Top Industry Leaders in the Automotive Airbag Inflators Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Airbag Inflator industry are:

ARC Automotive, Inc. (U.S.)

Daicel Corporation (Japan)

Jinzhou Jinheng Automotive Safety System Co., Ltd. (China)

Takata Corporation (Japan)

Autoliv Inc. (Sweden)

Toyoda Gosei Co., Ltd. (Japan)

Key Safety Systems (U.S.)

TRW Automotive (U.S.)

Aptiv PLC (U.S.)

And others include Toyoda Gosei Co., Ltd. (Japan)

Key Safety Systems (U.S.)

TRW Automotive (U.S.)

Aptiv PLC (U.S.).

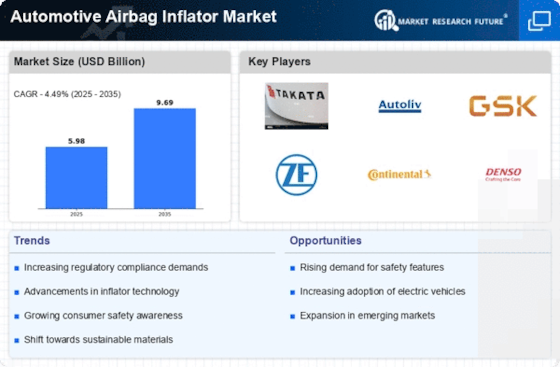

The automotive airbag inflator market, a crucial cog in the safety systems machinery, is set to inflate at a steady pace over the coming years. Driven by stringent regulations, rising disposable incomes, and increasing demand for high-end car features, the market is attracting intense competition from established players and innovative newcomers. To navigate this dynamic landscape, let's buckle up and explore the key strategies, trends, and factors shaping the current and future competitive scenario.

Key Players and Their Strategies:

The market is dominated by a handful of established giants like Autoliv, Daicel Corporation, ZF TRW, Joyson Safety Systems, and Nippon Kayaku. They boast extensive product portfolios, strong customer relationships with major automakers, and robust R&D capabilities. Their strategies revolve around:

Technological Differentiation: Focusing on developing safer, lighter, and more cost-effective inflators through continuous innovation. Example: Autoliv's hybrid inflator combining pyrotechnic and compressed gas for faster deployment.

Geographic Expansion: Tapping into the burgeoning demand from emerging economies like China and India through strategic partnerships and local production facilities. Example: Daicel's joint venture with Chinese safety supplier Joyson Safety Systems.

Vertical Integration: Strengthening control over the supply chain by venturing into raw material production and component manufacturing. Example: ZF TRW's acquisition of airbag fabric manufacturer TRW Automotive in 2015.

Factors for Market Share Analysis:

Beyond the big players, smaller companies are carving niches with specialized offerings and agility. To assess market share dynamics, it's crucial to consider:

Product Mix: The diversity of inflator types (pyrotechnic, hybrid, stored gas) offered caters to different vehicle segments and price points. Companies with a broader range hold an edge.

Cost Competitiveness: Efficient manufacturing processes and economies of scale play a crucial role, especially in price-sensitive regions.

Regulatory Compliance: Meeting stringent safety standards is non-negotiable, and proactive players who excel in regulatory navigation gain trust and market share.

Customer Relationships: Building strong partnerships with automakers and Tier 1 suppliers ensures consistent demand and access to new business opportunities.

New and Emerging Trends:

The market is witnessing exciting innovations that will reshape the competitive landscape:

Advanced Sensor Technology: Integration of sensors into inflators enables intelligent deployment based on crash severity and occupant position, optimizing safety and reducing injury risks.

Sustainable Materials: The growing focus on eco-friendly solutions encourages exploration of bio-based and recyclable materials for inflator components.

Connected Airbags: Integrating airbags with vehicle communication systems opens up possibilities for real-time crash data analysis and predictive maintenance, enhancing safety and operational efficiency.

Overall Competitive Scenario:

The automotive airbag inflator market is poised for sustained growth, driven by a confluence of factors. While established players continue to dominate, disruptive technologies and changing consumer preferences offer opportunities for nimble new entrants. The companies that successfully navigate this dynamic landscape by continuously innovating, optimizing costs, and adapting to new trends will secure their positions as leaders in this life-saving market.

Latest Company Updates:

ARC Automotive, Inc. (U.S.): No recent news specifically on airbag inflators. Focuses on seat belt pretensioners and other safety products.

Daicel Corporation (Japan): Developed and manufactures non-azide inflators using lithium nitrate propellant, considered a safer alternative to ammonium nitrate used in Takata inflators. Announced a joint venture with Chinese airbag manufacturer Ningbo Joyson Safety Systems in 2022 to expand production

Takata Corporation (Japan): Currently under bankruptcy protection. The Coordinated Remedy Program overseen by the NHTSA continues to manage the Takata airbag recall in the US.

Autoliv Inc. (Sweden): A major global supplier of airbags and other safety systems. Has invested heavily in non-azide inflator technology and is a leading supplier to major automakers.