Top Industry Leaders in the Automotive Fuel Rail Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Fuel Rail industry are:

Cooper-Standard Automotive Inc (US)

Magneti Marelli S.p.A. (Italy)

Roberts Bosch GmbH (Germany)

Continental AG (Germany)

Nikki Co. Ltd. (Japan)

Landi Renzo S.p.A (Italy)

Linamar Corporation (Canada)

AISIN SEIKI Co. Ltd. (Japan)

Sanoh Industrial Co. Ltd. (Japan)

TI Fluid Systems (UK)

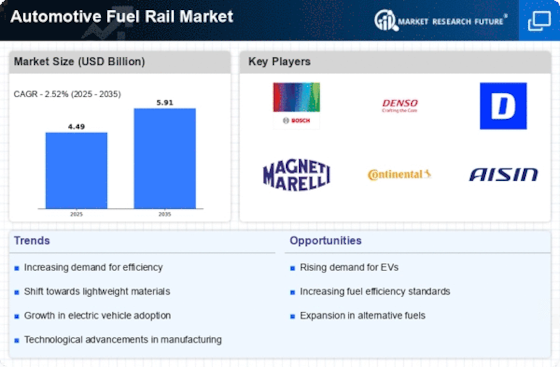

The automotive fuel rail market pulsates with the dynamic interplay of established players, ambitious newcomers, and a constant churn of technological advancements. Understanding this competitive landscape is crucial for any participant aiming to secure a sustained advantage.

Key Players and their Strategies:

Tier-1 giants: Bosch, Continental, DENSO, and Magneti Marelli (Calsonic Kansei) dominate the market with their comprehensive product portfolios, strong OEM partnerships, and global reach. They leverage economies of scale to optimize costs and maintain technological leadership through R&D investments in areas like lightweight materials and direct injection systems.

Tier-2 contenders: Companies like Aisin Seiki, USUI, Cooper Standard, and Dura Automotive Systems carve their niche through cost-competitiveness, regional focus, and specialization in specific fuel rail segments. They forge strategic alliances with regional automakers and Tier-1 suppliers to secure market access and knowledge transfer.

Emerging players: Chinese manufacturers like Zhongyuan Fuel and Beijing Aerospace Xingda are making inroads with their aggressive pricing strategies and focus on the rapidly growing domestic market. Their agility in adapting to local regulations and catering to specific OEM needs poses a potential threat to established players.

Factors for Market Share Analysis:

Product offering: The ability to cater to diverse vehicle platforms, engine types, and fuel delivery systems across various regions is crucial. Offering lightweight, high-performance rails with leak-proof designs and advanced monitoring features fosters competitive differentiation.

Technological prowess: Continuous investment in R&D to develop lighter, more efficient, and cost-effective fuel rail designs is paramount. Adoption of advanced materials like composite polymers and additive manufacturing holds immense potential for market share gains.

Geographical reach: Establishing a strong presence in key automotive hubs like North America, Europe, and Asia provides access to major OEMs and fuels market expansion. Building efficient production and distribution networks across regions is essential for efficient operations.

Collaboration and partnerships: Strategic alliances with OEMs, Tier-1 suppliers, and technology providers can fast-track market entry, share knowledge, and optimize resource allocation. Forging partnerships for joint development and production unlocks access to new markets and technologies.

New and Emerging Trends:

Electrification: The rise of electric vehicles necessitates the development of fuel rails for hybrid and fuel cell systems. Players who adapt their expertise to cater to these emerging segments stand to gain a significant edge.

Direct injection technology: The growing adoption of direct injection engines demands high-precision fuel rails with enhanced pressure tolerance and leak-proof capabilities. Companies investing in this technology will find favor with OEMs seeking optimized fuel efficiency and performance.

Lightweighting: The relentless pursuit of fuel efficiency is driving the demand for lighter fuel rails made from composite materials. Players adept at utilizing these materials while maintaining structural integrity will gain a competitive advantage.

Data-driven optimization: Leveraging sensor data and AI-powered analytics to monitor fuel rail performance and predict potential failures can pave the way for predictive maintenance and improved fuel efficiency. Companies embracing these solutions will gain an edge in aftermarket services and customer satisfaction.

Overall Competitive Scenario:

The automotive fuel rail market remains fiercely competitive, characterized by a diverse range of players employing various strategies to secure market share. Technological advancements, shifting emission regulations, and the rise of alternative fuel vehicles continuously reshape the landscape. Success hinges on adaptability, strategic partnerships, and a relentless focus on innovation. Players who anticipate these trends and tailor their offerings accordingly will be best positioned to navigate the dynamic terrain of the automotive fuel rail market.

Latest Company Updates:

Cooper-Standard Automotive Inc (US):

- August 2023: Cooper Standard announces collaboration with a major European automaker on the development of lightweight, high-performance fuel rails for their next-generation electric vehicles. (Source: Cooper Standard press release)

Magneti Marelli S.p.A. (Italy):

- October 2023: Unveils a new generation of fuel rail systems with integrated pressure sensors and leak detection capabilities for improved fuel system monitoring. (Source: Magneti Marelli press release)

Robert Bosch GmbH (Germany):

- September 2023: Bosch receives patent for a novel fuel rail design that reduces noise and vibration, improving engine performance and passenger comfort. (Source: Bosch website)

Continental AG (Germany):

- November 2023: Announces collaboration with a major American automaker on the development of fuel rail systems with integrated cooling channels for increased fuel system efficiency. (Source: Continental AG press release)

Nikki Co. Ltd. (Japan):

- June 2022: Develops a new fuel rail manufacturing process using additive printing, offering greater design flexibility and weight reduction potential. (Source: Nikkei Asian Review)