Integration of Infotainment Systems

The Automotive Electronics Market is witnessing a transformative shift with the integration of advanced infotainment systems. These systems are becoming essential features in modern vehicles, offering drivers and passengers enhanced connectivity and entertainment options. The demand for seamless integration of smartphones, navigation systems, and multimedia content is driving manufacturers to develop sophisticated electronic solutions. Recent market analysis suggests that the infotainment system segment is projected to grow significantly, potentially reaching 50 billion USD by 2027. This trend indicates a shift in consumer expectations, as they seek vehicles equipped with cutting-edge technology that enhances their driving experience. Consequently, the Automotive Electronics Market is adapting to meet these evolving consumer demands.

Increasing Demand for Safety Features

The Automotive Electronics Market is experiencing a notable surge in demand for advanced safety features. Consumers are increasingly prioritizing safety in their vehicle purchases, leading to a rise in the integration of electronic systems designed to enhance driver and passenger safety. This trend is reflected in the growing adoption of technologies such as collision avoidance systems, lane departure warnings, and adaptive cruise control. According to recent data, the market for automotive safety electronics is projected to reach approximately 30 billion USD by 2026. This increasing focus on safety is driving manufacturers to innovate and incorporate sophisticated electronic systems, thereby propelling the overall growth of the Automotive Electronics Market.

Regulatory Push for Emission Standards

The Automotive Electronics Market is also shaped by regulatory pressures aimed at reducing vehicle emissions. Governments worldwide are implementing stringent emission standards, compelling manufacturers to adopt advanced electronic systems that optimize fuel efficiency and reduce pollutants. This regulatory environment is fostering innovation in automotive electronics, particularly in areas such as engine control units and exhaust after-treatment systems. Data suggests that the market for automotive electronics related to emissions control is expected to grow substantially, driven by these regulatory requirements. As manufacturers strive to comply with these standards, the Automotive Electronics Market is likely to see increased investment in technologies that enhance environmental performance.

Growth of Autonomous Vehicle Technologies

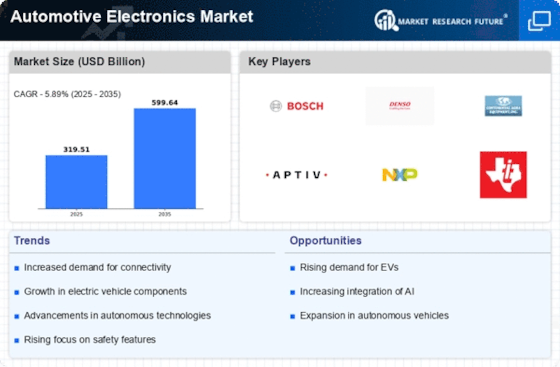

The Automotive Electronics Market is on the brink of a revolution with the growth of autonomous vehicle technologies. As manufacturers invest in research and development for self-driving capabilities, the demand for sophisticated electronic systems is escalating. These systems include sensors, cameras, and artificial intelligence algorithms that enable vehicles to navigate and make decisions independently. Current projections indicate that the market for autonomous vehicle electronics could exceed 60 billion USD by 2030. This rapid advancement in technology is not only reshaping the Automotive Electronics Market but also influencing consumer perceptions and acceptance of autonomous driving solutions. The potential for increased safety and efficiency in transportation is driving this trend forward.

Advancements in Electric Vehicle Technology

The Automotive Electronics Market is significantly influenced by advancements in electric vehicle (EV) technology. As the automotive sector shifts towards electrification, the demand for electronic components that support EV functionality is escalating. This includes battery management systems, electric powertrains, and regenerative braking systems. Recent statistics indicate that the EV market is expected to grow at a compound annual growth rate of over 20% through the next decade. This growth is prompting automotive manufacturers to invest heavily in electronic innovations, thereby enhancing the overall landscape of the Automotive Electronics Market. The integration of these technologies not only improves vehicle performance but also aligns with the increasing consumer preference for sustainable transportation solutions.