Market Analysis

In-depth Analysis of Automotive Camshaft Market Industry Landscape

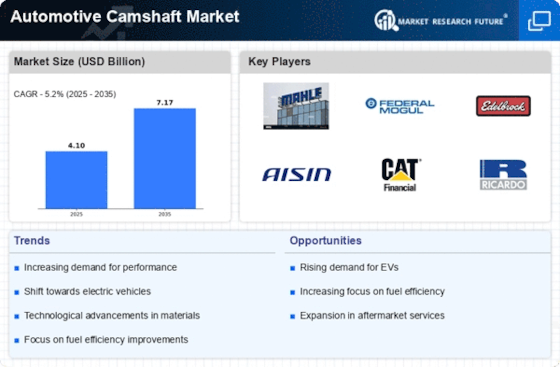

The Automotive Camshaft Market is influenced by a multitude of market factors that collectively shape its dynamics. One of the primary drivers in this market is the global automotive industry's growth, as the demand for vehicles directly impacts the need for camshafts. The increasing population, urbanization, and rising disposable incomes in emerging economies contribute significantly to the growth of the automotive sector, thereby boosting the demand for camshafts.

Technological advancements play a crucial role in shaping the Automotive Camshaft Market. As automotive manufacturers focus on enhancing fuel efficiency, reducing emissions, and improving overall performance, there is a constant need for innovative camshaft technologies. This includes the adoption of lightweight materials, precision engineering, and the integration of smart technologies to meet stringent regulatory standards and consumer expectations.

Government regulations and emission standards are pivotal factors affecting the Automotive Camshaft Market. Stringent emission norms globally drive automakers to invest in advanced engine technologies, including camshaft innovations, to comply with environmental standards. This regulatory landscape propels the market toward the development of more efficient and eco-friendly camshaft solutions, contributing to sustainable practices in the automotive industry.

The market is also heavily influenced by consumer preferences and trends. Changing consumer demands for high-performance vehicles, increased fuel efficiency, and a growing interest in electric and hybrid vehicles shape the camshaft market. As consumers become more environmentally conscious, there is a noticeable shift towards eco-friendly alternatives, prompting manufacturers to adapt their camshaft technologies accordingly.

Supply chain dynamics are critical in the Automotive Camshaft Market. The availability of raw materials, manufacturing processes, and the distribution network directly impact market growth. Fluctuations in raw material prices, geopolitical factors affecting the supply chain, and disruptions like the COVID-19 pandemic highlight the vulnerability of the automotive industry, including the camshaft market, to external shocks.

Competitive forces within the automotive industry contribute to the market dynamics of camshafts. The presence of several key players, each vying for market share, results in continuous innovation and product development. Collaborations, partnerships, and mergers and acquisitions among industry players influence the competitive landscape, driving advancements in camshaft technology and fostering market growth.

Global economic conditions also play a pivotal role in shaping the Automotive Camshaft Market. Economic downturns can lead to a decline in consumer spending on automobiles, affecting the overall demand for camshafts. Conversely, periods of economic growth and stability tend to boost consumer confidence, leading to increased automotive sales and, consequently, a higher demand for camshaft components.

The aftermarket segment is another significant factor in the Automotive Camshaft Market. As vehicles age, there is a growing need for replacement parts, including camshafts. Factors such as vehicle maintenance, repairs, and customization contribute to the aftermarket demand, and manufacturers often tailor their offerings to cater to this segment, expanding their market reach.

In conclusion, the Automotive Camshaft Market is intricately woven into the fabric of the broader automotive industry, with factors like technological advancements, government regulations, consumer preferences, supply chain dynamics, competition, economic conditions, and the aftermarket playing crucial roles. The interplay of these elements continuously shapes the market, driving innovation and adaptation within the camshaft segment to meet the evolving needs of the automotive sector.

Leave a Comment