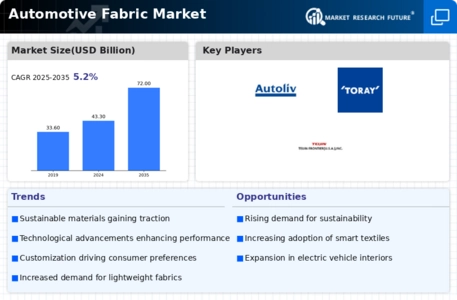

Sustainability in Automotive Fabric Market

The increasing emphasis on sustainability is a pivotal driver in the Automotive Fabric Market. Manufacturers are progressively adopting eco-friendly materials, such as recycled polyester and organic cotton, to meet consumer demand for sustainable products. This shift not only aligns with environmental regulations but also enhances brand reputation. According to recent data, the market for sustainable automotive fabrics is projected to grow at a compound annual growth rate of 8.5% over the next five years. This trend indicates a significant transformation in consumer preferences, as buyers are more inclined to choose vehicles that utilize environmentally responsible materials. Consequently, the Automotive Fabric Market is witnessing a surge in innovation, with companies investing in research and development to create sustainable fabric solutions that do not compromise on quality or performance.

Technological Advancements in Automotive Fabric Market

Technological advancements are reshaping the Automotive Fabric Market, leading to the development of high-performance textiles. Innovations such as nanotechnology and smart textiles are enhancing the functionality of automotive fabrics, making them more durable, lightweight, and resistant to wear and tear. For instance, the integration of moisture-wicking and temperature-regulating properties in fabrics is becoming increasingly common. This evolution is not merely a trend; it reflects a broader movement towards enhancing user experience in vehicles. The market for advanced automotive textiles is expected to reach USD 30 billion by 2026, indicating a robust growth trajectory. As manufacturers continue to explore new technologies, the Automotive Fabric Market is likely to see a proliferation of products that cater to the evolving needs of consumers, thereby driving market expansion.

Growth of Electric and Hybrid Vehicles in Automotive Fabric Market

The growth of electric and hybrid vehicles is significantly influencing the Automotive Fabric Market. As these vehicles become more prevalent, there is an increasing need for lightweight and energy-efficient materials that contribute to overall vehicle performance. Automotive fabrics play a crucial role in reducing vehicle weight, which in turn enhances fuel efficiency and extends battery life in electric models. Recent statistics indicate that the electric vehicle market is projected to grow at a CAGR of 22% through 2030, which will likely drive demand for specialized automotive fabrics. Manufacturers are responding to this trend by developing innovative materials that meet the specific requirements of electric and hybrid vehicles. This alignment with the evolving automotive landscape positions the Automotive Fabric Market for substantial growth as it adapts to the needs of modern vehicle designs.

Rising Demand for Vehicle Customization in Automotive Fabric Market

The rising demand for vehicle customization is a significant driver in the Automotive Fabric Market. Consumers are increasingly seeking personalized options for their vehicles, which extends to the choice of fabrics used in interiors. This trend is particularly pronounced among luxury and premium vehicle segments, where buyers are willing to invest in bespoke solutions that reflect their individual tastes. Data suggests that the customization market within the automotive sector is expected to grow by 10% annually, highlighting a shift towards more personalized consumer experiences. As a result, manufacturers are expanding their offerings to include a wider variety of fabrics, colors, and textures. This focus on customization not only enhances customer satisfaction but also fosters brand loyalty, making it a crucial factor in the ongoing evolution of the Automotive Fabric Market.

Regulatory Compliance and Safety Standards in Automotive Fabric Market

Regulatory compliance and safety standards are critical drivers in the Automotive Fabric Market. Governments worldwide are implementing stringent regulations regarding vehicle safety and emissions, which directly impact the materials used in automotive interiors. Fabrics must not only meet aesthetic requirements but also adhere to fire resistance, toxicity, and durability standards. This regulatory landscape compels manufacturers to invest in high-quality materials that ensure compliance while maintaining performance. The market for automotive fabrics that meet these safety standards is expected to grow, as consumers increasingly prioritize safety in their vehicle choices. Furthermore, adherence to these regulations can enhance a brand's credibility and market position. As such, the Automotive Fabric Market is likely to see continued investment in research and development to create fabrics that fulfill both regulatory requirements and consumer expectations.