Top Industry Leaders in the Automotive Lane Warning System Market

*Disclaimer: List of key companies in no particular order

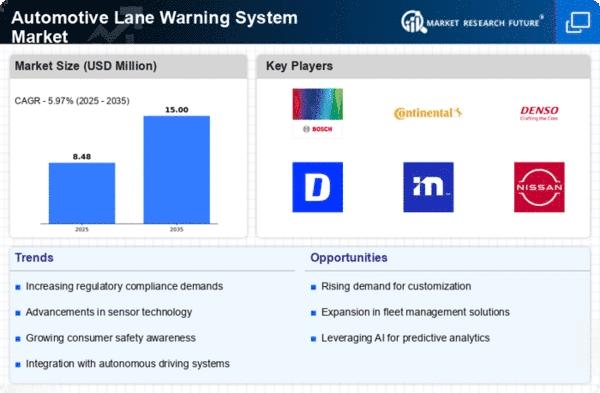

Top listed companies in the Automotive Lane Warning System industry are:

Robert Bosch (Germany)

Denso Corporation (Japan)

Continental AG (Germany)

Autoliv Inc (Sweden)

Delphi (UK)

Magna International (Canada)

ZF TRW (US)

Nissan (Japan)

Hitachi Automotive Systems (Japan)

Mobileye (Israel).

Keeping Lane: Exploring the Competitive Landscape of the Automotive Lane Warning System Market

Beneath the sleek dashboards and bustling highways, a silent guardian resides – the automotive lane warning system (LW) market. This multi-billion dollar space thrums with activity, with established giants, nimble innovators, and regional specialists vieing for control over keeping drivers safely within their lane markings. Let's dissect the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Global Titans: Companies like Robert Bosch, Continental AG, and Denso Corporation leverage their extensive experience, diverse system portfolios, and global reach to maintain their dominance. They cater to major automakers, offering advanced LW systems incorporating camera sensors, advanced algorithms, and multi-stage warnings (visual, audible, haptic). Bosch's Driver Assistance Display exemplifies their focus on multi-sensory and integrated safety solutions.

Technology Disruptors: Startups like Mobileye and Delphi Technologies are disrupting the market with next-generation technologies like AI-powered vision systems, high-definition cameras, and integration with other driver assistance features. They cater to tech-savvy carmakers seeking advanced functionality, improved accuracy, and potential for autonomous driving applications. Mobileye's EyeQ® chips showcase their focus on AI-powered vision systems for enhanced lane detection.

Cost-Effective Challengers: Chinese manufacturers like Yanfeng Automotive Interiors and Minda KTSN Plastic Solutions GmbH & Co. are making waves with competitively priced LW systems, targeting budget-conscious automakers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Minda KTSN's lane departure warning system demonstrates their focus on cost-effective safety solutions.

Regional Champions: Companies like Valeo in France and Hyundai Mobis in South Korea excel in specific geographic regions, leveraging strong local relationships and deep understanding of regional regulations and driver behavior. They offer tailored solutions like camera systems optimized for challenging environmental conditions. Hyundai Mobis' Lane Departure Warning System demonstrates their focus on regional customization for optimal performance.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation features like real-time lane edge detection, cross-traffic alerts, and integration with blind-spot monitoring systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in lower-priced vehicle segments. Companies offering affordable solutions without compromising on accuracy or reliability stand out.

Regulatory Landscape and Safety Standards: Navigating the evolving regulatory landscape, ensuring compliance with NCAP requirements, and demonstrating strong safety performance records are paramount for market access and brand reputation. Companies with strong compliance records gain an edge.

Data Privacy and Security: Mitigating privacy concerns regarding camera data usage and implementing robust cybersecurity measures are crucial for building trust and customer acceptance. Companies with strong data privacy practices gain market share.

New and Emerging Trends:

Focus on Multi-sensor Fusion: Integrating camera data with lidar, radar, and GPS for enhanced accuracy and redundancy in challenging weather conditions or complex lane markings is becoming increasingly important. Companies offering multi-sensor fusion solutions stand out.

Lane Keeping Assist Systems (LKAS): Developing advanced LW systems that proactively steer the vehicle back into the lane offer additional safety and driver support. Companies offering LKAS functionality gain an edge.

Customization and Personalization: Enabling customizable warning modes, intensity levels, and sensitivity adjustments cater to individual driver preferences and enhance user experience. Companies offering configurable options gain market share.

Connected Car Integration: Integrating LW systems with vehicle-to-everything (V2X) platforms for real-time lane closure information and communication with other vehicles on the road opens new possibilities for enhanced safety and traffic management. Companies embracing connectivity cater to the demand for intelligent transportation systems.

Overall Competitive Scenario:

The automotive lane warning system market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and regional champions excel in specific markets. Factors like technology innovation, affordability, regulatory compliance, and data privacy play a crucial role in market share analysis. New trends like multi-sensor fusion, LKAS, personalization, and connected car integration offer exciting growth opportunities. To stay on track in this evolving landscape, players must prioritize innovation, cater to diverse customer needs, address data privacy concerns, and explore technology-driven solutions. By keeping drivers safely within their lane, they can secure a dominant position in this crucial segment of the automotive safety market.

Latest Company Updates:

Robert Bosch (Germany):

• Jun 2023: Unveiled the next-generation Mid-Range Radar (MRR) with enhanced lane detection capabilities for improved LDWS performance. (Source: Bosch press release)

Denso Corporation (Japan):

• Jul 2023: Introduced a LiDAR-based lane detection system for autonomous driving applications with high-precision mapping capabilities. (Source: Denso website)

Continental AG (Germany):

• Apr 2023: Launched a next-generation camera system with improved lane marking recognition and wider field of view for LDWS and LKA functions. (Source: Continental press release)

Autoliv Inc (Sweden):

• Mar 2023: Introduced a multi-sensor fusion (camera and radar) LDWS system designed for diverse road environments and weather conditions. (Source: Autoliv website)