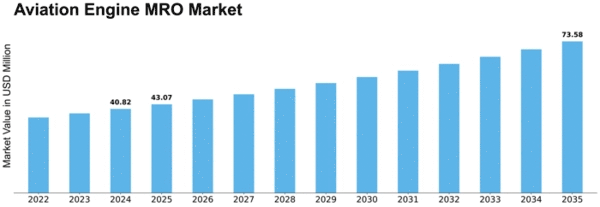

Aviation Engine Mro Size

Aviation Engine MRO Market Growth Projections and Opportunities

There is a strong increase in the aviation engine MRO market due to various factors that affect not only micro service needs but also address essential issues of maintaining and improving performance for aircraft engines. One significant market driver is the increasing growth of aviation all over the world coupled with increased air traffic and aircraft usage. As more and more flights increase, the demand for aviation engine MRO services increases since engines remain in a good state through regular maintenance repairing as well as overhaul procedures. Technological developments have a critical role in defining the Aviation Engine MRO market. Innovations in engine design, material and diagnostics technologies result to much efficient and reliable engines. For example, advanced materials such as composites and alloys enhance engine performance and longevity while diagnostic tools ad sensors allow for proactive maintenance keeping the customer informed about their engines real-time health. These technological advancements not only prolong the service life of aircraft engines, but they also increase fuel economy and therefore address both economic issues as well as environmental concerns. Regulatory compliance and safety standards are key factors shaping the aviation engine MRO market dynamics. Aviation authorities globally place stringent requirements on the airworthiness and safety of aircraft engines. These standards must be observed by MRO providers, who should carry out maintenance and repair work based on procedures and guidelines approved. Adherence with regulatory requirements is a prerequisite for the certification of MRO facilities and sustaining Airlines’ trust ad aviation authorities. The Aviation Engine MRO market is also affected by the degree of competition in the market and key players present. Functional and cost-effective engine maintenance solutions are offered by established MRO providers, engine manufacturers as well as independent service facilities competing actively in the market. Companies are encouraged to innovate due to intense competition, as they would invest in research and development so that they can improve advanced repair techniques optimizing processes reducing turnaround times. The competitive arena affects the pricing structure and service choices airlines can make regarding their engine maintenance requirements. Global economic factors also contribute to the formation of Aviation Engine MRO market. Demand for engine maintenance services also depends on economic conditions in terms of airline profitability, fleet expansion plans and fuel prices.

Leave a Comment