Market Analysis

In-depth Analysis of Aviation Alternative Fuel Market Industry Landscape

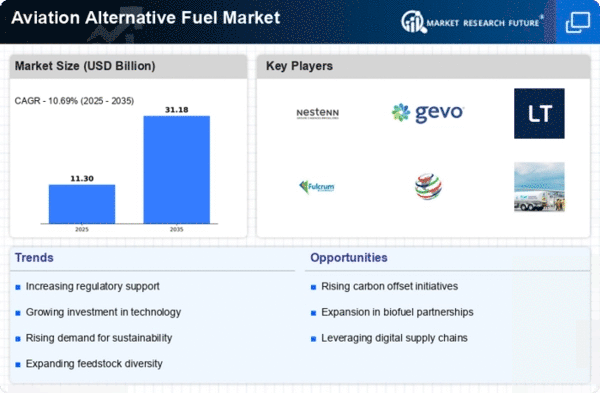

The Aviation Alternative Fuel Market experiences dynamic shifts influenced by a confluence of factors, including environmental concerns, regulatory mandates, technological advancements, and the aviation industry's commitment to sustainability. As the aviation sector strives to reduce its carbon footprint, the market dynamics of alternative aviation fuels are undergoing significant changes. One of the primary drivers shaping these dynamics is the global focus on mitigating climate change and the aviation industry's commitment to adopting cleaner and more sustainable fuel options.

Technological advancements play a pivotal role in shaping the market dynamics of aviation alternative fuels. Continuous research and development efforts focus on creating innovative fuel formulations that offer lower carbon emissions and improved energy efficiency. Biofuels derived from renewable sources, such as feedstocks like algae and plant residues, are gaining prominence as viable alternatives to traditional jet fuels. The market dynamics respond to these technological innovations by promoting the development and adoption of alternative fuels that meet stringent environmental standards and offer a pathway toward achieving carbon-neutral aviation.

Environmental considerations are integral to the market dynamics of aviation alternative fuels. With increasing awareness of the environmental impact of traditional aviation fuels, there is a growing demand for cleaner and greener alternatives. Sustainable aviation fuels (SAFs) made from biomass, waste, or synthetic processes are gaining traction, offering a way to reduce the aviation industry's reliance on fossil fuels. Regulatory frameworks and sustainability goals further contribute to the market dynamics by driving the adoption of alternative fuels that align with carbon reduction targets.

Economic factors, including the cost of production and government incentives, influence the market dynamics of aviation alternative fuels. Fluctuations in feedstock prices, production technologies, and overall supply chain costs can impact the economic viability of alternative fuels compared to traditional jet fuels. Government incentives and policies that support the development and use of sustainable aviation fuels play a crucial role in shaping market dynamics by creating a conducive environment for investment and adoption.

Competitive dynamics within the aviation alternative fuel market are characterized by collaboration among stakeholders, including fuel producers, airlines, and governments. Strategic partnerships and alliances are common strategies employed by market participants to overcome barriers to entry, scale up production, and promote the widespread use of alternative fuels. The market dynamics are influenced by the ability of industry players to work together to address the challenges associated with the production, distribution, and adoption of aviation alternative fuels.

Geographical variations also contribute to the market dynamics of aviation alternative fuels. Different regions may have varying levels of regulatory support, infrastructure readiness, and feedstock availability, impacting the adoption rates of sustainable aviation fuels. Market players need to navigate these regional variations by considering local factors and tailoring their strategies to align with the specific conditions and requirements of each market.

Leave a Comment