Top Industry Leaders in the Automatic Transmission Market

*Disclaimer: List of key companies in no particular order

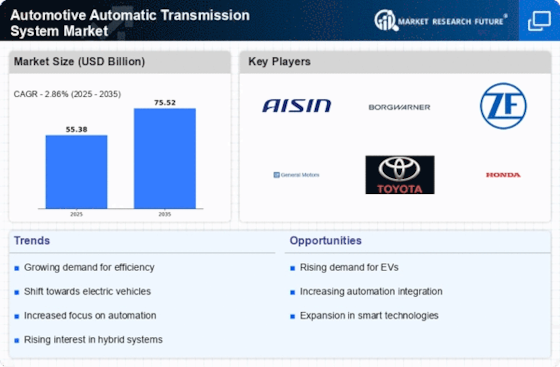

In the dynamic realm of the global automotive automatic transmission system market, a robust growth engine propels forward, fueled by escalating urbanization, increasing disposable income, and a growing preference for comfort and convenience. Within this landscape, established players and innovative upstarts engage in a strategic dance to secure market share. Let's delve into the key strategies defining this competitive scenario and explore the factors influencing market share, along with new and emerging trends shaping the future of the industry.

Key Strategies Redefined:

Prominent players such as Magna International Inc. (Canada), Aisin Seiki Co., Ltd. (Japan), ZF Friedrichshafen AG (Germany), GETRAG (Germany), and JATCO Ltd. (Japan) are at the forefront. Additionally, Eaton Corporation PLC (Republic of Ireland), Continental AG (Germany), Allison Transmission (U.S.), BorgWarner Inc. (U.S.), and GKN PLC (U.K.) contribute to the competitive landscape.

Giants Lead the Way: Established players leverage their extensive experience, research and development capabilities, and global reach to maintain dominant positions. Investments in fuel-efficient transmissions, dual-clutch transmissions (DCTs), and hybrid/electric vehicle (HEV/EV) compatible systems solidify their dominance in both traditional and future-oriented segments.

Partnerships Fuel Growth: Strategic partnerships and collaborations form a cornerstone of success. Alliances between transmission manufacturers and automakers expedite knowledge sharing, optimize cost structures, and accelerate the adoption of new technologies.

Regional Focus: Players tailor strategies to regional demands. Aisin AW targets the burgeoning Asian market with fuel-efficient transmissions for smaller vehicles, while ZF focuses on Europe's premium segment with advanced 8- and 9-speed automatics, ensuring market fit and customer satisfaction.

Embracing Innovation: Leading manufacturers proactively embrace and drive innovation. Hyundai Transys, for instance, focuses on AI-powered adaptive transmissions that learn driver behavior for optimized gear changes and improved fuel efficiency. Investments in electrification-related technologies showcase a future-oriented vision.

Factors Influencing Market Share:

Transmission Type: Market share analysis based on transmission types, including conventional automatics, DCTs, continuously variable transmissions (CVTs), and automated manual transmissions (AMTs), provides nuanced insights. Aisin AW excels in CVTs, while ZF dominates the DCT segment.

Geographic Breakdown: Regional variations impact market share significantly. Asia Pacific leads due to rapid urbanization and a preference for automatics, while Europe's focus on high-performance vehicles favors advanced transmissions from ZF and Bosch.

Vehicle Segment: Analysis across segments—passenger cars, SUVs, light trucks, and commercial vehicles—reveals player specificities. Aisin AW caters heavily to small cars, while ZF targets premium SUVs and luxury sedans.

Technology Adoption: Tracking a player's adoption of new technologies, such as fuel-efficient transmissions, EV compatibility, and AI integration, provides insights into future competitiveness. Early adopters gain a first-mover advantage and attract environmentally conscious consumers.

New and Emerging Trends:

Electrification-driven Transformation: The rise of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is reshaping the transmission landscape. Companies like Magna and BorgWarner are at the forefront, developing dedicated EV transmissions and multi-speed hybrid transmissions for improved efficiency and performance.

Connectivity and Automation: Integrating transmissions with vehicle networks and autonomous driving systems gains traction, opening opportunities for real-time adaptive gear changes and automated driving functionalities. Companies like ZF and Bosch actively explore these avenues.

Material Advancements: Exploration of lighter, stronger materials like carbon fiber and composite plastics aims to reduce transmission weight and enhance fuel efficiency. Aisin AW and Jatco are actively researching and developing such materials.

Overall Competitive Scenario:

Intense competition characterizes the automotive automatic transmission system market, with established players and innovative upstarts striving for dominance. Success hinges on adapting to regional demands, embracing new technologies, and forging strategic partnerships. Players addressing electrification, connectivity, and material advancements gain a crucial edge in this dynamic and evolving landscape. The future promises further diversification and technological advancements, making it an exciting space to observe.

Industry Developments and Latest Updates:

Magna International Inc. (Canada):

-

Date: November 15, 2023 -

Development: Announced plans to invest in the development of next-generation electric vehicle (EV) transmissions, focusing on high-efficiency and compact designs.

Aisin Seiki Co., Ltd. (Japan):

-

Date: December 5, 2023 -

Development: Unveiled a new 8-speed automatic transmission designed for hybrid and plug-in hybrid vehicles (PHEVs), offering improved fuel efficiency and performance.

GETRAG (Germany):

-

Date: September 19, 2023 -

Development: Announced a partnership with REE Automotive to develop and supply dual-clutch transmissions for REE's modular EV platform.

JATCO Ltd. (Japan):

-

Date: July 12, 2023 -

Development: Developing a continuously variable transmission (CVT) specifically for small EVs, aiming for improved fuel economy and driving comfort.