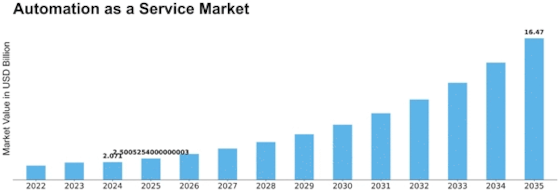

Automation As A Service Size

Automation as a Service Market Growth Projections and Opportunities

The Automation as a Service (AaaS) market is encountering a significant flood driven by several market factors that mirror the developing landscape of business operations. One key factor is the increasing demand for productivity and cost-viability in various businesses. As organizations endeavor to streamline their cycles, automate redundant tasks, and enhance overall efficiency, the adoption of Automation as a Service turns into a convincing arrangement. This demand is particularly conspicuous in areas like manufacturing, finance, healthcare, and IT, where monotonous and rule-based tasks can be seamlessly automated, allowing human assets to zero in on additional strategic and creative aspects of their jobs.

Another critical market factor is the rapid advancements in innovation, especially in the realms of artificial knowledge (AI) and machine learning. These innovations play a pivotal job in enabling sophisticated automation capabilities. With the consistent improvement of AI algorithms, organizations can leverage Automation as a Service to achieve exceptional degrees of accuracy and speed in their operations. The ability of these frameworks to learn from data and adapt to changing circumstances positions AaaS as a dynamic and future-confirmation arrangement.

Moreover, the increasing intricacy of business processes and the requirement for agility in the cutting edge serious landscape add to the development of the AaaS market. Organizations are gone up against with intricate work processes and a staggering volume of data that can be challenging to manually manage. Automation as a Service offers a scalable and adaptable arrangement, allowing organizations to adjust their automation levels based on developing prerequisites. This scalability is particularly advantageous for companies encountering fluctuating workloads or those going through digital transformation initiatives.

Market factors also incorporate the rising importance of online protection and compliance. As organizations handle touchy data and face a steadily developing threat landscape, the implementation of secure and compliant automation processes becomes paramount. Automation as a Service suppliers frequently integrate powerful security features and adhere to regulatory standards, offering organizations a reliable arrangement that limits the gamble of data breaches and guarantees compliance with industry regulations.

Cost-viability is a significant driver in the AaaS market. Adopting automation allows companies to decrease operational expenses associated with manual labor, blunders, and shortcomings. In addition, the pay-as-you-go model presented by many AaaS suppliers enables organizations to enhance costs based on their actual usage, making automation an attractive recommendation for organizations, everything being equal.

Leave a Comment