Top Industry Leaders in the Automotive OEM Coatings Market

In the glistening world of automobiles, more than meets the eye lies beneath the vibrant hues and dazzling finishes. Automotive OEM coatings play a crucial role, not just in aesthetics, but also in protecting vehicles from corrosion, weather, and wear. Let's delve into the dynamic landscape of this competitive market, exploring the strategies, market share factors, industry news, and recent developments shaping its trajectory.

In the glistening world of automobiles, more than meets the eye lies beneath the vibrant hues and dazzling finishes. Automotive OEM coatings play a crucial role, not just in aesthetics, but also in protecting vehicles from corrosion, weather, and wear. Let's delve into the dynamic landscape of this competitive market, exploring the strategies, market share factors, industry news, and recent developments shaping its trajectory.

Strategies Adopted by Coating Titans:

-

Product Diversification: Companies like Axalta, BASF, and PPG are expanding their portfolios beyond traditional solvent-based paints. They're venturing into water-based options, powder coatings, and high-performance functional coatings like self-healing paints and scratch-resistant finishes. -

Sustainability Push: Green credentials are becoming a key differentiator. Companies are developing low-VOC (volatile organic compounds) coatings, implementing resource-efficient processes, and exploring bio-based materials to minimize environmental impact. -

Digitalization and Automation: Embracing digital tools like simulation software, robotic painting systems, and AI-powered color formulation is improving efficiency, reducing waste, and ensuring consistent quality. -

Regional Focus: Asia-Pacific, particularly China and India, is witnessing explosive growth in car production. Companies are establishing manufacturing facilities and distribution networks in these regions to capture market share. -

Collaborations and Partnerships: Partnering with car manufacturers, research institutions, and raw material suppliers fosters innovation, accelerates development, and opens doors to new market segments.

Factors Influencing Market Share:

-

Product Portfolio Breadth: Offering a diverse range of coatings suitable for different surfaces, substrates, and performance requirements expands market reach and caters to specific customer needs. -

Quality and Performance: Consistent high quality, superior durability, and exceptional performance in terms of corrosion resistance, scratch resistance, and colorfastness are essential for building trust and brand reputation. -

Technical Expertise: Possessing the knowledge and expertise to tailor coatings for specific needs, like electric vehicle battery protection or extreme weather resistance, is crucial for gaining an edge. -

Cost-Effectiveness: Balancing high performance with competitive pricing is key. Companies need to optimize production processes and offer flexible pricing models to win over cost-conscious clients.

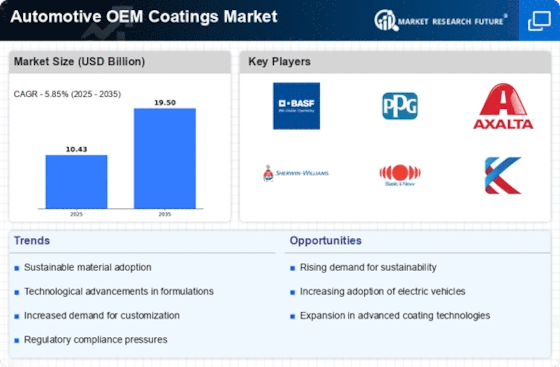

Key Companies in the automotive OEM coatings market include

- BASF SE (Germany)

- PPG Industries Inc. (US)

- Nippon Paints Holdings Co. Ltd (Japan)

- Akzo Nobel N.V. (The Netherlands)

- Axalta Coating Systems Ltd (US)

- Berger Paints India Ltd (India)

- Kansai Paint Co. Ltd (Japan)

- The Sherwin-Williams Company (US)

- KCC Corporation (South Korea)

- Covestro AG (Germany)

- Esdee Paints Ltd (India)

- Lubrizol Corporation (US)

Recent Developments:

-

August 2023: BASF introduces a new waterborne coating technology offering superior durability and corrosion resistance, targeting the electric vehicle segment. -

September 2023: Axalta unveils a high-solid, low-VOC paint with improved color consistency and faster drying times, catering to sustainability concerns and production efficiency demands. -

October 2023: PPG expands its online marketplace for automotive refinish coatings, offering customers convenient access to a wider product range.