Top Industry Leaders in the Automotive Injector Nozzle Market

*Disclaimer: List of key companies in no particular order

Automotive Injector Nozzle industry leaders on the list are:

Haynes Corporation

Infineon Technologies AG

Magneti Marelli S.p.A.

Keihin Corporation

Robert Bosch GmbH Alternative Fuel Systems Inc.

Eaton Corporation PLC

Denso Corporation

Delphi Automotive PLC Camshaft Inc.

Continental AG, among others.

Transonic Combustion Inc. (U.S.)

Federal-Mogul Corporation (U.S.)

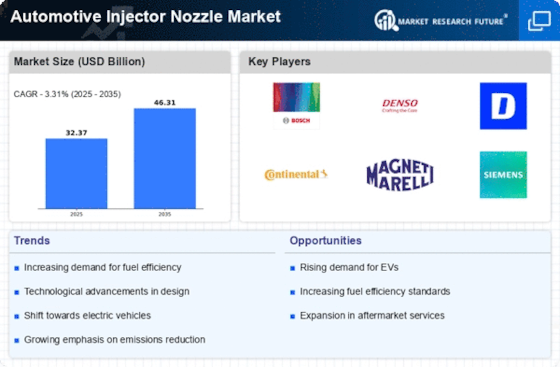

The automotive injector nozzle market plays a crucial role in engine performance and efficiency, and it's expected to maintain steady growth in the coming years. This growth is driven by several factors, including:

Increasing vehicle production and sales: Rising demand for automobiles, particularly in emerging economies, translates to a greater need for injector nozzles.

Advancements in fuel injection technology: Development of multi-hole nozzles and piezo technology leads to improved fuel atomization and combustion, driving demand for these advanced injector systems.

Stricter emission regulations: Governments are implementing stringent norms to curb vehicular pollution, pushing manufacturers towards cleaner technologies that involve efficient fuel injection.

This dynamic market attracts several key players vying for market share. Let's analyze the strategies adopted by some prominent players:

Tier 1 Suppliers:

Bosch: Known for its technological prowess and global reach, Bosch maintains a strong market position through continuous innovation in piezo injectors and spray patterns. They leverage strategic partnerships with automakers and invest heavily in R&D to stay ahead of the curve.

Denso: Another major player, Denso focuses on high-precision manufacturing and fuel efficiency improvements. They have a strong presence in Asian markets and are actively partnering with emerging electric vehicle manufacturers to adapt their injector technology.

Delphi Technologies: With a focus on aftermarket and OE supply, Delphi emphasizes cost-effectiveness and reliability. They cater to a broader range of vehicles and are exploring alternative materials like lightweight composites for injector bodies.

Emerging Players:

China National Petroleum Corporation (CNPC): This Chinese giant is making strides in domestic injector production, aiming to challenge established players. They leverage government support and economies of scale to offer competitive pricing.

Young Shin Precision Machinery: A South Korean manufacturer, Young Shin emphasizes niche markets like high-performance engines and diesel applications. They invest heavily in customized injector solutions and cater to specific OEM requirements.

Market share analysis:

Factors influencing market share are dynamic and multifaceted. Some key aspects to consider include:

Technology portfolio: Companies offering advanced nozzles with superior atomization and efficiency hold an edge.

Production capacity and cost efficiency: Maintaining adequate production capacity and competitive pricing attracts a larger customer base.

Brand reputation and reliability: Established players with a proven track record of quality and reliability enjoy customer loyalty.

Geographical reach and distribution network: A widespread presence across key markets and a robust distribution network are crucial for market penetration.

New and Emerging Trends:

The injector nozzle market is witnessing several exciting trends:

Focus on alternative fuels: With the rise of electric and hybrid vehicles, injector technology is adapting to handle biofuels and hydrogen, requiring research into new materials and spray patterns.

Direct injection systems: Advanced direct injection systems with multi-stage injection and precise control are gaining traction, leading to further optimization of fuel combustion.

3D printing: additive manufacturing technology holds the potential for innovative nozzle designs with complex geometries and customized fuel spray characteristics.

Smart injectors: Integration of sensors and actuators within injectors could pave the way for real-time engine monitoring and adaptive fuel injection, improving efficiency and emission control.

Overall Competitive Scenario:

The automotive injector nozzle market is likely to remain fiercely competitive in the coming years. Established players will strive to maintain their dominance through continuous innovation and strategic partnerships. However, emerging players with cost-effective solutions and a niche market focus can create disruptions. The key to success lies in adapting to evolving trends, embracing new technologies like alternative fuels and smart injectors, and maintaining a balance between quality, cost, and reliability.

Latest Company Updates:

Haynes Corporation:

- October 2023: Announced collaboration with a major European automaker to develop and supply high-pressure injectors for next-generation gasoline engines.

Infineon Technologies AG:

- September 2023: Launched new piezo injector technology with faster response times and improved spray control.

Magneti Marelli S.p.A.:

- October 2023: Acquired a competitor specializing in low-emission injector technology.

Robert Bosch GmbH: Focuses on multi-hole and common rail injector technologies for both gasoline and diesel engines.

Eaton Corporation PLC: Develops injectors for heavy-duty vehicles and off-highway applications.

Denso Corporation supplies injectors for a wide range of vehicles, including Toyota and Lexus brands.