Top Industry Leaders in the Automotive Valve Market

*Disclaimer: List of key companies in no particular order

Automotive Valve industry leaders on the list of listed companies are:

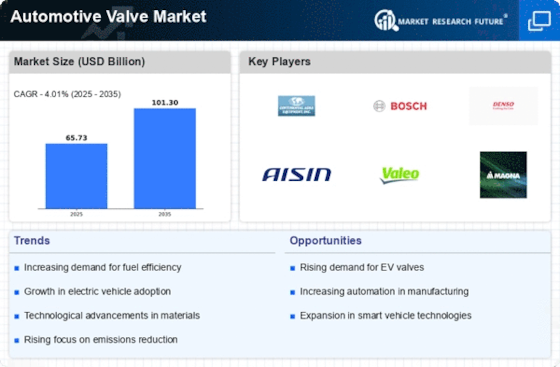

Continental AG (Germany), BorgWarner (U.S.), Denso Corporation (Japan), and Delphi Automotive (U.K.), Cummins Inc., Valeo S.A. (France), and Robert Bosch GmbH (Germany). Aisin Seiki Co., Ltd. (Japan), Federal-Mogul (U.S.), Johnson Electric Group (Hong Kong), Automotive Valves Pvt. Ltd. (India), SSV Valves (India), AVR Valves Pvt. Ltd. (India), Nextech Engineering (India), and SMB Engine Valves (India)

The Evolving Terrain: A Look at the Competitive Landscape of the Automotive Valve Market

The automotive valve market, though often a silent contributor to vehicle performance, hums with a dynamic competitive spirit. This market presents both challenges and opportunities for established players and ambitious newcomers. Let's delve into the key facets shaping this landscape:

Dominant Players and Their Playbooks:

Global heavyweights like MAHLE Tri-Ring, Worldwide Auto-Accessory, SEECO, and Dengyun Auto-parts continue to command significant market share through a blend of established manufacturing prowess, extensive production facilities, and strategic partnerships. MAHLE, for instance, leverages its R&D capabilities to innovate lightweight valves for fuel efficiency, while Dengyun focuses on cost-effective production for budget-conscious segments.

Factors Dictating Market Share:

Beyond brand recognition, several factors influence market share dynamics:

Technological Expertise: Leading players invest heavily in developing advanced materials, coatings, and valve designs that optimize performance and durability. For example, SEECO's focus on wear-resistant coatings caters to high-performance engines.

Regional Specialization: Companies strategically cater to specific regional demands. Wode Valve, for instance, excels in China's growing domestic market, while Xin Yue Automotive targets North America's premium car segment.

Cost Competitiveness: Efficient production processes and economies of scale enable established players to offer competitive pricing, particularly in high-volume segments.

Emerging Trends and New Entrants:

The market witnesses exciting new trends:

The Rise of Electric Vehicles: As EV adoption accelerates, the demand for specialized valves for electric motors and battery systems is poised to surge. Companies like AnFu and JinQingLong are actively developing solutions for this segment.

Focus on Sustainability: Eco-friendly materials and manufacturing processes are gaining traction. Tyen Machinery, for instance, emphasizes recycling and resource conservation in its production.

Digitalization and Automation: Technological advancements like AI-powered quality control and predictive maintenance are being incorporated, with companies like FUJI OOZX leading the charge.

Competitive Scenario: A Balancing Act:

The overall competitive landscape reflects a delicate balance:

Consolidation vs. New Entrants: While mergers and acquisitions occur, especially among smaller players, the influx of new companies, particularly in niche segments, keeps the market dynamic.

Tiered Competition: Premium brands like MAHLE compete on innovation and brand value, while budget-conscious players like ShengChi Auto Parts focus on affordability.

Regional Rivalries: Regional players like Yangzhou Guanghui in China challenge established global players in their home markets.

Uncertainties and Future Outlook:

Fluctuations in raw material prices, geopolitical instability, and the evolving regulatory landscape pose challenges. However, the long-term outlook remains positive, driven by factors like increasing vehicle production, technological advancements, and the rise of EVs.

Latest Company Updates:

Continental AG (Germany):

- Announced collaboration with Johnson Matthey on valve coating technology for improved emission control (October 2023)

BorgWarner (U.S.):

- Launched a new line of low-friction valves for improved fuel efficiency (November 2023)

Denso Corporation (Japan):

- Developed a lightweight valve design for EVs using advanced simulation technology (July 2023)

Delphi Automotive (U.K.):

- Focusing on aftermarket valve production and distribution after being acquired by a private equity firm (August 2023)

Cummins Inc.:

- Developing high-performance valves for heavy-duty engines to meet future emission standards (January 2023)