Top Industry Leaders in the Automotive Power Electronics Market

*Disclaimer: List of key companies in no particular order

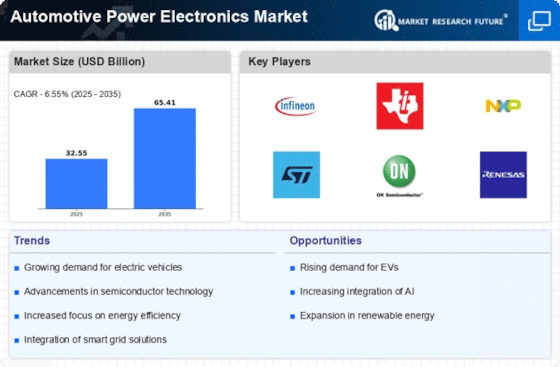

The automotive power electronics market, the brains behind the brawn of modern vehicles, pulsates with vibrant competition. Driven by the burgeoning demand for electric vehicles (EVs) and advanced driver-assistance systems (ADAS), attracting numerous established and emerging players. Understanding the intricacies of this landscape is crucial for navigating the electrifying potential within.

Key Player Strategies:

Established players like Infineon, Bosch, and Texas Instruments hold significant market share through their long-standing expertise, robust product portfolios, and global reach. Their strategies revolve around:

Vertical integration: Securing raw materials and critical components internally to manage costs and supply chain disruptions.

R&D investments: Developing cutting-edge technologies like silicon carbide (SiC) MOSFETs and GaN transistors for increased efficiency and power density.

Strategic partnerships: Collaborating with carmakers and startups to co-develop innovative solutions and gain early market access.

Emerging players like NXP Semiconductors, Rohm Semiconductor, and onsemi are carving their niche through:

Focus on specific segments: Targeting niche applications like battery management systems or on-board chargers to gain a foothold.

Cost-competitive offerings: Leveraging lower production costs in regions like China to offer attractive price points.

Rapid innovation: Prioritizing R&D and agile product development cycles to cater to the dynamic market demands.

Factors for Market Share Analysis:

Several factors influence market share, demanding comprehensive analysis:

Product portfolio breadth and depth: Offering a wide range of power electronics solutions for diverse applications attracts a larger customer base.

Technological advancements: Pioneering and deploying cutting-edge technologies like wide bandgap semiconductors can provide a competitive edge.

Geographical presence: Strong footholds in major automotive manufacturing regions like Europe, Asia, and North America are crucial.

Brand reputation and quality: A proven track record for reliability and performance fosters customer loyalty and brand recognition.

Cost competitiveness: Striking a balance between affordability and quality is essential for market penetration.

New and Emerging Trends:

The market is constantly evolving, fueled by exciting trends:

Silicon carbide (SiC) and gallium nitride (GaN) adoption: These wide bandgap materials offer higher efficiency and switching speeds, reducing energy consumption and component size.

Integrated power modules: Combining multiple power electronics components into compact units simplifies design and improves thermal management.

Software-defined power electronics: Advanced software control algorithms optimize power conversion efficiency and enable dynamic system adjustments.

Artificial intelligence (AI) integration: Leveraging AI for predictive maintenance and fault detection in power electronics systems.

Overall Competitive Scenario:

The automotive power electronics market is characterized by:

Moderate consolidation: While established players hold significant shares, new entrants are steadily gaining traction through specialization and innovation.

Intensified R&D focus: Technological advancements are a key battleground, with players vying for leadership in new materials and software solutions.

Regional variations: Growth dynamics differ across regions, with China and Europe being particularly vibrant markets.

Sustainability emphasis: Environmental regulations and customer preferences drive demand for energy-efficient power electronics solutions.

Industry Developments and Latest Updates:

Infineon Technologies AG (Germany):

- Dec 19, 2023: Announced collaboration with Rimac Technology for silicon carbide (SiC) inverters in high-performance electric vehicles (EVs). (Source: Infineon press release)

Texas Instruments Inc. (U.S.):

- Oct 26, 2023: Announced industry's first automotive-qualified 12V-to-5V buck-boost converter for advanced driver-assistance systems (ADAS). (Source: Texas Instruments press release)

ON Semiconductor Corp. (U.S.):

- Dec 22, 2023: Partnered with Stellantis for SiC inverters and battery management systems in its electric Ram trucks. (Source: Reuters)

- Sep 20, 2023: Introduced new SiC MOSFET modules with integrated drivers for high-voltage automotive applications. (Source: ON Semiconductor press release)

Renesas Electronics Corp. (Japan):

- Dec 20, 2023: Unveiled 72V automotive DC-DC converter ICs for mild hybrid and start-stop systems. (Source: Renesas press release)

Mitsubishi Heavy Industries Ltd. (Japan):

- Dec 12, 2023: Demonstrated prototype SiC inverter with 99.8% efficiency for heavy-duty EVs and trucks. (Source: Nikkei Asia)

Top Companies in the Automotive Power Electronics industry includes,

Infineon Technologies AG (Germany), Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Renessa Electronics Corp. (Japan), Mitsubishi Heavy Industries Ltd. (Japan), Maxim Products Inc. (U.S.), NXP Semiconductors N.V. (Netherlands), Qualcomm Ins. (U.S.), Robert Bosch GmbH (Germany), and Vishay Intertechnology Inc. (U.S.), and others.