Top Industry Leaders in the Automotive Engine Valves Market

Analyzing the Competitive Landscape of the Automotive Engine Valves Market

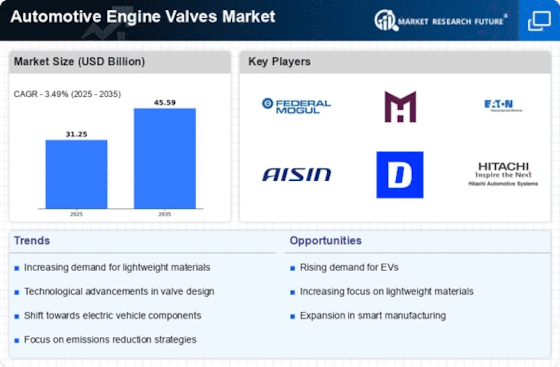

The automotive engine valves market stands as a pivotal yet mature segment within the expansive automotive industry. Despite its entrenched nature, the market dynamics are in flux due to technological strides, evolving consumer preferences, and the looming advent of electric vehicles. This necessitates an acute comprehension of the competitive landscape, strategies adopted by key players, and emerging trends to flourish in this dynamic arena.

Key Players and their Strategies:

Amidst the market's incumbents like Continental AG, Aptiv PLC, Denso Corporation, Eaton Corporation PLC, Federal-Mogul Holdings Corp, FTE Automotive GMBH, Hitachi Ltd, Knorr-Bremse AG, and others, a select group including Mahle Group, Knorr-Bremse, Hitachi, FTE Automotive, Federal-Mogul Holdings, Denso, and Delphi Automotive reigns supreme. These entities have embraced diverse strategies to retain their market foothold:

Product Diversification: Leading entities are extending their repertoire beyond conventional valves, embracing lightweight materials such as titanium and ceramics. Mahle's "EcoValve" initiative and Knorr-Bremse's focus on advanced valve coatings exemplify this drive.

Technological Innovation: Sustained investments in research and development propel performance and operational efficiency enhancements. Hitachi's integration of laser welding technology for superior valve durability and FTE Automotive's emphasis on noise reduction valves illustrate this trajectory.

Geographic Expansion: Emerging markets, particularly in Asia Pacific, offer substantial growth prospects. Companies like Denso and Delphi Automotive strategically establish manufacturing facilities in these regions, tapping into local demand and streamlining supply chains.

Strategic Partnerships: Collaborations with automakers and technology providers are increasingly prevalent. Mahle's alliance with Bosch for valve control systems and Knorr-Bremse's collaboration with Siemens for intelligent valve actuators epitomize this strategic approach.

Factors for Market Share Analysis:

Beyond established players, a gamut of factors drives market share dynamics:

Production Capacity and Geographic Reach: Entities with robust manufacturing capabilities and a global presence, such as Mahle and Knorr-Bremse, hold an edge over smaller players.

Quality and Reliability: Engine valves, as critical components, demand exceptional performance and durability. Companies boasting proven track records in these facets, like FTE Automotive and Hitachi, command stronger brand loyalty.

Cost Competitiveness: Balancing quality with affordability is pivotal in a cost-sensitive market. Players like Federal-Mogul Holdings and Delphi Automotive, with optimized production processes and competitive pricing strategies, appeal to budget-conscious consumers.

Customer Service and Relationships: Nurturing robust ties with automakers and aftermarket distributors is pivotal for securing long-term contracts and fostering repeat business. Denso's extensive service network and Knorr-Bremse's focus on aftermarket solutions epitomize this strategy.

Emerging Trends and New Entrants:

The automotive engine valves market is undergoing several intriguing trends:

Electrification: While electric vehicles pose a long-term challenge, valve technologies are adapting to hybrid and mild-hybrid engines, with Mahle developing specialized valves for such applications.

Additive Manufacturing: The advent of 3D printing presents avenues for customized and lightweight valve designs, potentially disrupting traditional manufacturing processes. New entrants like Apis Cor and Desktop Metal are exploring this terrain.

Connectivity and Data Analytics: Integrating sensors and data analysis capabilities into valves can enable predictive maintenance and real-time performance optimization. Companies like Hitachi and Denso are actively pursuing this trajectory.

Overall Competitive Scenario:

The automotive engine valves market exhibits moderate consolidation, with established players commanding a significant share. Yet, competitive pressures escalate due to technological advancements, novel materials, manufacturing techniques, and the evolving automotive landscape. Players adept in adapting to these trends, embracing innovation, and fostering strong customer relationships are poised to navigate the market complexities and sustain their competitive edge.

Further Insights:

Regional variations in market growth and demand patterns present both opportunities and challenges for global players.

The ascent of autonomous driving technologies could potentially influence future valve designs and functionalities.

Sustainability and environmental regulations are increasingly crucial, driving demand for eco-friendly valves and manufacturing processes.

By vigilantly monitoring these trends and comprehending the evolving competitive landscape, automotive engine valve manufacturers can strategize effectively and cement their positions in this ever-evolving market.

Industry Developments and Latest Updates:

Continental AG (Germany):

- Date: December 19, 2023

- Source: Press Release

- Update: Announced a partnership with a leading Chinese valve manufacturer to develop and produce next-generation lightweight engine valves for electric vehicles. These valves will be crafted from high-strength alloys, featuring optimized designs to enhance efficiency and reduce emissions.

Aptiv PLC (U.K.):

- Date: December 15, 2023

- Source: Investor Presentation

- Update: Aptiv emphasized its focus on developing smart valve systems with integrated sensors and actuators during its investor presentation. These systems aim to enable real-time engine monitoring and optimization, contributing to improved fuel economy and performance.

Denso Corporation (Japan):

- Date: November 30, 2023

- Source: Industry Conference Presentation

- Update: Denso presented its research on advanced valve materials and coatings at the Automotive Engineering Conference. The company is exploring new materials like ceramics and coatings like graphene to further reduce valve weight and improve wear resistance.

Eaton Corporation PLC (U.S.):

- Date: October 26, 2023

- Source: Earnings Call Transcript

- Update: During its earnings call, Eaton mentioned ongoing investments in its engine valve business, including expanding production capacity and developing new valve designs for high-performance engines.

Federal-Mogul Holdings Corp (U.S.):

- Date: September 20, 2023

- Source: Company Website

- Update: Federal-Mogul launched a new line of high-performance engine valves designed for heavy-duty truck applications. The valves feature enhanced durability and fatigue resistance to withstand the demanding operating conditions of trucks.