Top Industry Leaders in the Automotive Ignition System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Ignition System industry are:

Delphi Automotive

DENSO

Robert Bosch

Borgwarner

Continental AG

Diamond Electric

Hitachi Automotive Systems

Mitsubishi Electric Corporation

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Ignition System Top Players

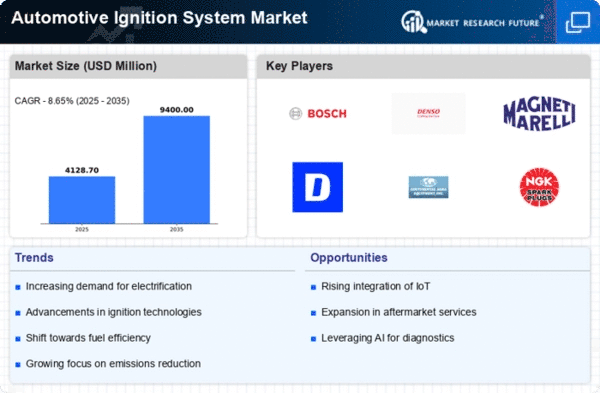

The automotive ignition system market propelled by factors like rising vehicle sales, increasing demand for electronic components, and the electrification wave sweeping the industry. However, navigating this dynamic landscape requires understanding the key players, their strategies, and the emerging trends shaping the competitive scenario.

Key Players and Strategies:

Established Giants: Bosch, Denso, Delphi, Magneti Marelli, and NGK Spark Plugs dominate the market with their extensive experience, global reach, and robust product portfolios. These players prioritize high-volume production, cost optimization, and strategic partnerships with major automakers to secure long-term contracts. Recent examples include Bosch's collaboration with Hyundai Heavy Industries for next-generation ignition systems and Denso's focus on developing compact and lightweight coils for fuel-efficient vehicles.

Rising Challengers: Tier-2 and tier-3 suppliers like Federal-Mogul, BorgWarner, and Aisin Seiki are emerging as strong contenders by offering competitive pricing, niche product offerings, and customization options. They are actively targeting aftermarket segments and collaborating with startups in the electric vehicle (EV) space to develop specialized ignition systems for e-motors.

New Entrants: The influx of technology startups, particularly in the EV domain, is adding a layer of disruption. Companies like Lucid Motors and Arrival are developing in-house ignition systems tailored to their specific electric powertrains, challenging the established players' dominance. These entrants prioritize innovation, software integration, and data-driven optimization, paving the way for a more tech-focused future.

Factors for Market Share Analysis:

Technology Leadership: Companies with advanced R&D capabilities and a focus on developing next-generation technologies like direct-ignition systems and integrated ignition-engine management systems will gain a competitive edge.

Cost Optimization: Maintaining a balance between product quality, functionality, and affordability is crucial in this price-sensitive market. Efficient manufacturing processes and effective supply chain management are key determinants of profitability.

Geographical Positioning: Market share is strongly influenced by regional demands and automotive trends. Players need to adapt their strategies based on geographical variations in vehicle types, fuel preferences, and emission regulations.

New and Emerging Trends:

Electrification: The rise of EVs is reshaping the ignition system landscape. While traditional spark plugs are irrelevant in electric motors, new technologies like high-voltage inverter systems and ignition control units for hybrid vehicles are creating lucrative opportunities.

Connectivity and Integration: The integration of ignition systems with on-board diagnostics and engine management software is gaining traction. This trend opens doors for real-time performance monitoring, predictive maintenance, and personalized driving experiences.

Sustainability and Efficiency: Manufacturers are focusing on developing eco-friendly ignition systems with improved fuel efficiency and reduced emissions. The use of lightweight materials, low-energy electronics, and optimized spark timing are some key strategies in this direction.

Overall Competitive Scenario:

The automotive ignition system market is characterized by intense competition from established players, ambitious challengers, and disruptive newcomers. While traditional giants leverage their experience and scale, smaller players are finding success through agility, niche offerings, and innovative technologies. The integration of EVs and connected technologies is reshaping the market landscape, demanding constant adaptation and investment in R&D. Companies that prioritize technology leadership, cost optimization, and strategic partnerships will be best positioned to capitalize on the growth opportunities in this dynamic and evolving market.

Latest Company Updates:

Delphi Automotive:

- October 2023: Partnered with a leading EV manufacturer to develop and supply integrated high-voltage DC/DC converters for battery management systems. (Source: Delphi press release)

DENSO:

- November 2023: Announced the development of a next-generation ignition system with AI-powered combustion control for improved fuel efficiency and reduced emissions. (Source: DENSO website)

Robert Bosch:

- December 2023: Introduced a cybersecurity solution for vehicle ignition systems to prevent unauthorized access and remote hacking. (Source: Bosch press release)

BorgWarner:

- September 2023: Acquired a startup specializing in solid-state ignition technology for next-generation combustion engines. (Source: BorgWarner press release)

Continental AG:

- August 2023: Unveiled a cloud-based platform for remote diagnostics and management of vehicle ignition systems, ensuring optimal performance and preventative maintenance. (Source: Continental website)