Market Analysis

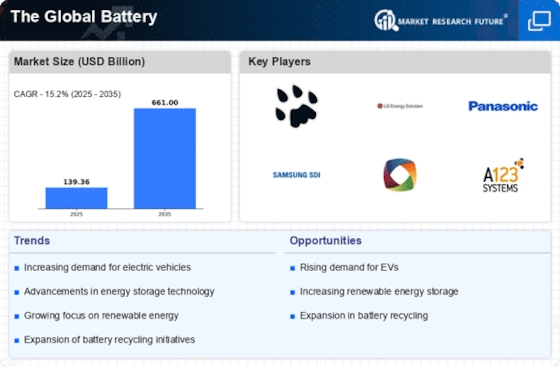

Battery Market (Global, 2024)

Introduction

The market for batteries is undergoing a period of transformation. It is being driven by the increasing demand for storage devices in various sectors, such as the automobile, consumer products, and renewable energy. The batteries are also becoming more powerful, more efficient, and more sustainable, and manufacturers are developing new products to meet the changing needs of consumers and industries. These changes are being driven by the shift to electric vehicles and the integration of renewable energy into the grid. The growing importance of reducing CO2 emissions and promoting sustainable development is also influencing the competitive landscape. The companies are trying to differentiate themselves by their green practices and their advanced technology. The dynamic environment is presenting challenges and opportunities for the players. They are faced with the need to manage regulatory issues, supply chain complexities, and the need to produce batteries at the lowest possible cost.

PESTLE Analysis

- Political

- In 2024, government policy is promoting the use of batteries, particularly in the context of the drive for a switch to renewable energy. For example, the American government has set aside a budget of seven billion dollars to develop batteries and the recovery of materials for batteries as part of its plan for energy independence and reducing greenhouse gas emissions. The European Union has set itself the goal of having seventy per cent of its new cars be electric by 2030, thereby driving demand for batteries and increasing political support for related industries.

- Economic

- The market for batteries is in a good state of health. By 2024, investments in batteries will amount to about fifteen billion dollars. This includes both research and development, and the expansion of the production facilities. Lithium-ion batteries have fallen in price to about one hundred and twenty dollars per kilowatt hour. This makes electric vehicles more attractive to consumers and increases the economic growth of the industry.

- Social

- The demand for sustainable energy is on the increase. In recent studies it has been shown that in developed countries, consumers are willing to pay an additional price for an electric car with advanced battery technology. The trend towards the greening of the public opinion is reflected in the increasing willingness to pay for more sustainable products.

- Technological

- By the end of 2025, solid-state batteries will have an energy density of 500 Wh/Kg. In 2024, the number of patents related to batteries has risen to more than 10,000. This is an indication of the rapid development of the field and the fierce competition in the market.

- Legal

- The regulatory framework is evolving in support of the battery market. New regulations in the European Union stipulate that, by 2024, all manufacturers of batteries must comply with the strictest standards of recyclability and sustainability. The use of at least fifty per cent of recycled lithium in batteries is to be required, which is to have a major impact on the industry's supply chains and production processes.

- Environmental

- The question of the environment is at the forefront of the question of batteries. According to the International Energy Agency, the batteries are responsible for about 30 percent of the total life-cycle emissions of electric vehicles. The industry is investing heavily in cleaner production processes. By 2024, it is expected that the carbon footprint of batteries will be reduced by $ 3 billion. The goal is to reduce the emissions by 20 percent by 2025.

Porter's Five Forces

- Threat of New Entrants

- The battery market in 2024 faces a moderate threat of new entrants. The demand for batteries, especially for electric vehicles and the storage of renewable energy, is growing, but the high cost of building factories and developing new technology is a deterrent. Also, the economies of scale and brand loyalty of the leading companies are a barrier to entry.

- Bargaining Power of Suppliers

- Suppliers of raw materials in the market for batteries have great bargaining power, because of the limited availability of lithium, cobalt, and nickel. As the market for electric vehicles and storage systems grows, suppliers are able to dictate terms and prices. In addition, the geopolitical factors that affect mining and production could increase their power.

- Bargaining Power of Buyers

- The buyers in the market for batteries have a medium degree of bargaining power. In the interests of economies of scale, the large producers and car manufacturers are able to negotiate better terms, while the smaller companies and end users have less negotiating power. However, with the increasing availability of alternative battery technology and the increasing demand for a more sustainable approach, the buyers have an incentive to seek better solutions.

- Threat of Substitutes

- The threat of substitutes in the battery market is moderate. Competition from supercapacitors and fuel cells is growing, but their use is not yet widespread in all applications. However, further development of these new products could be a threat to the battery industry in the future, especially if they offer better performance or lower cost.

- Competitive Rivalry

- Competition is intense in the battery industry, with a large number of players vying for market share in a rapidly growing industry. The major companies are investing heavily in research and development, to keep the batteries at the forefront of technology. And the race to secure supply chains for key materials is further increasing competition.

SWOT Analysis

Strengths

- Growing demand for electric vehicles (EVs) driving battery production.

- Technological advancements leading to improved battery efficiency and lifespan.

- Diverse applications across various industries including consumer electronics, renewable energy, and automotive.

Weaknesses

- High production costs associated with raw materials and manufacturing processes.

- Environmental concerns related to battery disposal and recycling.

- Limited infrastructure for charging and battery swapping in certain regions.

Opportunities

- Expansion of renewable energy storage solutions creating new market segments.

- Government incentives and regulations promoting electric vehicle adoption.

- Emerging markets showing increased interest in battery technology and applications.

Threats

- Intense competition leading to price wars and reduced profit margins.

- Supply chain disruptions affecting raw material availability.

- Rapid technological changes requiring continuous innovation and adaptation.

Summary

The battery market in 2024 is characterized by strong growth driven by the electric vehicle industry and technological developments. Despite this, the high cost of production and the concerns about the environment persist. Opportunities are mainly in the storage of renewable energy and in the support of government policy. Competition and supply chain risks threaten profits. The industry must capitalize on its strengths and overcome its weaknesses to seize the opportunities and ward off the risks.

Leave a Comment