changes in regulations or the introduction of new ones can impact the market by influencing manufacturing practices, pricing, and market entry barriers.

Market competition is a constant factor shaping the Beam Bender market landscape. With numerous players vying for market share, competition drives innovation and cost-effectiveness. Companies strive to differentiate their products through features, quality, and pricing strategies. The competitive environment often results in the continuous improvement of beam bending solutions, benefiting end-users who gain access to more advanced and cost-effective technologies.

The construction industry, being one of the primary consumers of beam bending equipment, significantly influences the market. Construction activities, including residential, commercial, and infrastructure projects, drive the demand for beams of various shapes and sizes. As construction trends evolve, the Beam Bender market adapts to meet the changing requirements of the industry. Urbanization, population growth, and infrastructure development contribute to the sustained demand for beam bending solutions.

Technological adoption within end-user industries also affects the Beam Bender market. As industries such as aerospace, automotive, and energy increasingly integrate advanced materials and designs into their products, the demand for precise beam bending capabilities rises. This prompts beam bender manufacturers to develop solutions that can accommodate a diverse range of materials and meet stringent specifications.

Environmental considerations are gaining prominence in influencing market dynamics. Sustainable and eco-friendly practices are becoming key considerations for both manufacturers and end-users. Companies that incorporate energy-efficient technologies and materials with lower environmental impact may gain a competitive edge in the market. Additionally, government initiatives promoting sustainability can drive the adoption of environmentally friendly beam bending solutions.

Leave a Comment