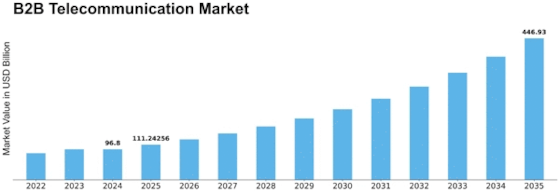

B2b Telecommunication Size

B2B Telecommunication Market Growth Projections and Opportunities

The B2B telecommunication market is influenced by a multitude of factors that collectively shape its dynamics and trajectory. One of the primary determinants is technological innovation. As new communication technologies emerge, businesses seek to capitalize on these advancements to enhance their connectivity and operational efficiency. The ongoing evolution of technologies such as 5G, the Internet of Things (IoT), and Artificial Intelligence (AI) plays a pivotal role in driving the demand for advanced telecommunication services. Market competition is another significant factor shaping the B2B telecommunication landscape. With numerous providers vying for market share, a competitive environment is created, leading to continuous improvements in services, pricing models, and bundled offerings. This competitive pressure drives innovation as companies strive to differentiate themselves and provide unique value propositions. Regulatory factors also exert a substantial impact on the B2B telecommunication market. Governments and regulatory bodies play a crucial role in shaping the industry by establishing rules and standards related to spectrum allocation, data privacy, and market competition. Changes in regulations can either open new opportunities or present challenges for telecommunication providers. Navigating regulatory landscapes becomes imperative for companies operating in the B2B telecommunication space, as compliance with evolving regulations is essential for sustained growth and market presence. The global economic environment significantly influences the B2B telecommunication market. Economic trends, such as recessions or periods of economic growth, can impact businesses' budgets and investment decisions. During economic downturns, businesses may prioritize cost-cutting measures, influencing their choices in telecommunication services. On the other hand, economic prosperity may lead to increased investments in technology and communication infrastructure as companies expand their operations. Customer demand and preferences play a pivotal role in shaping the B2B telecommunication market. Businesses increasingly seek communication solutions that are tailored to their specific needs, emphasizing factors such as reliability, scalability, and customization. The growing reliance on remote work and flexible work arrangements has further intensified the demand for telecommunication services that support seamless collaboration and connectivity across dispersed teams. Providers that can align their offerings with these evolving customer expectations are better positioned to thrive in the competitive B2B telecommunication landscape. Infrastructure development is a foundational factor influencing the B2B telecommunication market. The availability and quality of telecommunication infrastructure, including network coverage and bandwidth, impact the accessibility and performance of services. Infrastructure considerations are crucial not only for meeting current demands but also for preparing for the future growth of the B2B telecommunication market.

Leave a Comment