Top Industry Leaders in the Automotive Pressure Sensor Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

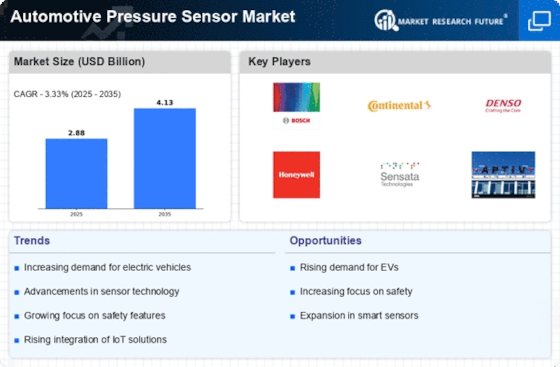

Sensing the Pulse of Performance: Exploring the Competitive Landscape of the Automotive Pressure Sensor Market

Beneath the sleek exterior of every modern car, a network of silent guardians monitors essential parameters - the automotive pressure sensor market. This bustling multi-billion dollar space hums with activity, as established titans, nimble innovators, and regional specialists vie for a share in the lifeblood of vehicle safety and performance. Let's delve into the key strategies, market dynamics, and future trends shaping this crucial landscape.

Key Player Strategies:

Global Titans: Companies like Bosch, Continental, and Denso leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers and aftermarket suppliers, offering high-precision pressure sensors for various applications, from tire pressure monitoring systems (TPMS) to engine manifold and fuel rail pressure. Bosch's ABS 8 pressure sensor exemplifies their focus on high reliability and advanced functionality.

Technology Disruptors: Startups like Sensiq and Xtralift are disrupting the market with innovative technologies like microfluidics and miniaturized sensors. They cater to automakers seeking lightweight, compact, and highly accurate pressure sensors for advanced engine management systems and next-generation electric vehicles. Sensiq's microfluidic pressure sensors showcase their focus on space-saving and precise solutions.

Cost-Effective Challengers: Chinese manufacturers like Sensata Technologies and Lingyi Technology are making waves with competitively priced pressure sensors, targeting budget-conscious car owners in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Lingyi Technology's TPMS sensors demonstrate their focus on cost-effective tire pressure monitoring solutions.

Niche Specialists: Companies like Sensata Technologies and TE Connectivity excel in specific segments like tire pressure sensors or hydraulic pressure sensors for brakes and transmissions. They leverage their deep understanding of niche applications and offer tailored solutions with advanced functionalities. TE Connectivity's pressure sensors for brake systems showcase their focus on specific vehicle systems and safety-critical applications.

Factors for Market Share Analysis:

Accuracy and Reliability: Delivering highly accurate and reliable pressure measurements under diverse operating conditions, ensuring long service life, and adhering to strict automotive safety standards are paramount for market success. Companies with a track record of accuracy and reliability gain an edge.

Technology and Innovation: Implementing cutting-edge technologies like wireless pressure communication, on-chip signal processing, and integration with vehicle health monitoring systems caters to modern vehicle architectures and advanced driver-assistance systems (ADAS). Companies leading in innovation stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive markets. Companies offering affordable solutions without compromising on basic functionality gain market share.

Safety and Regulatory Compliance: Adhering to strict safety regulations, ensuring sensor redundancy for critical applications, and offering tamper-proof TPMS solutions attract manufacturers and regulators alike. Companies prioritizing safety and compliance gain an edge.

New and Emerging Trends:

Focus on Automated Driving: Adapting pressure sensor technology to support autonomous driving functions, monitoring tire pressure for optimal grip and performance, and integrating with advanced collision avoidance systems presents significant growth opportunities. Companies specializing in ADAS-compatible sensors stand out.

Connected Car Integration: Integrating pressure sensors with connected car technologies, providing real-time tire pressure monitoring and predictive maintenance insights, and enabling remote diagnostics for fleet management caters to modern vehicle connectivity needs. Companies embracing data-driven solutions gain an edge.

Focus on Sustainability and Energy Efficiency: Developing lightweight and low-power pressure sensors, optimizing fuel efficiency through precise engine pressure monitoring, and promoting sustainable manufacturing practices cater to increasing demand for environmentally conscious automotive solutions. Companies demonstrating sustainability commitment attract ethical investors and regulatory benefits.

Regional Customization and Compliance: Adapting sensor designs and materials to cater to specific regional climatic conditions, adhering to diverse regulatory standards, and offering regional distribution networks attract local automakers and aftermarket suppliers. Companies with strong regional customization capabilities gain market share.

Overall Competitive Scenario:

The automotive pressure sensor market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative features and miniaturization. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific applications. Factors like accuracy, technology, affordability, and safety play a crucial role in market share analysis. New trends like ADAS integration, connected car solutions, sustainability, and regional customization offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse vehicle requirements, embrace sustainable practices, and explore data-driven solutions. By sensing the pulse of performance with precision and adaptability, they can secure a dominant position in this vital automotive space.

Infineon:

• Oct 2023: Announced development of a new high-precision pressure sensor for EV battery management systems, offering improved safety and efficiency (Source: Infineon press release)

Sensata:

• Dec 2023: Acquired Pressure Controls Inc., expanding its portfolio of pressure sensors for industrial and commercial vehicle applications (Source: Sensata press release)

Robert Bosch:

• Dec 2023: Partnered with Samsung to develop next-generation pressure sensors using AI and machine learning, aiming to improve accuracy and reliability (Source: Reuters)

Denso:

• Dec 2023: Invested in a startup developing advanced MEMS pressure sensors for medical and industrial applications, leveraging expertise for automotive sensors (Source: Nikkei Asian Review)

NXP: Partnered with a Chinese automaker to develop a customized pressure sensor for TPMS, showcasing regional market expansion efforts (Source: NXP press release, Oct 2023)

Analog Devices: Announced a new pressure sensor with integrated signal conditioning circuitry, simplifying design for automotive engineers (Source: Analog Devices website, Nov 2023)

Top listed global companies in the industry are:

Infineon, Sensata, Robert Bosch, Denso, Delphi, Texas Instruments, NXP, Analog Device, Melexis, General Electric, and TE Connectivity