Top Industry Leaders in the Automotive Connectors Market

*Disclaimer: List of key companies in no particular order

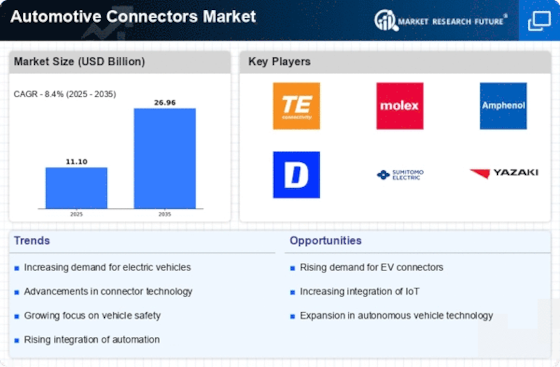

The automotive connectors market, a crucial cog in the complex machinery of vehicle manufacturing, is experiencing a dynamic shift in its competitive landscape. Driven by technological advancements and evolving consumer preferences, established players are being challenged by nimble innovators, fostering a vibrant and competitive environment.

Key Player Strategies:

Global Giants: Bosch, TE Connectivity, Molex, and Delphi Automotive leverage their extensive supply chains, robust manufacturing capabilities, and diverse product portfolios to maintain their market leadership. They prioritize strategic partnerships with automakers and Tier 1 suppliers, while simultaneously investing in R&D for next-generation connector technologies.

Regional Champions: Companies like Yazaki and Sumitomo Electric excel in specific geographic regions, often boasting strong relationships with local automakers. They cater to regional preferences and regulatory requirements, offering cost-effective solutions tailored to specific markets.

Innovation Hubs: Startups and smaller players are disrupting the market with cutting-edge connectors for electric vehicles, autonomous driving systems, and advanced infotainment features. Companies like Amphenol LTW and TE Connectivity AVX specialize in high-speed data transmission and EMI shielding, catering to the evolving needs of electrified and connected vehicles.

Factors for Market Share Analysis:

Product Portfolio Diversity: Offering a wide range of connectors for various applications, from engine management to advanced driver-assistance systems, grants a competitive edge.

Technological Prowess: Investing in R&D for miniaturization, lightweighting, and enhanced performance of connectors is crucial for staying ahead of the curve.

Quality and Reliability: Maintaining stringent quality control standards and ensuring long-term reliability of connectors is paramount for building brand trust and securing customer loyalty.

Supply Chain Efficiency: Robust global supply chains, efficient logistics, and responsiveness to market fluctuations are essential for meeting the demands of high-volume automotive production.

New and Emerging Trends:

Electrification & Connectivity: The rise of electric vehicles and autonomous driving technologies is driving demand for specialized connectors capable of handling high voltage, data transmission, and sensor integration.

Miniaturization & Lightweighing: Automotive manufacturers seek to reduce vehicle weight and optimize fuel efficiency, creating demand for smaller, lighter connectors with enhanced functionality.

Material Innovation: Advancements in materials like high-performance plastics and composite alloys are paving the way for connectors with improved durability, thermal resistance, and EMI shielding.

Sustainability Focus: Eco-friendly materials and manufacturing processes are gaining traction, with players developing connectors made from recycled plastics and utilizing energy-efficient production methods.

The automotive connectors market is a battleground where established giants face off against agile innovators, with technology and adaptation acting as the primary weapons. While global reach and diverse product portfolios provide an advantage for established players, the ability to cater to niche segments and embrace cutting-edge technologies is crucial for smaller players to gain traction. As electrification and connectivity reshape the automotive landscape, companies that prioritize R&D, invest in sustainable practices, and forge strategic partnerships are poised to secure their positions in this ever-evolving market.

Industry Developments and Latest Updates:E Connectivity (Switzerland):

- October 26, 2023: Announced a new partnership with a leading European EV manufacturer to supply high-voltage charging connectors for their upcoming electric vehicle models. (Source: E Connectivity press release)

Delphi Automotive (UK):

- November 17, 2023: Unveiled a new line of lightweight, compact connectors designed for use in advanced driver-assistance systems (ADAS). (Source: Automotive News)

Yazaki Corporation (Japan):

- December 20, 2023: Reported a 15% increase in revenue from their automotive connector division in the third quarter of 2023 compared to the same period in 2022. (Source: Yazaki Corporation financial report)

Sumitomo Electric (Japan):

- November 3, 2023: Developed a new type of high-performance connector that can withstand extreme temperatures and vibrations, making it ideal for use in electric vehicle batteries. (Source: Sumitomo Electric press release)

Amphenol Corporation (US):

- November 9, 2023: Acquired a leading manufacturer of fiber optic connectors for the automotive industry, expanding their portfolio in high-speed data transmission solutions. (Source: Amphenol press release)

Top Companies in the Automotive Connectors industry includes,

E Connectivity (Switzerland)

Delphi Automotive (UK)

Yazaki Corporation (Japan)

Sumitomo Electric (Japan)

Japan Aviation Electronics Industry (Japan)

Amphenol Corporation (US)

Hirose Electric Co. Ltd (Japan)

Hu Lane Associates Inc. (Taiwan)

Korea Electric Terminal Co. Ltd (South Korea)

Kyocera Corporation (Japan), and others.