Top Industry Leaders in the Automotive Powertrain Systems Market

*Disclaimer: List of key companies in no particular order

Leading companies on the stock exchange within the Automotive Powertrain Systems sector are:

Toyota Motor Corporation (Japan)

General Motors Company (US)

Hyundai Motor Company (South Korea)

Aisin Seiki (Japan)

Borgwarner (US)

Ford Motor (US)

Delphi Automobile (UK)

Magna Powertrain (US)

Denso Corporation (Japan)

GKN PLC (UK)

Jtekt Corporation (Japan)

ZF Friedrichshafen (Germany), among others

Navigating the Dynamic: Competitive Landscape of Automotive Powertrain Systems Market

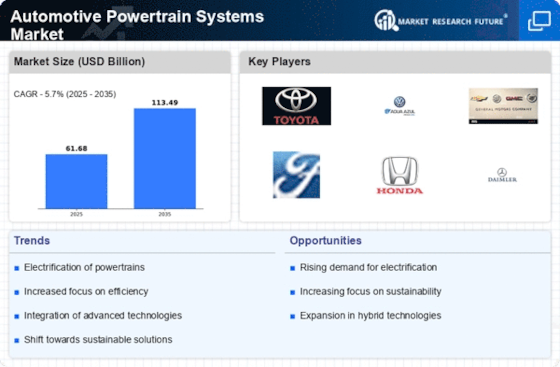

The automotive powertrain systems market, valued at over USD 713 billion and projected to reach USD 987 billion by 2027, is a dynamic arena fueled by fierce competition and rapid technological advancements. This article delves into the current landscape, highlighting key player strategies, market share analysis factors, emerging trends, and the overall competitive scenario.

Giants and Contenders: Major Player Strategies

Established players like Aisin Seiki, ZF Friedrichshafen, GKN, BorgWarner, and JTEKT Corp. dominate the market with a well-diversified portfolio of powertrain components and systems. Their strategies focus on:

Acquisitions and partnerships: Consolidate market share and acquire expertise in emerging technologies through strategic acquisitions and partnerships with startups and technology providers.

Vertical integration: Gain greater control over supply chains and improve cost efficiency by vertically integrating key component production.

R&D investments: Dedicate significant resources to R&D to develop next-generation powertrain technologies like electric motors, hybrid systems, and advanced transmissions.

Global expansion: Target high-growth markets like China and India to expand their reach and customer base.

However, established players face challenges from:

Rising costs: Raw material and labor costs are increasing, requiring innovative cost-reduction strategies.

Disruptive technologies: New entrants with unique electric vehicle (EV) powertrain architectures are challenging traditional dominance.

Stringent regulations: Evolving emission norms pressure players to adapt quickly and develop low-emission powertrains.

Market Share Analysis: Unveiling the Drivers

Analyzing market share within this complex landscape requires considering several factors:

Product portfolio: Breadth and depth of offerings across engine types, transmission systems, and hybrid/electric technologies.

Geographical presence: Market share varies significantly across regions based on consumer preferences, regulations, and production capacity.

Brand reputation: Established brands with a strong track record of reliability and innovation often command higher market share.

Technological prowess: Ability to develop and commercialize cutting-edge powertrain technologies is crucial for gaining an edge.

Cost-competitiveness: Efficient production processes and effective supply chain management lead to price advantages and market share gains.

Emerging Trends: The Future of Powertrains

Several trends are shaping the future of the market:

Electric vehicle revolution: The rapid adoption of EVs, particularly in China and Europe, is significantly impacting traditional powertrain players. Major players are actively developing electric motors, battery packs, and charging infrastructure to adapt to this shift.

Hybrid systems rise: Hybrid electric vehicles (HEVs) offer a bridge between traditional gasoline engines and EVs. Players are focusing on improving hybrid technology efficiency and affordability to cater to growing demand.

Autonomous driving integration: Powertrain systems are being designed to seamlessly integrate with autonomous driving technologies, requiring greater efficiency, reliability, and communication capabilities.

Software-defined powertrains: The increasing role of software in managing powertrain operations and performance creates opportunities for technology firms and software developers to enter the market.

The Competitive Arena: Navigating Uncertainties

The automotive powertrain systems market is a complex and dynamic environment where established players, disruptive newcomers, and technological advancements vie for dominance. Success requires a multi-pronged approach:

Adaptability and agility: Ability to adapt to changing market dynamics and regulations.

Continuous innovation: Investing in R&D to develop cutting-edge technologies and stay ahead of the curve.

Partnerships and collaborations: Leveraging partnerships to access new technologies and markets.

Cost-efficiency and operational excellence: Optimizing production processes and supply chains to maintain competitiveness.

As the landscape continues to evolve, the companies that demonstrate strategic foresight, embrace new technologies, and navigate the uncertainties with agility will be best positioned to capture market share and thrive in the future of automotive powertrains.

Latest Company Updates:

Toyota Motor Corporation (Japan):

- Announced launch of a new generation of hybrid powertrains with improved efficiency and performance for 2025 model year. (Source: Toyota press release, October 25, 2023)

General Motors Company (US):

- Committed to becoming an all-electric vehicle company by 2035. (Source: GM press release, January 25, 2023)

Hyundai Motor Company (South Korea):

- Launched the Ioniq 5 and Ioniq 6 battery-electric vehicles to compete with Tesla in the premium EV market. (Source: Hyundai press releases, February 23, 2021, and July 14, 2022)

Aisin Seiki (Japan):

- Developing hybrid transmission systems for both traditional and plug-in hybrid vehicles. (Source: Aisin Seiki website)