Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is significantly impacting the Automotive Chemicals Market. As these vehicles become more prevalent, there is an increasing demand for specialized automotive chemicals tailored to their unique requirements. For example, electric vehicles require specific cooling fluids and battery maintenance products that differ from traditional vehicles. By 2025, the market for automotive chemicals catering to electric and hybrid vehicles is projected to grow by approximately 8% annually. This shift presents opportunities for manufacturers to innovate and develop new products that enhance the performance and safety of electric vehicles, thereby driving growth in the automotive chemicals sector.

Regulatory Compliance and Environmental Standards

The Automotive Chemicals Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing emissions and promoting the use of eco-friendly chemicals. This has led to a shift in the market towards greener alternatives, such as bio-based lubricants and water-based paints. In 2025, it is anticipated that the market for environmentally compliant automotive chemicals will account for nearly 30% of total sales. Companies are investing in research and development to create products that not only meet regulatory requirements but also appeal to environmentally conscious consumers. This trend is likely to reshape the competitive landscape of the automotive chemicals sector.

Technological Advancements in Automotive Chemicals

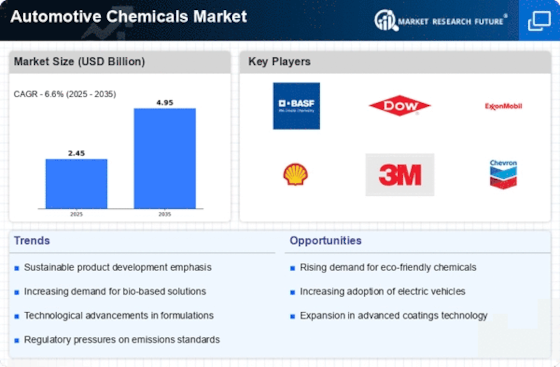

Technological advancements play a pivotal role in shaping the Automotive Chemicals Market. Innovations in chemical formulations and production processes have led to the development of more efficient and effective automotive chemicals. For instance, the introduction of synthetic lubricants has significantly improved engine performance and longevity. Additionally, advancements in nanotechnology are enabling the creation of coatings that enhance vehicle durability and aesthetics. As of 2025, the market for advanced automotive chemicals is expected to grow by approximately 6% annually, driven by these technological innovations. This evolution not only meets the demands of modern vehicles but also aligns with the industry's shift towards sustainability and performance enhancement.

Increasing Demand for Automotive Maintenance Products

The Automotive Chemicals Market is experiencing a notable surge in demand for maintenance products, driven by the growing awareness of vehicle upkeep among consumers. As vehicles age, the need for high-quality automotive chemicals, such as lubricants, coolants, and cleaning agents, becomes increasingly critical. In 2025, the market for automotive maintenance chemicals is projected to reach approximately 25 billion USD, reflecting a compound annual growth rate of around 4.5%. This trend is further fueled by the rising number of vehicles on the road, which necessitates regular maintenance and servicing. Consequently, manufacturers are focusing on developing innovative and environmentally friendly products to cater to this expanding market segment.

Expansion of Automotive Manufacturing in Emerging Markets

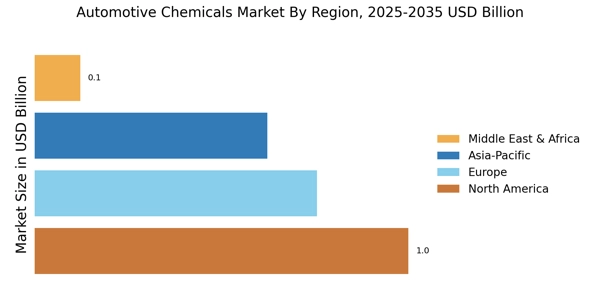

The expansion of automotive manufacturing in emerging markets is a significant driver for the Automotive Chemicals Market. Countries such as India, Brazil, and Southeast Asian nations are witnessing rapid growth in vehicle production, leading to an increased demand for automotive chemicals. In 2025, it is estimated that these emerging markets will contribute to nearly 40% of the global automotive chemicals demand. This growth is attributed to rising disposable incomes, urbanization, and a burgeoning middle class. Consequently, manufacturers are strategically positioning themselves to tap into these markets by establishing local production facilities and distribution networks, thereby enhancing their market presence and competitiveness.