Top Industry Leaders in the Automotive Power Modules Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Power Modules industry are:

Mitsubishi Electric Corporation (Japan)

Toshiba Corporation (Japan)

NXP Semiconductors (Netherlands)

Continental AG (Germany)

Renesas Electronics Corporation (Japan)

Infineon Technologies (Germany)

Fuji Electric Co. (Japan)

Robert Bosch GmbH (Germany)

ON Semiconductor (US)

TMicroelectronics (Switzerland)

Rohm Semiconductor (Japan)

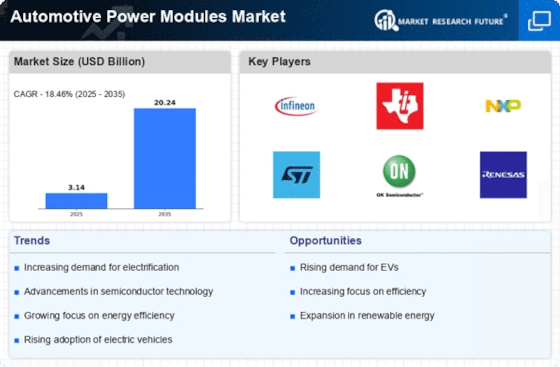

The automotive power modules market is experiencing a surge, fueled by the rising electrification of vehicles. These compact units, housing critical power management components, are no longer mere auxiliary parts; they're becoming the brains behind efficient and reliable energy distribution in modern cars. Navigating this dynamic landscape requires understanding the key players, their strategies, and the emerging trends shaping their competitive approaches.

Key Players and their Strategies:

Tier 1 automotive suppliers like Continental AG, Robert Bosch GmbH, Denso Corporation, Hitachi Automotive Systems Ltd, and Mitsubishi Electric Corporation dominate the market. These established players leverage their extensive know-how in power electronics, automotive systems, and global reach to maintain their hold. Continental, for instance, focuses on high-voltage modules for electric vehicles, while Bosch emphasizes modularity and scalability for diverse applications. Denso, meanwhile, capitalizes on its strong ties with Japanese automakers.

However, the market is witnessing the rise of new entrants like Infineon Technologies AG, STMicroelectronics N.V., and ROHM Semiconductor. These chipmakers boast expertise in power semiconductor technology and offer cost-effective alternatives, often focusing on specific niches like low-voltage DC-DC converters or on-board chargers. Their agility and focus on innovation pose a challenge to established players.

Factors Influencing Market Share Analysis:

Several factors determine market share in this dynamic landscape:

Product Portfolio: Offering a diverse range of modules catering to different voltage levels, applications (motor drives, battery management, etc.), and vehicle types (passenger cars, commercial vehicles) is crucial.

Technological Prowess: Continuous R&D in high-efficiency semiconductors, thermal management solutions, and miniaturization is key to staying ahead.

Partnerships and Collaborations: Collaborations with automakers, tier 2 suppliers, and research institutions foster faster innovation and market access.

Cost Competitiveness: Balancing technological sophistication with affordability is essential for wider adoption, especially in cost-sensitive segments.

Sustainability Focus: Developing modules with minimal environmental impact, using recycled materials and promoting energy efficiency, resonates with increasingly eco-conscious consumers.

New and Emerging Trends:

The future of automotive power modules is marked by exciting trends:

Silicon Carbide (SiC) Adoption: SiC's superior switching performance and thermal management capabilities are driving its integration in high-voltage modules for improved efficiency and power density.

Software-Defined Power Modules: Integrating intelligence into modules, enabling real-time monitoring, diagnostics, and adaptive control, optimizes performance and simplifies system design.

Wireless Power Transfer: Eliminating cables for battery charging and in-vehicle power distribution offers convenience and weight reduction.

Standardization Efforts: Collaboration within the industry to establish common module specifications and interfaces could reduce development costs and accelerate adoption.

Overall Competitive Scenario:

The automotive power modules market is characterized by intense competition, with established players facing pressure from new entrants and disruptive technologies. To thrive, companies need to strike a balance between maintaining their core strengths and adapting to the evolving landscape. Continuous innovation, strategic partnerships, and a focus on sustainable solutions will be critical for success in this rapidly transforming market.

Latest Company Updates:

Mitsubishi Electric: October 26, 2023: Unveiled a new SiC-based traction inverter module for electric vehicles (EVs) offering 50% higher power density and 20% lower energy loss compared to previous models. (Source: Mitsubishi Electric press release)

Toshiba: December 12, 2023: Signed a joint development agreement with Rohm Semiconductor on silicon carbide (SiC) power modules for automotive applications. (Source: Toshiba press release)

NXP Semiconductors: December 7, 2023: Announced the industry's first 800V-1200V GaN power module for on-board chargers in EVs, enabling faster charging and increased efficiency. (Source: NXP press release)

Continental AG: November 30, 2023: Launched a new 48V DC-DC converter module with integrated silicon nitride (Si3N4) packaging for improved thermal management and reliability. (Source: Continental press release)