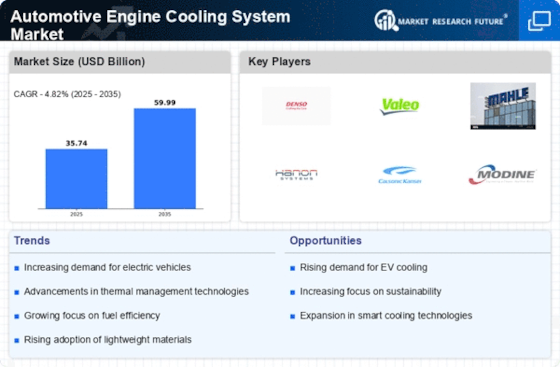

Top Industry Leaders in the Automotive Engine Cooling System Market

Navigating the Intensely Competitive Arena of the Automotive Engine Cooling System Market

In the realm of the automotive engine cooling system market, where the pursuit of optimal engine performance converges with the evolving landscape of vehicle electrification, the stakes are high. Whether well-established industry giants or ambitious newcomers, comprehending the competitive landscape becomes imperative. This exploration unravels the strategies, trends, and determinants that shape the battleground for market dominance.

Strategic Moves by Key Players:

Tier 1 Dominance: Global powerhouses such as Valeo, MAHLE, and Schaeffler leverage extensive supply chain networks and partnerships with Original Equipment Manufacturers (OEMs) to sustain significant market shares. Their focus revolves around ensuring cost-efficiency, reliability, and adaptability to cater to diverse vehicle platforms.

Innovation Champions: Continental and Denso spearhead the development of cutting-edge cooling technologies, including electric coolant pumps, variable rate fan controls, and integrated thermal management systems. These innovations not only address fuel efficiency concerns but also pave the way for the integration of electric and hybrid vehicles.

Regional Specialists: Companies like Calsonic Kansei and Hanon Systems carve out niches in specific geographical markets by capitalizing on regional preferences and cost competitiveness. They often serve as cost-effective alternatives to Tier 1 suppliers for certain vehicle segments.

Emerging Stars: Startups such as Echodyne and Noctua Thermal Solutions disrupt the market with novel cooling technologies. Their emphasis on innovative materials, thermoelectric modules, and Artificial Intelligence (AI)-powered cooling algorithms attracts attention from both OEMs and investors.

Factors Influencing Market Share Analysis:

Product Portfolio Breadth: Offering a comprehensive range of cooling system components, from radiators and water pumps to thermostats and control units, provides a competitive edge. This versatility enables players to cater to diverse vehicle types and customer preferences.

Technological Prowess: Continuous investment in Research and Development (R&D) to create high-efficiency, lightweight, and environmentally friendly cooling solutions is crucial. Players showcasing advancements in electric coolant pumps, smart fan controls, and thermal management systems position themselves for gaining market share.

Cost Competitiveness: Striking a balance between quality and affordability is paramount in this price-sensitive market. Streamlined production processes, strategic material sourcing, and efficient supply chain management are pivotal for cost optimization.

Geographical Footprint: Establishing robust manufacturing and distribution networks across key automotive hubs, such as China, Europe, and North America, is vital for capturing regional market share and meeting the demands of OEMs.

OEM Relationships: Forge strong partnerships with major automakers and Tier 1 suppliers to ensure a consistent order flow, secure access to new technologies, and early entry into emerging markets.

New and Emerging Trends:

Electrification Focus: The surge in electric and hybrid vehicles presents challenges and opportunities. Thermal management of battery packs and electric motors demands new cooling technologies, creating opportunities for innovative startups and adaptable established players.

Material Advancements: Lightweight materials like composite plastics and aluminum alloys gain traction to enhance fuel efficiency and reduce vehicle weight. Players investing in such material development gain a competitive advantage.

Data-Driven Optimization: Integrating AI and sensor technology into cooling systems enables real-time performance monitoring, predictive maintenance, and dynamic adjustments based on driving conditions. This trend favors players leading in intelligent thermal management solutions.

Sustainability Drive: The emphasis on reducing environmental impact results in the development of eco-friendly coolants and energy-efficient systems. Players showcasing green credentials and sustainable practices win favor with environmentally conscious consumers and regulators.

The Overall Competitive Scenario: The automotive engine cooling system market emerges as a fiercely competitive landscape where established players, regional specialists, and innovative startups vie for market share. Staying ahead necessitates a multi-faceted approach: maintaining a diverse product portfolio, fostering continuous technological innovation, ensuring cost competitiveness, establishing a robust geographic footprint, and cultivating strategic partnerships. As the industry undergoes a shift towards electric and hybrid vehicles, success hinges on the ability to anticipate and cater to evolving demands and embrace new technologies. The players adept at navigating this high-performance arena will secure their position at the top of the leaderboard.

Recent Industry Developments and Updates:

Visteon Corporation (December 15, 2023): Announced a collaboration with a leading electric vehicle startup to develop high-efficiency thermal management systems for battery packs and electric motors.

Mahle GmbH (December 20, 2023): Unveiled a new lightweight and compact electric water pump at the Tokyo Motor Show designed for hybrid and electric vehicles, offering improved efficiency and reduced noise.

BorgWarner (November 30, 2023): Received a major order from a European automaker for its latest variable displacement water pump technology, optimizing engine cooling and improving fuel efficiency.

Calsonic Kansei Corporation (December 12, 2023): Partnered with a Japanese university to develop advanced heat pipe technology for automotive applications, potentially leading to smaller and lighter cooling systems.

Continental AG (December 5, 2023): Announced plans to invest €2 billion in the development and production of electric vehicle components, including thermal management systems.

Top Companies in the Automotive Engine Cooling System Industry: