Bathroom Worktops Size

Bathroom Worktops Market Growth Projections and Opportunities

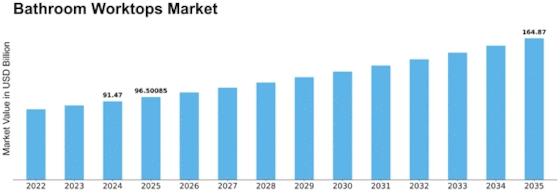

In 2022, the bathroom countertops market was estimated to be worth USD 82.2 billion. The Bathroom Worktops market is expected to develop at a compound annual growth rate (CAGR) of 5.50% between 2023 and 2032, from an estimated USD 86.7 billion in 2023 to USD 133.0 billion by 2032. Growing trends in bathroom remodeling and renovations, together with an increasing need for long-lasting and low-maintenance materials, are the main factors propelling the market's expansion.

The bathroom worktops market, an integral segment within the home improvement industry, is influenced by various market factors that contribute to its trends and growth. One of the key factors driving this market is the increasing emphasis on aesthetics and functionality in bathroom design. As homeowners seek to create stylish and functional bathrooms, the choice of worktops becomes a crucial element in achieving the desired aesthetic appeal. Bathroom worktops, available in various materials such as granite, quartz, marble, and solid surface options, cater to diverse consumer preferences, allowing for customization and personalization in bathroom design.

Technological advancements and innovations in manufacturing processes play a crucial role in the bathroom worktops market. Continuous research and development efforts lead to the introduction of new materials, finishes, and production techniques. Advanced manufacturing technologies contribute to the durability, stain resistance, and ease of maintenance of modern bathroom worktops. Brands that invest in cutting-edge technologies and stay abreast of design trends align with consumer preferences for contemporary and high-performance bathroom surfaces.

Consumer demographics and lifestyle choices significantly impact the bathroom worktops market. The diversity in consumer preferences, including design aesthetics, color choices, and budget considerations, prompts manufacturers to offer a wide variety of worktop options. Homeowners with varying lifestyle needs may prioritize different materials based on factors such as durability, maintenance requirements, and resistance to moisture. Brands that understand and cater to these diverse preferences can effectively capture market share and build brand loyalty among a broad range of consumers.

Economic factors, including disposable income and housing market trends, play a crucial role in the bathroom worktops market. Economic stability in regions with higher disposable incomes often leads to increased spending on home improvement projects, including bathroom renovations. Housing market trends, such as increased home sales or a surge in remodeling activities, can influence the demand for bathroom worktops as homeowners invest in upgrading their living spaces.

Brand image and reputation are vital elements shaping consumer perceptions within the bathroom worktops market. Well-established manufacturers and those with a track record of producing high-quality, durable worktops often benefit from positive associations with reliability and craftsmanship. Effective marketing campaigns that highlight features such as resistance to stains, ease of cleaning, and design versatility contribute to a brand's visibility and appeal, influencing consumer preferences and brand loyalty.

Market accessibility and distribution channels significantly impact the availability of bathroom worktops to consumers. Widespread distribution through various retail channels, including home improvement stores, kitchen and bath showrooms, and online platforms, ensures that homeowners have easy access to a diverse range of bathroom worktop options. The growth of e-commerce has further increased accessibility, allowing consumers to explore and purchase worktops conveniently from the comfort of their homes.

Sustainability considerations are gaining prominence in the bathroom worktops market as environmental awareness grows. Homeowners and designers seek worktop materials that align with their values of sustainability and eco-friendliness. Brands that offer worktops made from recycled or responsibly sourced materials, as well as those that adopt environmentally friendly manufacturing practices, appeal to consumers seeking sustainable choices for their home improvement projects.

Competition within the bathroom worktops market fosters innovation and drives manufacturers to differentiate themselves. Numerous brands, ranging from well-established manufacturers to niche players, compete to offer worktops with unique designs, finishes, and features. This competitive landscape prompts manufacturers to continuously enhance their product portfolios, introducing new materials, colors, and design elements to meet the evolving preferences of consumers seeking both style and functionality in their bathroom worktops.

Regulatory considerations, including safety standards and compliance with environmental regulations, are crucial in the bathroom worktops market. Manufacturers must adhere to safety standards to ensure that worktops meet specific criteria for consumer safety and durability. Compliance with environmental regulations, including guidelines for waste disposal and emissions, is essential for building and maintaining trust among environmentally conscious consumers.

Leave a Comment