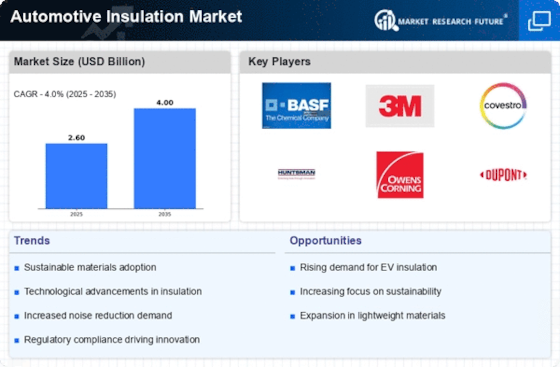

Growing Electric Vehicle Adoption

The Automotive Insulation Market is significantly influenced by the growing adoption of electric vehicles (EVs). As the automotive landscape shifts towards electrification, the need for specialized insulation materials that cater to the unique requirements of EVs is becoming apparent. These vehicles require insulation solutions that not only provide thermal and acoustic benefits but also address safety concerns related to battery systems. Market analysts project that the EV segment will account for a substantial share of the insulation market, with growth rates potentially exceeding 7% annually. This trend underscores the importance of adapting insulation technologies to meet the evolving demands of the Automotive Insulation Market.

Rising Demand for Noise Reduction

The Automotive Insulation Market is experiencing a notable increase in demand for noise reduction solutions. As consumers become more discerning about vehicle comfort, manufacturers are compelled to enhance acoustic insulation in vehicles. This trend is driven by the growing awareness of the impact of noise pollution on health and well-being. According to recent data, the market for acoustic insulation materials is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is indicative of a broader shift towards prioritizing passenger comfort, which is likely to influence product development strategies within the Automotive Insulation Market.

Increased Focus on Safety Standards

The Automotive Insulation Market is also shaped by an increased focus on safety standards and regulations. As governments worldwide implement stricter safety protocols, manufacturers are compelled to enhance the performance of insulation materials to meet these requirements. Insulation plays a crucial role in fire resistance and overall vehicle safety, prompting investments in research and development. The market for fire-resistant insulation materials is anticipated to grow, with projections indicating a rise of approximately 4.8% in the coming years. This emphasis on safety not only drives innovation but also ensures that the Automotive Insulation Market remains aligned with regulatory expectations.

Shift Towards Lightweight Materials

The Automotive Insulation Market is witnessing a shift towards lightweight materials as manufacturers strive to improve fuel efficiency and reduce emissions. Lightweight insulation solutions not only contribute to overall vehicle weight reduction but also enhance performance and handling. Recent studies indicate that the adoption of lightweight materials in automotive applications could lead to a reduction in fuel consumption by up to 10%. This trend is particularly relevant in the context of stringent emissions regulations, prompting manufacturers to explore innovative insulation options that align with sustainability goals. As a result, the demand for lightweight insulation materials is expected to rise, shaping the future landscape of the Automotive Insulation Market.

Enhanced Thermal Management Solutions

In the Automotive Insulation Market, the need for effective thermal management solutions is becoming increasingly critical. With the rise of electric vehicles, there is a heightened focus on maintaining optimal battery temperatures to ensure performance and longevity. Insulation materials that can withstand high temperatures while providing energy efficiency are in demand. The market for thermal insulation materials is expected to expand significantly, with estimates suggesting a growth rate of around 6.5% annually. This trend reflects the automotive sector's commitment to innovation and efficiency, as manufacturers seek to integrate advanced insulation technologies into their designs.