Growing Focus on Safety Features

Safety remains a paramount concern in the automotive sector, influencing the Automotive Gas Charged Shock Absorbers Market. The incorporation of gas charged shock absorbers enhances vehicle stability and control, which are essential for accident prevention. As regulatory bodies impose stricter safety standards, manufacturers are compelled to adopt advanced shock absorber technologies to comply with these regulations. Market analysis suggests that vehicles equipped with superior shock absorbers are more likely to achieve higher safety ratings, making them more appealing to consumers. This growing emphasis on safety features is expected to drive the demand for gas charged shock absorbers, thereby positively impacting the Automotive Gas Charged Shock Absorbers Market.

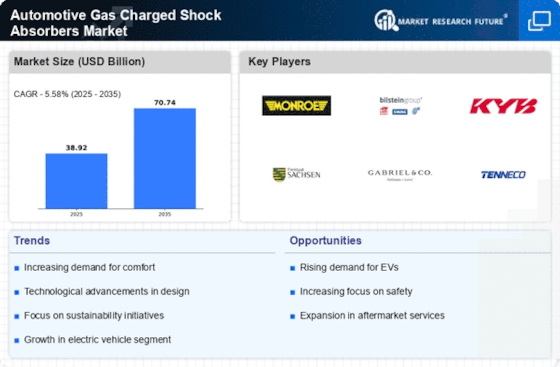

Increasing Adoption of Electric Vehicles

The shift towards electric vehicles (EVs) is significantly influencing the Automotive Gas Charged Shock Absorbers Market. As the automotive landscape evolves, manufacturers are integrating advanced shock absorber technologies to enhance the performance and comfort of EVs. Gas charged shock absorbers are particularly beneficial for electric vehicles, as they help manage the unique weight distribution and handling characteristics associated with EVs. Market projections indicate that the EV segment is expected to grow at a rapid pace, which will likely lead to increased demand for specialized shock absorber solutions. This trend underscores the importance of adapting to new vehicle technologies within the Automotive Gas Charged Shock Absorbers Market.

Rising Demand for Enhanced Vehicle Performance

The Automotive Gas Charged Shock Absorbers Market is experiencing a notable increase in demand driven by consumers' desire for improved vehicle performance. Enhanced shock absorbers contribute to better handling, stability, and ride comfort, which are critical factors for consumers when purchasing vehicles. As automotive manufacturers focus on delivering superior driving experiences, the integration of gas charged shock absorbers has become a priority. Market data indicates that the segment of vehicles equipped with advanced shock absorber technology is projected to grow significantly, reflecting a shift towards performance-oriented vehicles. This trend is likely to continue as consumers increasingly prioritize performance features, thereby propelling the Automotive Gas Charged Shock Absorbers Market forward.

Rising Consumer Awareness of Vehicle Maintenance

Consumer awareness regarding vehicle maintenance is on the rise, positively impacting the Automotive Gas Charged Shock Absorbers Market. As vehicle owners become more informed about the importance of maintaining optimal shock absorber performance, they are more likely to invest in high-quality gas charged shock absorbers. This trend is further supported by the increasing availability of information through digital platforms, which educates consumers on the benefits of regular maintenance. Market data suggests that consumers are willing to pay a premium for enhanced performance and longevity, which is likely to drive sales in the Automotive Gas Charged Shock Absorbers Market. This growing awareness is expected to sustain demand for advanced shock absorber solutions.

Technological Innovations in Shock Absorber Design

Technological advancements are reshaping the Automotive Gas Charged Shock Absorbers Market. Innovations such as adjustable damping systems and advanced materials are enhancing the performance and durability of shock absorbers. These developments allow for better customization of ride characteristics, catering to diverse consumer preferences. Furthermore, the integration of smart technologies, such as sensors that adjust damping in real-time, is becoming more prevalent. This evolution in design not only improves vehicle handling but also contributes to overall driving comfort. As manufacturers continue to invest in research and development, the Automotive Gas Charged Shock Absorbers Market is poised for substantial growth driven by these technological innovations.