Top Industry Leaders in the Automotive Air Flow Meter Market

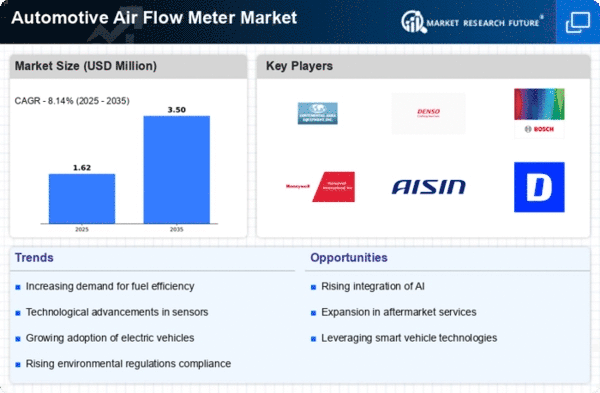

The automotive air flow meter market is a crucial cog in the automotive ecosystem, ensuring optimal engine performance and fuel efficiency. With stringent emission regulations and the burgeoning electric vehicle (EV) landscape, this market is undergoing a dynamic transformation. Players are adapting their strategies and vying for market share, making it imperative to understand the competitive landscape.

Key Player Strategies:

Established Giants: Leading players like Denso, Bosch, and Hitachi leverage their brand recognition, extensive distribution networks, and R&D prowess to maintain strong market positions. They prioritize product innovation, focusing on sensor miniaturization, enhanced accuracy, and integration with engine management systems. Denso, for instance, introduced a compact Hot Wire Air Flow Meter with improved fuel efficiency.

Cost-Conscious Challengers: Tier-2 and Tier-3 players from emerging economies like China and India are challenging established players with competitive pricing strategies. They cater to budget-conscious segments with cost-effective air flow meters, often with slightly lower accuracy specifications. Chinese players like United Automotive Electronic Systems are making significant inroads, capturing market share through aggressive pricing and strategic partnerships.

Technology Disruptors: Emerging players are introducing innovative technologies like ultrasonic and multipoint averaging pitot tube air flow meters, challenging the dominance of traditional vane and hot wire types. These sensors offer advantages like long lifespan, reduced maintenance, and improved accuracy, particularly in harsh environments. Startups like Sensi Flow are gaining traction with their ultrasonic flow meter solutions for EV battery thermal management systems.

Market Share Analysis Factors:

Product Portfolio: Companies with diverse offerings catering to different vehicle segments and engine types hold an edge. Bosch, with its wide range of vane and hot wire meters for gasoline and diesel engines, maintains a strong market position.

Geographical Presence: A global presence and strong relationships with automakers give players access to wider markets and potential economies of scale. Denso's established presence in major automotive manufacturing hubs like Japan, Europe, and North America gives them a significant advantage.

Technological Advancements: Continuous innovation in sensor design, materials, and integration capabilities is crucial for market leadership. Hitachi's development of a highly accurate and compact Hot Wire Air Flow Meter for EVs demonstrates their commitment to technological advancement.

After-Sales Service and Support: Reliable after-sales service and technical support networks are essential for building customer trust and loyalty. Bosch's extensive global service network and training programs for technicians enhance their brand image and customer satisfaction.

New and Emerging Trends:

EV-Specific Air Flow Meters: The rise of EVs demands specialized air flow meters for measuring air intake in battery packs and thermal management systems. Companies like Sensi Flow are catering to this growing segment with dedicated EV solutions.

Sensor Fusion and Integration: Integrating air flow meter data with other sensors like exhaust gas temperature and oxygen sensors can provide holistic engine performance insights. Bosch's Engine Management Systems incorporating air flow meter data are a prime example of this trend.

Data Analytics and AI-powered solutions: Leveraging data from air flow meters for predictive maintenance and real-time engine optimization is gaining traction. Hitachi's LuMIflo platform, which analyzes air flow data for predictive maintenance, showcases the potential of AI in this space.

Overall Competitive Scenario:

The automotive air flow meter market is characterized by intense competition, with established players facing challenges from cost-conscious competitors and technology disruptors. Innovation, diversification, and strategic partnerships are key for success in this dynamic landscape. The increasing demand for EV-specific solutions and the integration of air flow meter data with other sensors and AI present significant growth opportunities for the future. Players who adapt swiftly and capitalize on these trends will be the ones driving the market forward.

Industry Developments and Latest Updates:

Denso Corporation:

October 27, 2023: Denso develops a new hot-wire airflow meter with enhanced accuracy and faster response time, aimed at improving engine performance and fuel efficiency.

Robert Bosch GmbH:

November 8, 2023: Bosch unveils a miniaturized vortex airflow meter for tight engine compartments, enabling greater design flexibility and packaging benefits.

Festo AG & Co. KG:

October 24, 2023: Festo introduces a new airflow meter specifically designed for hydrogen fuel cell vehicles, addressing unique measurement challenges of this technology.

Hitachi, Ltd.:

November 3, 2023: Hitachi unveils a next-generation airflow meter with integrated temperature and pressure sensors, providing comprehensive intake manifold data for advanced engine control strategies.

Top Companies in the Automotive Air Flow Meter industry includes,Denso Corporation (Japan)

Robert Bosch GmbH (Germany)

Festo AG & Co. KG (Germany)

Hitachi, Ltd. (Japan)

Delphi Automotive PLC (U.K)

ACDelco (U.S)

Mitsubishi Motors Corporation (Japan)

K&N Engineering, Inc. (the U.S)

Nissan Motor Co., Ltd. (Japan)

FLIR Systems (U.S)