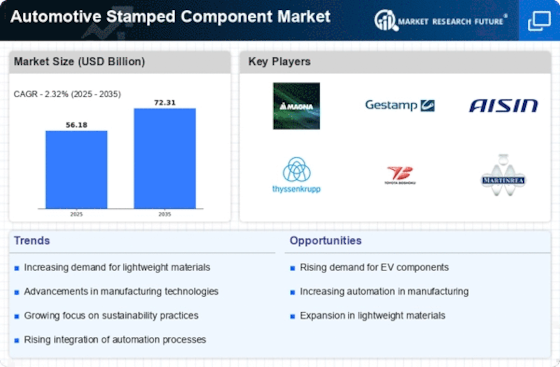

Top Industry Leaders in the Automotive Stamped Component Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Stamped Component industry are:

Gestamp, Batesville Tool & Die, Trans-Matic, Lindy Manufacturing, Magna, All-New Stamping

Competitive Landscape of the Automotive Stamped Component Market: Shifting Gears

The automotive stamped component market, valued at over $11 billion in 2023, pulsates with dynamic competition. Established players grapple with nimble entrants, all vying for a slice of this steadily growing pie. Understanding the key strategies, market share determinants, and emerging trends is crucial for navigating this complex landscape.

Key Player Strategies:

Tier 1 Suppliers Dominate: Global giants like Magna International, Gestamp, and Adient leverage economies of scale, vast R&D capabilities, and established OEM relationships to solidify their positions. Tier 1s are increasingly offering integrated solutions, encompassing design, manufacturing, and logistics.

Niche Players Carve Out Spaces: Smaller, regionally focused players capitalize on specialization in specific components or materials like aluminum or high-strength steel. Their agility and responsiveness sometimes trump scale, catering to niche segments or regional requirements.

Strategic Collaborations Thrive: Joint ventures and partnerships are commonplace, enabling knowledge sharing, technology transfers, and access to new markets. Examples include Gestamp's collaboration with Tata Motors in India and CIE Automotive's partnership with BorgWarner for lightweighting solutions.

Market Share Determinants:

Geographical Presence: Proximity to major auto hubs like China, the US, and Europe remains crucial for efficient supply chains and cost-competitiveness. Players like Martinrea International in North America and CIE Automotive in Asia Pacific capitalize on their regional strongholds.

Technological Prowess: Innovation in high-speed stamping, multi-material forming, and advanced coatings differentiates frontrunners. Adient's lightweight seats made from high-strength steel and Gestamp's hot stamping advancements are prime examples.

Sustainability Focus: Environmental regulations and consumer demand for greener vehicles push sustainability to the forefront. Companies like Gestamp and ThyssenKrupp invest heavily in recycling initiatives and carbon-neutral production processes.

Emerging Trends and New Strategies:

Electric Vehicle (EV) Revolution: The rise of EVs presents both challenges and opportunities. Stamped components need to be lighter and stronger to accommodate battery packs, while offering greater design flexibility. Tier 1s are actively adapting their portfolios, with Magna acquiring HAUS, a specialist in aluminum battery enclosures.

Additive Manufacturing (3D Printing): While not yet mainstream, 3D printing shows promise for producing complex, lightweight components on-demand, potentially disrupting traditional stamping processes. Companies like Trumpf and EOS are collaborating with automakers to explore its potential.

Data-Driven Optimization: Big data analytics and simulation tools are transforming the industry. By optimizing stamping processes, predicting maintenance needs, and minimizing material waste, companies can gain significant cost and efficiency advantages.

Overall Competitive Scenario:

The automotive stamped component market is a tightrope walk, demanding constant adaptation and innovation. Tier 1 giants face pressure from both nimble niche players and disruptive technologies. Success hinges on strategic partnerships, embracing sustainability, and capitalizing on the EV revolution. New entrants must leverage their agility and technological expertise to carve out their niches. Ultimately, the winners will be those who can deliver cost-effective, lightweight, and sustainable components while navigating the rapidly evolving automotive landscape.

Latest Company Updates:

Gestamp: Signed a joint venture agreement with a Chinese company to build a new stamping plant in China (source: Reuters, Jan 5, 2024).

Batesville Tool & Die: Won a major contract from a European automaker to supply body panels for a new SUV model (source: Metal Forming magazine, Dec 2023 issue).