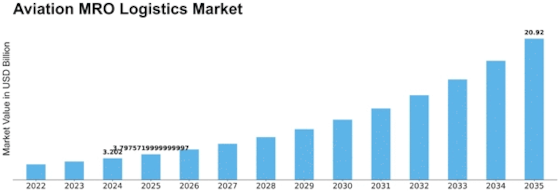

Aviation Mro Logistics Size

Aviation MRO Logistics Market Growth Projections and Opportunities

The Aviation Maintenance, Repair, and Overhaul (MRO) Logistics market is witnessing significant growth, propelled by a combination of factors that reflect the dynamic and complex nature of the aviation industry. A primary driver of the MRO Logistics market is the continuous expansion of the global aviation fleet. With an increasing number of aircraft in operation, airlines and MRO service providers are facing heightened demand for maintenance services, spurring the need for efficient and streamlined MRO logistics solutions. These solutions encompass the transportation, warehousing, and distribution of spare parts, components, and equipment crucial for the maintenance and repair of aircraft.

Technological advancements play a pivotal role in shaping the Aviation MRO Logistics market. The adoption of digital technologies, including advanced analytics, IoT (Internet of Things), and RFID (Radio-Frequency Identification), is enhancing the efficiency of MRO logistics operations. Real-time tracking and monitoring of spare parts and components facilitate better inventory management, reduce lead times, and contribute to overall cost savings for both airlines and MRO service providers. The integration of digital solutions into MRO logistics processes is becoming increasingly vital in addressing the complexities of managing large and diverse inventories.

The global nature of the aviation industry drives the demand for international MRO logistics services. As airlines and MRO providers operate on a global scale, the effective movement of aircraft parts and components across borders becomes crucial. International trade regulations, customs procedures, and transportation networks all influence the MRO Logistics market. The ability to navigate these complexities while ensuring timely delivery and compliance with aviation safety standards is a key factor in the success of MRO logistics providers.

Regulatory compliance is a significant consideration in the Aviation MRO Logistics market, with strict aviation safety and maintenance standards governing the movement of aircraft components. Compliance with regulations set by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), is imperative for MRO logistics providers to ensure the airworthiness of aircraft. Adherence to these standards not only ensures safety but also contributes to the reputation and reliability of MRO logistics services.

The increasing trend towards predictive maintenance in the aviation industry is influencing the MRO Logistics market. Airlines are adopting advanced data analytics and predictive maintenance technologies to anticipate component failures and optimize maintenance schedules. This trend impacts MRO logistics by requiring a more agile and responsive supply chain that can deliver spare parts precisely when needed, minimizing aircraft downtime and enhancing operational efficiency.

The economic health of the aviation industry, including airline profitability and fleet expansion plans, directly affects the Aviation MRO Logistics market. Economic downturns or fluctuations in air travel demand can impact airline budgets for maintenance activities, influencing the volume of MRO logistics services required. Conversely, during periods of growth and fleet expansion, the demand for MRO logistics services tends to increase as airlines invest in the upkeep of their expanding fleets.

Environmental sustainability is an emerging factor in the Aviation MRO Logistics market. As the aviation industry places a greater emphasis on environmental responsibility, MRO logistics providers are exploring eco-friendly practices and technologies to reduce their carbon footprint. This includes optimizing transportation routes, adopting fuel-efficient aircraft for cargo movements, and implementing sustainable packaging practices.

Leave a Comment