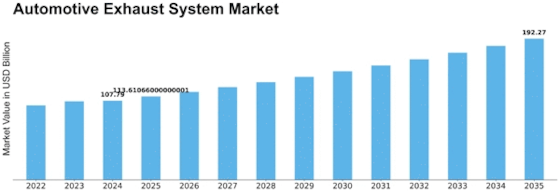

Automotive Exhaust System Size

Automotive Exhaust System Market Growth Projections and Opportunities

The automotive exhaust system market is a dynamic sector that plays a crucial role in the overall performance of vehicles and compliance with environmental regulations. Technical innovation is the main driver of market development in the exhaust system sector of automotive. With automotive manufacturers consistently trying to boost engine efficiency, lower emissions, and improve the overall vehicle performances, they make the necessary research and investments in the development of advance exhaust system technologies. Involvements of innovations like SCR systems, particulate filters, and lightweight materials set the market in a state of evolution, affecting the product offerings and shaping the competitive landscape. The regulatory averages determine the automotive exhaust system market growth, guiding manufacturers to fabricate systems that adhere to or exceed emission requirements. Stringent emission regulations that have been introduced by the governments of most countries worldwide force manufacturers to follow the use of cleaner and more efficient technologies. The need for compliance with standards such as Euro 6, EPA Tiamer3, and some other regional emission requirements forms the market by influencing the adoption. Consumer preferences are also very influential to how the market dynamics evolve. With the rising levels of climate consciousness, consumers get more and more inclined to non-harmful and green automotive options. The shift towards electric and hybrid cars has resulted in a rise of electric and hybrid vehicle demand, which in turn negatively affects the traditional exhaust system in automotive market. Producers find it difficult to cope with this transition because they have to meet the demand for vehicles operated on internal combustion engines as well as electric and hybrid cars which constitute the emerging market. The development of future industry trends that see more connected vehicles and the integrating of high end sensors, also affect the market for four wheel exceed systems. The emergence of self-driving innovation and the development of intelligent exhaust system becomes the progressive feature of automobiles. They encourage the manufacturers of auto exhaust systems, sensory providers and technology companies to form alliances and partnerships, creating the room for constant innovation. Additionally, global economic conditions and geopolitical issues inform the dynamics of the market for the exhaust system in the automotive sector. Fluctuations in raw material prices, trade policies, and geopolitical tensions can impact the cost of production and supply chain dynamics, influencing pricing strategies and market competitiveness. Manufacturers must remain agile and responsive to external factors to navigate the challenges posed by the broader economic landscape.

Leave a Comment