Top Industry Leaders in the Automotive Electric Drivetrain System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Electric Drivetrain System industry are:

GKN plc

TM4

BorgWarner Inc

Aisin Seiki Co., Ltd

Dana Holding Corporation

American Axle & Manufacturing, Inc

Magtec

Visedo

Parker Hannifin Corp

AVTEC LTD

JTEKT Corporation

AxleTech International SAS

Punch Powertrain Nv

Magna International Inc.

Delphi Automotive LLP

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Electric Drivetrain System Top Players

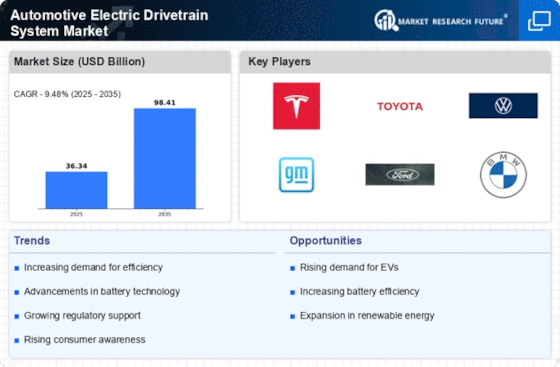

The automotive industry is experiencing a paradigm shift, fueled by the rising demand for electric vehicles (EVs) and stringent emission regulations. At the heart of this transformation lies the electric drivetrain system, a complex orchestration of components powering clean mobility. The competitive landscape in this burgeoning market is dynamic, with established players jostling for position alongside agile startups.

Key Players and Strategies:

Traditional Automakers: Giants like Toyota, Volkswagen, and General Motors leverage their vast resources and existing manufacturing infrastructure to scale up EV production. Their strategies involve developing proprietary platforms, strategic partnerships with battery and technology suppliers, and aggressive investments in battery production. Toyota, for instance, focuses on hybrid technology while VW's MEB platform underpins a range of EVs from various brands.

Tech Giants: Tech players like Tesla and BYD bring disruptive innovation and software expertise to the table. Tesla, the undisputed leader, boasts a vertically integrated manufacturing model and proprietary battery technology, offering superior range and performance. BYD, a Chinese powerhouse, excels in battery technology and affordability, making it a dominant force in its domestic market.

Tier 1 Suppliers: Established automotive suppliers like Bosch, Continental, and Denso are adapting their expertise in traditional components to cater to the EV drivetrain. They focus on developing efficient electric motors, inverters, and other critical components, often supplying to multiple automakers. Bosch, for instance, offers a modular eAxle system, while Continental is developing next-generation battery management systems.

Startups: Nimble startups like Rivian, Lucid Motors, and Fisker are challenging established players with innovative designs, direct-to-consumer sales models, and focus on premium segments. Rivian's focus on adventure vehicles and Lucid Motors' luxury sedans demonstrate how startups are carving out unique niches.

Market Share Analysis:

Market share in the electric drivetrain system market is currently fragmented, with Tesla leading the pack based on EV sales. However, the landscape is rapidly evolving. Factors like regional variations in regulations and consumer preferences, along with the pace of technological advancements, will play a crucial role in determining future market leaders. Analyzing these factors is essential for strategic decision-making:

Regional Regulations: Stringent emission regulations in Europe and China are driving rapid EV adoption, creating lucrative opportunities for players with strong regional presences. The US market, with its mix of federal and state incentives, presents a different dynamic.

Consumer Preferences: Consumer preferences for vehicle range, affordability, and features will influence choices. While Tesla caters to the performance-driven segment, BYD's success stems from offering budget-friendly options.

Technology Advancements: Rapid advancements in battery technology, charging infrastructure, and autonomous driving capabilities will continuously reshape the competitive landscape. Players investing heavily in R&D and partnerships with technology providers will hold an edge.

Emerging Trends:

Solid-State Batteries: The potential of solid-state batteries to boost range and safety is attracting significant investment. Established players like Toyota and startups like QuantumScape are racing to commercialize this technology.

Software-Defined Drivetrains: The increasing role of software in managing power delivery and optimizing performance is leading to software-defined drivetrains. Companies like Tesla and startups like Aurora are at the forefront of this trend.

Circular Economy: With concerns about battery recycling and resource scarcity mounting, companies are exploring strategies for a circular economy in the electric drivetrain system. BMW's commitment to responsible battery sourcing and recycling initiatives showcase this growing trend.

Overall Competitive Scenario:

The automotive electric drivetrain system market is a thrilling race with no clear winner yet. Traditional automakers are leveraging their strengths, tech giants are disrupting with innovation, and startups are carving out niches. Analyzing key player strategies, market share factors, and emerging trends is crucial for navigating this dynamic landscape. Companies that continuously adapt, embrace technological advancements, and cater to evolving consumer preferences will be the ones driving the future of electric mobility.

Latest Company Updates:

GKN plc:

- October 2023: Signed a joint development agreement with REE Automotive to develop e-drive systems for commercial vehicles. (Source: GKN plc press release)

TM4:

- January 2024: Launched a new high-efficiency electric motor for commercial vehicles with 98% efficiency. (Source: TM4 press release)

BorgWarner Inc:

- November 2023: Unveiled a new silicon carbide inverter technology for electric vehicles with improved performance and efficiency. (Source: BorgWarner press release)

Aisin Seiki Co., Ltd:

- October 2023: Introduced a new e-Axle system with integrated motor, gearbox, and inverter for improved packaging and efficiency. (Source: Aisin Seiki press release)

Dana Holding Corporation:

- September 2023: Acquired Spicer Electric Systems, a leading provider of electric drivetrain components. (Source: Dana Holding Corporation press release)