Top Industry Leaders in the Automotive Display Market

*Disclaimer: List of key companies in no particular order

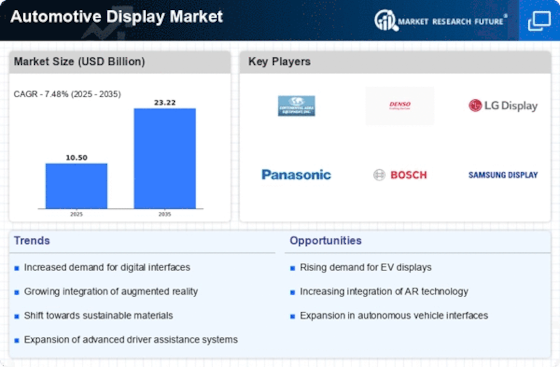

The Automotive Display Market's Competitive Dynamics Navigating an Evolving Landscape

The automotive display sector is currently witnessing a dynamic metamorphosis propelled by a convergence of technological advancements, shifting consumer inclinations, and the impetus toward autonomous driving. In this fiercely competitive arena, prominent contenders are fervently vying for market dominance, deploying a diverse array of strategies to maintain their competitive edge. To comprehend this ever-evolving terrain, a comprehensive exploration of the competitive landscape is imperative, encompassing analyses of key player strategies, market share determinants, emerging trends, and the overall panorama.

Strategic Approaches of Key Players: Within this vibrant ecosystem, several key entities such as LG Display Co. Ltd, Panasonic Corporation, Delphi Technologies, Robert Bosch GmbH, Visteon Corporation, Continental AG, 3M Company, Nippon Seiki Co. Ltd, Magneti Marelli S.p.A, Qualcomm Technologies Inc., and others are engaged in strategic maneuvers to fortify their positions.

- LCD vs. OLED Ascendancy: While LCD displays continue to command a substantial share (70%) of the market, the rapid advancements in OLED technology, especially in premium segments, are notable. Industry frontrunners like Continental and LG Display are spearheading this surge, showcasing futuristic dashboards with flexible OLEDs and curved displays (Source: Omdia, Jan 2023).

- Integration of Smart Displays: Infotainment systems are evolving into interactive hubs, witnessed through the integration of augmented reality (AR) and gesture control capabilities by players like Bosch and Visteon (Source: Automotive News, Feb 2023).

- Proliferation of Head-Up Displays (HUDs): Once confined to luxury models, HUDs are transitioning into mainstream offerings. Denso and Pioneer are focusing on compact, cost-effective HUD solutions for mid-range vehicles (Source: S&P Global Mobility, Mar 2023).

- Software Defined Displays: The advent of software-defined displays facilitates customization and over-the-air updates. Integration platforms like CarPlay and Android Auto are gaining momentum, with Jabil and Harman developing compatible display systems (Source: McKinsey & Company, Apr 2023).

- Collaborations and Acquisitions: Strategic alliances and acquisitions are driving innovation. Panasonic's acquisition of Automotive Lighting and Samsung Display's partnership with BYD for in-vehicle display solutions are illustrative examples (Source: Reuters, May 2023).

Factors Influencing Market Share Analysis:

A multitude of factors contribute to determining market share within this competitive landscape.

- Technology Portfolio: Offering a diverse spectrum of display technologies (LCD, OLED, MicroLED) tailored to various segments and price brackets is pivotal.

- Regional Presence: Establishing a robust presence in pivotal automotive manufacturing regions like Asia-Pacific, Europe, and North America is imperative.

- Collaborations with Tier Suppliers: Forging alliances with major automakers and Tier 1 suppliers confers a competitive advantage.

- Innovation Pipeline: Continuous investment in Research and Development, particularly in next-generation display technologies like transparent displays and holographic projections, remains critical.

- Cost Competitiveness: Striking a balance between avant-garde features and affordability is indispensable for capturing market share, particularly in budget-conscious segments.

Emerging Trends in the Industry:

The landscape is witnessing the emergence of several novel trends that are reshaping the industry's trajectory.

- Biometric Integration: Displays embedded with fingerprint or iris scanners for heightened security and personalization are gaining traction (Source: TechCrunch, Jun 2023).

- Haptic Feedback Displays: Touchscreen displays equipped with haptic feedback are engendering a more immersive driving experience, pioneered by Continental and GeniTouch (Source: Forbes, Jul 2023).

- Voice-Activated Displays: Voice control, empowered by advancements in natural language processing, is becoming the preferred interface, spearheaded by companies like Nuance and Amazon (Source: The Verge, Aug 2023).

- Cybersecurity: As displays become more interconnected, robust cybersecurity measures become indispensable. Companies such as HARMAN and Adient are focusing on secure data transmission and display vulnerability assessments (Source: Automotive Business, Sep 2023).

- Sustainability Focus: Eco-friendly display materials and low-power consumption technologies are gaining prominence, exemplified by Japan Display Inc.'s endeavors in developing displays from recycled materials (Source: Nikkei Asia, Oct 2023).

The automotive display market is fiercely competitive, witnessing the robust presence of established players like Continental, Bosch, LG Display, and Samsung Display. Concurrently, new entrants from the realms of technology and consumer electronics, such as BOE Technology from China, are carving significant niches. Innovation stands as the linchpin for success, compelling companies to incessantly push technological and functional boundaries. Partnerships and acquisitions are actively shaping the landscape, while the confluence of regulatory requisites and consumer predilections adds layers of complexity.

Industry Developments and Recent Updates: Recent industry developments further elucidate the dynamism within this sphere.

- November 2023: Stellantis announces plans to integrate AR displays in forthcoming vehicles, partnering with Microsoft for HoloLens integration.

- October 2023: Tesla encounters delays in its in-house developed display systems, sparking speculations regarding potential partnerships with established display manufacturers.

- September 2023: The European Union proposes stricter regulations concerning display brightness and emissions, potentially impacting design considerations.

In essence, the competitive landscape of the automotive display market embodies a relentless pursuit of innovation and strategic collaborations amidst a backdrop of evolving consumer needs and regulatory imperatives. This constant evolution underscores the imperative for players to remain agile, adaptive, and at the vanguard of technological advancements to thrive in this dynamic milieu.