Market Analysis

In-depth Analysis of Automotive Capacitors Market Industry Landscape

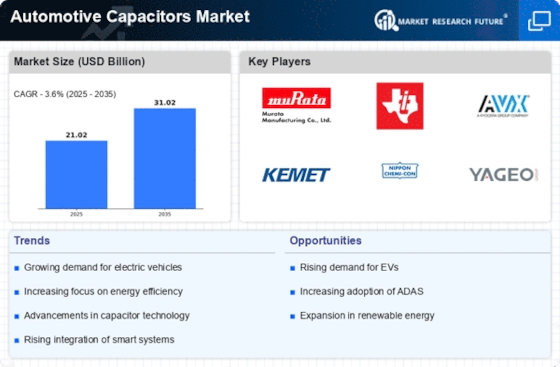

The automotive capacitors market is set to reach US$ 25.98 BN by 2032, at a 3.60% CAGR between years 2023-2032. The Automotive Capacitors Market mainly runs its activities within a dynamic environment that can be influenced by factors such as the demand, supply, and growth of the industry. The main stimulant of market dynamics in this category is the endless revolution in automotive technologies. The increasing advancement of vehicles, which is enabled by such attributes as electrification, autonomous driving and connected services rapidly increases the demand for capacitors. Capacitors also prove to be an essential element in promoting such technologies that are helping electronic systems within cars flow properly. In addition, various rules by the government along with needs to reduce energy use and pollution have forced automobilists to focus on energy saving and emission control. The new paradigm of the performance of such vehicles means that electric and hybrid variants now include capacitors as integral parts responsible for energy storage and transmission.

As a result, the Automotive Capacitors Market is also affected by a wave of movements in response to the green factors for capacitor replacement in the automobile and high demand for sustainable transportation. Other than these technological variables, market needs also depend on prevailing economic environment. The financial situation related to the impacts automotive application such as fluctuations in global economy, changes in customer purchasing power and performance of entire automotive industry primary governs the demand capacitors. Economic depressions may result in an interim period of cool down production in manufacturing vehicles and that can be also repercussed by this market negatively. On the contrary, accumulation of economic earnings and stability is accompanied by increase in automobile sales thereby creating demand for capacitors. In addition, the dynamics of Automotive market for capacitors are connected to its supply chain. The market performance indicators are raw materials supply, production capacity and suppliers manufacturing possibilities of components.

Any disruption in the supply chain can create an impact on various processes from production till availability to capacitors thereby carrying forward its effect on the market dynamics. Intrinsic Competition of automotive capacitors market also holds significant importance for determining the dynamics of this market. With more entrants to the market, there is a need for innovation based on cost effectiveness while differentiating products that reduce production and costs without compromising quality. For incumbents to remain competitive, they have to develop a strategy for constant change while disruptors find ways of establishing and sustaining their foothold. These three companies are fighting for market share like many others, but in this case they all bring innovations to the capacitor technology and force the actual backward distortion out of their way.

Leave a Comment