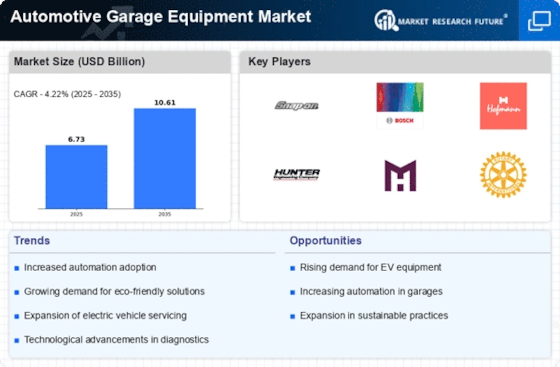

Top Industry Leaders in the Automotive Garage Equipment Market

*Disclaimer: List of key companies in no particular order

The dashboard is fading into the rearview mirror, replaced by the sleek and sophisticated realm of the automotive digital cockpit. This multi-billion dollar space is a bustling highway of competition, with established giants, tech-savvy disruptors, and regional champions vieing for control of the driver's interface. Let's navigate the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Top Companies in the Automotive Garage Equipment industry includes,

Arex Test Systems B.V. (Netherlands)

Boston Garage Equipment Ltd (U.K.)

Gray Manufacturing Company Inc. (U.S.)

Robert Bosch (Germany)

Maha Maschinenbau Haldenwang GmbH & Co. (Germany)

Snap-On Incorporated (U.S.)

Continental AG (Germany)

Vehicle Service Group (U.S.), and others.

Key Player Strategies:

Global Titans: Bosch, Continental, and Denso leverage their extensive experience, global reach, and diverse product portfolios to maintain their dominance. They cater to a wide range of car manufacturers and segments, offering comprehensive digital cockpit solutions encompassing instrument clusters, head-up displays, and infotainment systems. Bosch's Virtual Cockpit Plus exemplifies their focus on immersive driver experiences.

Technology Disruptors: Companies like Aptiv and Harman International are disrupting the market with cutting-edge features like augmented reality displays, holographic projections, and personalized driver profiles. They cater to tech-savvy consumers seeking futuristic functionalities and seamless connectivity. Aptiv's IVY platform showcases their focus on connected car technologies within the digital cockpit.

Regional Champions: Companies like Yanfeng Automotive Interiors in China and Joyson Group in India excel in their domestic markets, offering cost-effective digital cockpits tailored to regional preferences. They leverage strong local relationships and understanding of customer needs. Yanfeng's VOYAH interface exemplifies their focus on user-friendly and affordable digital experiences.

Sustainability Champions: Faurecia and Lear prioritize eco-friendly practices, utilizing recycled materials, offering low-power displays, and promoting sustainable manufacturing processes. They cater to environmentally conscious consumers and leverage sustainability as a competitive advantage. Lear's EcoSeats initiative with integrated digital displays showcases their commitment to green cockpits.

Factors for Market Share Analysis:

Product Portfolio Breadth: Offering a diverse range of digital cockpit solutions for different vehicle segments (economy, luxury, sports) and functionalities (basic displays, driver assistance systems, advanced connectivity) broadens customer reach. Companies with comprehensive portfolios gain an edge.

Technology Innovation: Investing in R&D for next-generation technologies like voice control, gesture recognition, and AI-powered personalization is crucial for staying ahead of the curve. Companies leading in innovation attract early adopters and premium contracts.

Cost and Affordability: Balancing cutting-edge features with competitive pricing is vital for mass adoption, particularly in budget-conscious segments. Companies offering cost-effective solutions without compromising functionality stand out.

Safety and Regulatory Compliance: Meeting stringent safety regulations and incorporating features enhancing driver focus and awareness is paramount. Companies with a strong track record of safety compliance gain trust and market access.

New and Emerging Trends:

Hyper-personalization: Adapting the digital cockpit interface to individual preferences, driving styles, and real-time data (fatigue, stress) creates a more intuitive and engaging experience. Companies offering personalized cockpits cater to the demand for driver comfort and convenience.

Seamless Connectivity: Integrating the digital cockpit with smartphones, cloud services, and smart home ecosystems streamlines user experiences and facilitates connected car capabilities. Companies offering seamless connectivity cater to the trend of integrated driving information and services.

Focus on Health and Wellness: Monitoring driver health metrics like fatigue, stress levels, and posture in real-time can promote active safety and well-being. Companies offering health-oriented features cater to the growing focus on driver safety and comfort.

Cybersecurity and Data Privacy: Ensuring robust cybersecurity measures and protecting driver data within the digital cockpit is becoming increasingly important. Companies prioritising cybersecurity gain trust and comply with evolving regulations.

Overall Competitive Scenario:

The automotive digital cockpit market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative features. Regional champions cater to specific markets, and sustainability champions attract eco-conscious consumers. Factors like product portfolio, technological innovation, affordability, and safety compliance play a crucial role in market share analysis. New trends like hyper-personalization, seamless connectivity, health and wellness focus, and cybersecurity offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace sustainable practices, and ensure robust cybersecurity measures. By navigating the changing landscape and aligning their strategies with market trends and driver demands, they can secure a prominent position in this rapidly evolving digital ecosystem.

Industry Developments and Latest Updates:

Arex Test Systems B.V. (Netherlands)

- Date: December 12, 2023

- Source: Arex press release

- Development: Announced the launch of the new ATS 7700 EV Battery Simulator, designed for testing and validating electric vehicle batteries in workshops and production lines.

Boston Garage Equipment Ltd (U.K.)

- Date: November 21, 2023

- Source: Boston Garage Equipment website

- Development: Launched the new BG-8000 two-post lift, featuring a compact design and high lifting capacity.

Gray Manufacturing Company Inc. (U.S.)

- Date: December 5, 2023

- Source: Gray Manufacturing website

- Development: Announced the expansion of their manufacturing facility in Michigan to meet growing demand for their alignment equipment.

Robert Bosch (Germany)

- Date: December 14, 2023

- Source: Bosch press release

- Development: Unveiled a new range of connected diagnostic tools for workshops, enabling remote support and data analysis.

Maha Maschinenbau Haldenwang GmbH & Co. (Germany)

- Date: December 7, 2023

- Source: Maha website

- Development: Presented their latest wheel alignment and brake testing equipment at the Reifenmesse trade show in Germany.

Vehicle Service Group (U.S.)

- Date: December 21, 2023

- Source: Vehicle Service Group website

- Development: Acquired the assets of Tekniq, a leading provider of shop management software for the automotive industry.