Automotive Adaptive Front Light Size

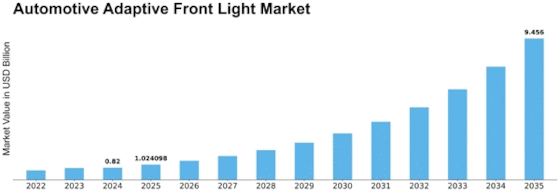

Automotive Adaptive Front Light Market Growth Projections and Opportunities

The Automotive Adaptive Front Light (AFL) market is undergoing significant transformations driven by a multitude of factors that define its market dynamics. In recent years, the automotive industry has witnessed a growing emphasis on safety and advanced driver-assistance systems (ADAS). As a crucial component of ADAS, Adaptive Front Lights have gained prominence for their ability to enhance visibility and safety during night driving. This growing focus on safety standards, coupled with consumer demand for advanced features, is a primary driver influencing the market dynamics of Automotive Adaptive Front Lights.

Safety regulations and standards play a pivotal role in shaping the market dynamics. Governments worldwide are increasingly implementing stringent safety norms, and automakers are incorporating advanced safety features to comply with these regulations. Adaptive Front Lights, with their ability to automatically adjust the direction and range of the vehicle's headlights based on driving conditions, contribute significantly to improving road safety. As safety concerns continue to drive regulatory changes, the demand for vehicles equipped with adaptive lighting systems is expected to rise, influencing market dynamics positively.

Consumer preferences and awareness of safety features also play a crucial role in shaping the Automotive Adaptive Front Light market. As consumers become more informed about the benefits of advanced safety technologies, there is a growing demand for vehicles equipped with features that enhance overall driving experience and safety. Automakers are responding to this demand by integrating Adaptive Front Lights into their vehicle models, creating a consumer-driven push that impacts market dynamics.

Furthermore, the evolving landscape of automotive technologies, including the rise of electric vehicles (EVs) and autonomous driving capabilities, contributes to the market dynamics of Automotive Adaptive Front Lights. Electric vehicles, with their advanced technology and focus on sustainability, often incorporate cutting-edge safety features, including adaptive lighting systems. The integration of Adaptive Front Lights into autonomous vehicles becomes crucial as these vehicles rely on advanced sensor technologies to navigate safely. As the automotive industry moves towards electrification and autonomy, the demand for adaptive lighting solutions is likely to witness a steady increase.

The competitive landscape also plays a vital role in shaping the market dynamics of Automotive Adaptive Front Lights. Key players in the industry are investing in research and development to stay ahead in terms of technology and innovation. Strategic partnerships and collaborations are common in this market, as companies seek to leverage each other's expertise to deliver cutting-edge adaptive lighting solutions. The competitive environment fosters advancements in technology, contributing to the overall evolution of the market.

However, challenges such as cost considerations and integration complexities pose hurdles to market growth. The cost-sensitive nature of the automotive industry, particularly in emerging markets, can impact the widespread adoption of advanced lighting technologies. Additionally, integrating adaptive lighting systems into existing vehicle architectures requires careful engineering and may pose challenges in terms of compatibility and cost-effectiveness.

In conclusion, the market dynamics of the Automotive Adaptive Front Light market are shaped by a combination of safety regulations, consumer preferences, technological advancements, and the competitive landscape. As safety becomes a paramount concern and consumers increasingly seek advanced features in their vehicles, the demand for Adaptive Front Lights is expected to grow. The intersection of safety, technology, and consumer-driven preferences will continue to influence the evolution of the Automotive Adaptive Front Light market in the coming years. Striking a balance between safety enhancements, cost considerations, and technological advancements will be crucial for market players to navigate and thrive in this dynamic landscape.

Leave a Comment