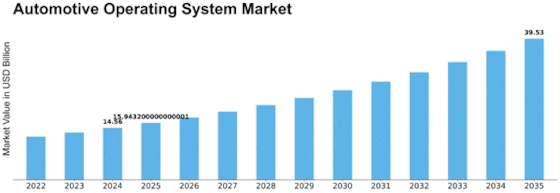

Automotive Operating System Size

Automotive Operating System Market Growth Projections and Opportunities

The market factors influencing automotive operating systems reflect a dynamic interplay of technological advancements, connectivity demands, safety considerations, regulatory standards, and industry trends. One crucial factor is the increasing complexity of in-vehicle technologies and the rise of connected and autonomous vehicles. Modern automotive operating systems serve as the technological backbone, integrating functionalities such as infotainment, navigation, connectivity, and advanced driver assistance systems (ADAS). The demand for seamless integration and coordination of these features drives the evolution of automotive operating systems, emphasizing their role in enhancing the overall driving experience.

Connectivity is a pivotal market factor shaping automotive operating systems. With the proliferation of smart devices and the Internet of Things (IoT), consumers expect their vehicles to be an extension of their connected lifestyle. Automotive operating systems must facilitate seamless connectivity, allowing drivers and passengers to access real-time information, entertainment, and communication services. As the automotive industry moves towards Vehicle-to-Everything (V2X) communication, operating systems play a critical role in enabling vehicles to communicate with each other and with infrastructure, enhancing safety and efficiency on the road.

Safety considerations are paramount in the development of automotive operating systems. The integration of ADAS features, such as collision avoidance systems, lane-keeping assistance, and adaptive cruise control, requires robust operating systems capable of real-time data processing and decision-making. The reliability and responsiveness of these systems directly impact vehicle safety, influencing consumer trust and compliance with stringent safety standards imposed by regulatory bodies.

Regulatory standards and compliance are key drivers in the automotive operating system market. Governments around the world enforce regulations related to vehicle safety, emissions, and cybersecurity. Automotive operating systems must adhere to these standards, ensuring that they meet the required safety and security protocols. As the automotive industry experiences increased scrutiny regarding cybersecurity threats, operating systems must incorporate measures to protect vehicles from potential cyber-attacks, further influencing their design and functionality.

Technological advancements, particularly in artificial intelligence (AI) and machine learning, play a crucial role in the market dynamics of automotive operating systems. AI-driven functionalities, such as natural language processing, voice recognition, and predictive analytics, are becoming integral components of modern operating systems. These advancements enhance the user experience, making vehicles more intuitive and responsive to user commands. Additionally, machine learning algorithms contribute to the improvement of autonomous driving capabilities, creating a continuous cycle of innovation in automotive operating systems.

Consumer preferences for user-friendly interfaces and personalized experiences influence the market factors of automotive operating systems. Drivers and passengers expect intuitive interfaces, touchscreens, and voice controls that mimic the user experience of smartphones and other smart devices. Customization options, including personalized settings for infotainment, climate control, and driver assistance features, contribute to a positive user experience and impact the market positioning of automotive operating systems.

Global economic factors, such as production costs, supply chain dynamics, and pricing strategies, influence the market for automotive operating systems. The cost of incorporating advanced technologies, securing intellectual property rights, and maintaining a competitive edge in the market can impact the overall affordability of vehicles. Economic conditions may also influence the adoption rate of new vehicles, subsequently affecting the demand for vehicles equipped with the latest automotive operating systems.

The market factors of automotive operating systems are shaped by the evolving landscape of in-vehicle technologies, connectivity demands, safety requirements, regulatory standards, technological advancements, consumer preferences, and economic considerations. As the automotive industry continues to embrace connectivity, electrification, and autonomous driving, operating systems will remain at the forefront of innovation. Manufacturers of automotive operating systems must navigate these multifaceted factors to deliver solutions that meet the diverse needs of consumers, ensure regulatory compliance, and contribute to the advancement of the connected and autonomous vehicle ecosystem.

Leave a Comment