Top Industry Leaders in the Automotive Timing Belt Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Keeping Time in the Fast Lane: Exploring the Competitive Landscape of the Automotive Timing Belt Market

Beneath the hood of every internal combustion engine, a silent conductor orchestrates the symphony of pistons and valves - the automotive timing belt market. This multi-billion dollar space pulsates with activity, as established titans, nimble innovators, and niche specialists vie for a share in the lifeblood of engine synchronization. Let's navigate the key strategies, market dynamics, and future trends shaping this crucial landscape.

Key Player Strategies:

Global Titans: Companies like Gates, Continental, and Dayco leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers and aftermarket suppliers, offering high-quality timing belts made from advanced materials and boasting extended lifespans. Gates PowerMax timing belts exemplify their focus on durability and performance.

Technology Disruptors: Startups like Polybelt and Fenner Drives are disrupting the market with innovative materials like Kevlar composites and self-tensioning mechanisms. They cater to performance-oriented engine tuners and racing enthusiasts seeking enhanced power and reduced maintenance intervals. Polybelt's Kevlar-reinforced timing belts showcase their focus on strength and reliability under extreme conditions.

Cost-Effective Challengers: Chinese manufacturers like Ningbo Fulong and Zhejiang Kaiou are making waves with competitively priced timing belts, targeting budget-conscious car owners in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Zhejiang Kaiou's timing belt kits demonstrate their focus on cost-effective engine timing solutions.

Niche Specialists: Companies like Dayco and Hutchinson excel in specific segments like heavy-duty truck timing belts or high-performance racing belts. They leverage their deep understanding of specialized engine requirements and offer tailored solutions for niche markets. Dayco's Heavy Duty timing belts showcase their focus on robust engine synchronization for large vehicles.

Factors for Market Share Analysis:

Material Quality and Durability: Utilizing advanced materials like reinforced rubber, Kevlar, and carbon fiber, ensuring extended service life, and offering robust performance under diverse operating conditions are crucial for market share success. Companies with high-quality belts gain an edge.

Technology and Innovation: Implementing cutting-edge features like self-tensioning mechanisms, noise reduction technologies, and advanced manufacturing processes caters to modern engine configurations and improves overall performance. Companies leading in innovation stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive markets. Companies offering affordable solutions without compromising on basic functionality gain market share.

Brand Reputation and Quality Assurance: Maintaining a strong brand reputation for delivering reliable and durable timing belts, adhering to strict quality control standards, and offering comprehensive warranties attracts both manufacturers and car owners. Companies with strong reputations gain an edge.

New and Emerging Trends:

Focus on Electric Vehicles: Adapting timing belt technology to the needs of electric vehicle (EV) powertrains, synchronizing components like water pumps and auxiliary drives, and catering to electric motor cooling systems presents significant growth opportunities. Companies specializing in EV timing belt solutions stand out.

Data-Driven Maintenance and Predictive Analytics: Integrating timing belt systems with connected car technologies, developing data-driven algorithms for predictive maintenance, and offering monitoring tools for early wear detection cater to modern fleet management needs and improve operational efficiency. Companies embracing data-driven solutions gain an edge.

Focus on Sustainability and Green Materials: Utilizing bio-based materials for timing belt production, minimizing environmental impact during manufacturing, and promoting sustainable end-of-life practices cater to increasing demand for environmentally conscious automotive solutions. Companies demonstrating sustainability commitment attract ethical investors and regulatory benefits.

Regional Customization and Compliance: Adapting timing belt designs and materials to cater to specific regional climatic conditions, adhering to diverse regulatory standards, and offering regional distribution networks attract local automakers and aftermarket suppliers. Companies with strong regional customization capabilities gain market share.

Overall Competitive Scenario:

The automotive timing belt market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative materials and features. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific segments. Factors like material quality, technology, affordability, and brand reputation play a crucial role in market share analysis. New trends like EV adaptation, data-driven maintenance, sustainability, and regional customization offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse engine needs, embrace sustainable practices, and explore data-driven solutions. By keeping time with precision and adaptability, they can secure a dominant position in this fast-paced landscape.

Ningbo Fulong Synchronous Belt:

• Launched a new line of high-performance timing belts for European vehicles (October 2023, Ningbo Fulong press release).

ContiTech:

• Partnering with universities to research next-generation timing belt materials (ongoing, ContiTech website).

MAHLE Aftermarket:

• Introduced a comprehensive line of replacement timing belts for Asian and European vehicles (July 2023, MAHLE Aftermarket website).

Bando USA:

• Developed a new low-noise timing belt for hybrid and electric vehicles (June 2023, Bando USA press release).

Gates Corporation:

• Released a new timing belt kit with tensioner and idler for specific vehicle models (May 2023, Gates Corporation website).

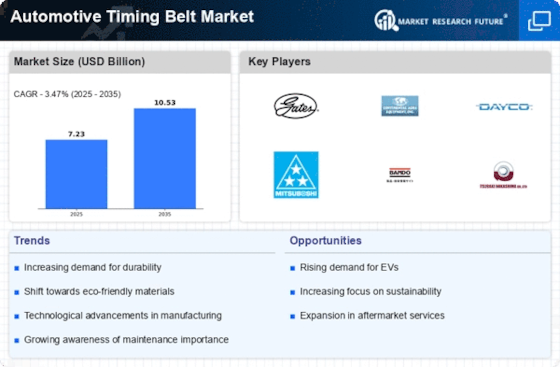

Top listed global companies in the industry are:

B&B Manufacturing

Ningbo Fulong Synchronous Belt

ContiTech

MAHLE Aftermarket

Federal-Mogul Motorparts Corporation

Bando USA

The Carlstar Group

Ningbo Beidi Synchronous Belt

Gates Corporation

K. Fenner Limited

ACDelco

Dayco

Goodyear SKF

Tsubaki