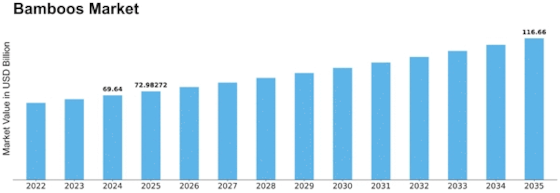

Bamboos Size

Bamboos Market Growth Projections and Opportunities

The bamboo market is influenced by several key factors that shape its dynamics and drive its growth. One significant factor is the increasing demand for bamboo across various industries, including construction, furniture, textiles, paper, and renewable energy. Bamboo is valued for its strength, flexibility, sustainability, and rapid growth rate, making it a preferred choice for a wide range of applications. The growing emphasis on eco-friendly and sustainable materials in construction, manufacturing, and consumer products drives the demand for bamboo, fueling market expansion.

Moreover, technological advancements and innovations in bamboo processing contribute to market growth. Manufacturers continually invest in research and development to improve bamboo harvesting, treatment, and manufacturing techniques. Innovations in bamboo engineering, such as laminated bamboo beams, engineered bamboo flooring, and bamboo-based composites, enhance the performance, durability, and aesthetic appeal of bamboo products. Additionally, advancements in manufacturing technologies and machinery optimize production processes, reduce waste, and increase efficiency, meeting the growing demand for high-quality bamboo products.

Another market factor is the availability of abundant bamboo resources in many regions globally. Bamboo grows prolifically in diverse climates and soil conditions, making it a highly renewable and sustainable resource. This availability ensures a stable supply chain for bamboo products, reducing dependency on traditional timber sources and contributing to forest conservation efforts. Furthermore, advancements in bamboo cultivation techniques, such as agroforestry and bamboo plantations, enhance productivity and sustainability in bamboo harvesting, meeting the needs of growing markets.

Regulatory compliance and adherence to sustainability standards significantly influence the bamboo market. Compliance with environmental regulations related to bamboo harvesting, processing, and trade is essential for manufacturers to ensure sustainable practices and market access. Adherence to certification schemes, such as Forest Stewardship Council (FSC) certification and Sustainable Forestry Initiative (SFI) certification, ensures responsible sourcing and production of bamboo products, enhancing market competitiveness and consumer trust.

Market competition also plays a significant role in shaping the bamboo market landscape. Key players in the industry engage in competitive strategies such as product differentiation, branding, and geographical expansion to gain a competitive edge and capture market share. Established bamboo manufacturers leverage their technical expertise, production capabilities, and distribution networks to maintain leadership positions. Conversely, emerging players focus on innovation, niche markets, and value-added products to establish their presence and compete effectively in the bamboo market.

Moreover, global economic factors influence the bamboo market, including economic growth rates, construction activity, consumer spending, and infrastructure development. Economic downturns can lead to reduced demand for bamboo products, particularly in construction and manufacturing sectors, affecting market growth. Conversely, economic recovery, increased construction projects, and infrastructure spending stimulate demand for bamboo, driving market expansion.

Consumer preferences and industry trends also impact the bamboo market dynamics. There is a growing demand for eco-friendly, natural materials in construction, interior design, and consumer products, driving the adoption of bamboo as a sustainable alternative to traditional materials such as wood and plastic. Additionally, trends such as minimalism, biophilic design, and green living promote the use of bamboo in architectural and interior applications, contributing to market growth and diversification.

Leave a Comment