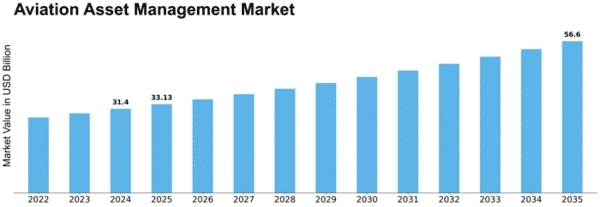

Aviation Asset Management Size

Aviation Asset Management Market Growth Projections and Opportunities

Numerous variables impact the aviation asset management market, which in turn shapes its overall structure. The requirement for effective asset management in aviation is strongly impacted by the global need for flights, which is one of the main factors. Airlines and leasing businesses are faced with the difficulty of assuring the long-term viability of their assets and fleet optimization as the aviation sector grows. Specialized services for asset management are becoming more and more necessary as the requirement for aviation assets rises. The aircraft asset management industry is significantly impacted by economic factors as well. The financial condition of leasing firms and airlines is directly impacted by interest rates, inflation rates, and economic growth. Airlines frequently buy new aircraft during prosperous economic times to keep up with the growing need for air travel. However, if investment in capital were to fall in the midst of an economic downturn, it might have an effect on the aviation asset sector.. Interest rates also affect the price of financing for lessors and airlines, which affects their choices on fleet growth and reduction. Another important component influencing the aviation asset management market's structure is regulation. Complicated rules that include everything from safety requirements to environmental concerns oversee the aviation sector. Aviation businesses need to abide by these rules in order to operate lawfully and safeguard their assets. Changes in regulations, such as those concerning safety protocols or emission standards, can have a substantial impact on the kind of assets that are wanted and the management strategies employed to maintain them. Technological improvements are another significant aspect impacting the aviation asset management industry. The rapid improvement of aviation technology, including better avionics and engines with superior fuel efficiency, could render older aircraft obsolete. Due to the constant creativity in the aviation business, asset managers have to assess if it is feasible to add fresh aircraft to fleets along with stay up to date with technical developments. Improved asset management techniques are also facilitated by developments in statistical analysis and predictive maintenance technologies. In the realm of aircraft asset management, market competitiveness and consolidation are essential elements. An advantage in the extremely competitive business environment of airplanes and leasing companies is effective asset management. The market is seeing an increase in mergers and acquisitions as companies look to cut expenses and improve operational effectiveness. These mergers have an impact on the regulatory structure of the sector since they result in the formation of larger businesses with a range of franchises and leadership philosophies. Global occurrences including pandemics and geopolitical unrest can significantly affect the aviation asset management sector. For example, the COVID-19 outbreak caused a sharp drop in demand for air travel, resulting in fleet grounded vessels and financial challenges for numerous aviation stakeholders. These unforeseen events demonstrate how important flexibility and risk management are essential within the aviation asset management sector. In summary, a variety of variables have molded the dynamic and complex landscape of the aviation asset management business. The ways in which airlines and leasing businesses manage their aviation assets are determined by the interplay of several market variables, ranging from financial circumstances and laws and regulations to technical breakthroughs and global events. Industry participants must be aware of these market variables in order to successfully negotiate the complexity present in the aviation asset management market.

Leave a Comment