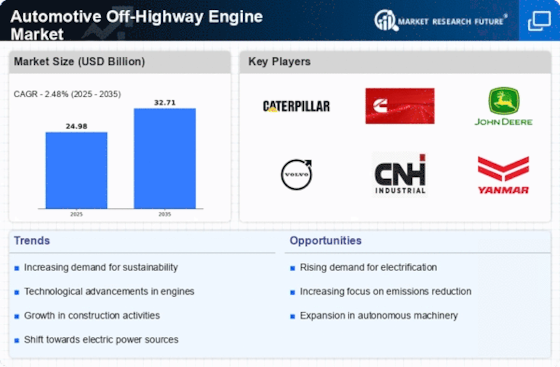

Top Industry Leaders in the Automotive Off-Highway Engine Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Off-Highway Engine industry are:

Caterpillar Inc. (U.S.), Cummins Inc. (U.S.), Deutz AG (Germany), Kubota Corporation (Japan), Volvo Group (Sweden), and Mahindra and Mahindra Limited (India). Deere & Company (U.S.), J.C. Bamford Excavators Limited (U.K.), AGCO Corporation (U.S.), and Massey Ferguson Limited (U.S.)

Powering the Rough Terrain: Exploring the Competitive Landscape of the Automotive Off-Highway Engine Market

Beneath the growl of bulldozers and the churn of tractors lies a hidden battleground - the automotive off-highway engine market. This multi-billion dollar space hums with activity, with established giants, nimble innovators, and regional specialists vying for control over the heart of construction, agricultural, and industrial vehicles. Let's dissect the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Global Titans: Companies like Cummins, Caterpillar, and Deutz AG leverage their extensive experience, diverse engine portfolios, and global reach to maintain their dominance. They cater to major equipment manufacturers, offering a wide range of off-highway engines covering various power outputs and applications, from excavators to harvesters. Cummins' QSX15 diesel engine exemplifies their focus on high-performance and versatility.

Technology Disruptors: Startups like Kohler Power and Yanmar Co. Ltd. are disrupting the market with next-generation technologies like electric and hybrid off-highway engines, advanced emissions control systems, and data-driven engine management platforms. They cater to tech-savvy equipment manufacturers and environmentally conscious users seeking emission reduction and improved fuel efficiency. Kohler's K-Series hybrid power unit showcases their focus on cleaner and more efficient solutions.

Cost-Effective Challengers: Chinese manufacturers like Weichai Power Co. Ltd. and Yuchai Machinery Group Co. Ltd. are making waves with competitively priced engines, targeting budget-conscious buyers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Weichai's WP series engines demonstrate their focus on cost-effective off-highway power solutions.

Regional Champions: Companies like Kubota Corporation in Japan and Mahindra & Mahindra Ltd. in India excel in specific geographic regions, leveraging strong local relationships and deep understanding of regional fuel availability and maintenance infrastructure. They offer tailored solutions like engines optimized for local fuel blends or service networks readily available in remote areas. Mahindra's M-POWER engines showcase their focus on regional customization for optimal performance and support.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation technologies like electrified drivetrains, alternative fuels, and advanced emissions control systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive sectors like construction and agriculture. Companies offering affordable solutions without compromising on reliability or performance stand out.

Fuel Availability and Efficiency: Ensuring compatibility with diverse fuel options like diesel, biodiesel, or natural gas, and optimizing fuel efficiency for extended operation times, are vital for operational flexibility and cost reduction. Companies with expertise in diverse fuel options and efficient engines gain an edge.

Durability and Reliability: Off-highway equipment operates in harsh environments, so engines must be robust, withstand extreme conditions, and offer long service intervals. Companies with strong track records of durability and reliability gain market share.

New and Emerging Trends:

Focus on Electrification: Integrating electric and hybrid propulsion systems into off-highway vehicles for reduced emissions and noise pollution presents significant growth opportunities. Companies offering reliable and efficient electric off-highway engines stand out.

Data-Driven Engine Management: Implementing technologies like IoT sensors, remote diagnostics, and predictive maintenance platforms for real-time engine performance monitoring and proactive service scheduling optimizes uptime and reduces maintenance costs. Companies embracing data-driven solutions cater to the demand for efficient fleet management.

Emission Regulations and Sustainability: Adapting engines to comply with evolving emission regulations and demonstrating a commitment to environmental sustainability through clean technologies and low-emission engines become increasingly important for market access and brand image. Companies with strong sustainability practices gain market share.

Regional Customization and Service Networks: Tailoring engine configurations and service networks to address specific regional needs, fuel availability, and maintenance infrastructure requirements becomes crucial for success in diverse markets. Companies with strong regional customization capabilities gain an edge.

Overall Competitive Scenario:

The automotive off-highway engine market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and regional champions excel in specific markets. Factors like technology innovation, affordability, fuel compatibility, and durability play a crucial role in market share analysis. New trends like electrification, data-driven solutions, sustainability, and regional customization offer exciting growth opportunities. To power the rough terrain and secure a dominant position in this evolving landscape, players must prioritize innovation, cater to diverse customer needs, embrace clean technologies, and tailor solutions to regional requirements. By powering reliable, efficient, and environmentally friendly engines, they can pave the way for a more sustainable and productive future for off-highway operations.

Latest Company Updates:

Caterpillar:

- Unveiled Cat C17B marine engine with Stage V compliant Tier 4 Final option in October 2023. (Source: Caterpillar website, Oct 24, 2023)

Cummins:

- Introduced QSX15 Tier 4 Final engine for construction equipment in September 2023. (Source: Cummins website, Sep 12, 2023)

Deutz AG:

- Launched TCD 3.6 L5 Stage V engine for compact construction equipment in December 2023. (Source: Deutz website, Dec 15, 2023)

Volvo Group:

- Launched electric wheel loaders and excavators under Volvo Construction Equipment brand. (Source: Volvo CE website, Oct 31, 2023)

Kubota Corporation:

- Released V3800 Tier 4 Final engine for agricultural and construction applications in November 2023. (Source: Kubota website, Nov 7, 2023)