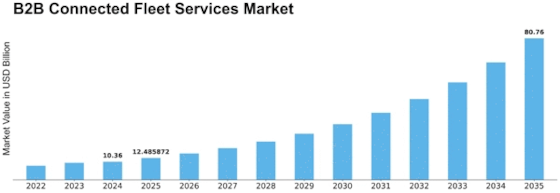

B2b Connected Fleet Services Size

B2B Connected Fleet Services Market Growth Projections and Opportunities

This comprehensive study on the global B2B connected fleet market provides in-depth insights into industry trends, market dynamics, size, competitive landscape, and growth opportunities. The research report categorizes the global facility management services market based on service type, fleet type, application, and region/country.

Service types within the B2B connected fleet market include vehicle tracking, remote diagnostics, driver management, stolen vehicle tracking, and others. Among these, the vehicle tracking segment dominated the market in 2021, with a valuation of USD 2,551.6 million.

Regarding fleet types, the market has been segmented into conventional and electric types. The conventional segment is anticipated to register a substantial Compound Annual Growth Rate (CAGR) of 38.1% and is projected to reach USD 32,752.8 million by the end of 2030. Meanwhile, the electric segment, valued at USD 556.0 million, is expected to reach USD 8,466.4 million by the end of 2030.

In terms of application, the B2B connected market is categorized into passenger cars, trucks, buses, and others. The truck segment is expected to hold the largest CAGR of 23.6%, reaching USD 14,166.7 million by the end of 2030. In comparison, the passenger car segment, valued at USD 4,109.9 million, is projected to reach USD 19,806 million by 2030.

Geographically, the study covers North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is anticipated to dominate the facility management services market throughout the study period.

The global market is highly competitive, featuring several vendors offering feature-rich and innovative solutions to their customers. Major vendors profiled in the study include Hyundai Motor Company, Bosch Mobility Solutions, Verizon Connect, Scania, Aptiv, UD Trucks, Telefonktiebolaget Ericsson, Michelin Connected Fleet, Merchants Fleet, DafTrucks N.V, and Toyota.

This research provides a comprehensive understanding of the B2B connected fleet market, shedding light on critical factors such as service types, fleet types, applications, and regional dynamics. The dominance of North America and the competitive landscape of prominent vendors underscore the evolving nature of the connected fleet services industry, where innovation and advanced solutions play a pivotal role in meeting the diverse needs of businesses and organizations worldwide.

Leave a Comment