Focus on Infection Control and Hygiene

The Automated Hospital Beds Market is also shaped by a heightened focus on infection control and hygiene standards in healthcare settings. The ongoing emphasis on maintaining a sterile environment has led to the development of automated beds that are easier to clean and maintain. Features such as antimicrobial surfaces and seamless designs are becoming increasingly important in hospital bed design. As healthcare facilities prioritize infection prevention, the demand for automated hospital beds that support these initiatives is expected to rise. Recent studies indicate that hospitals implementing advanced hygiene protocols have seen a reduction in hospital-acquired infections, further underscoring the importance of investing in automated solutions.

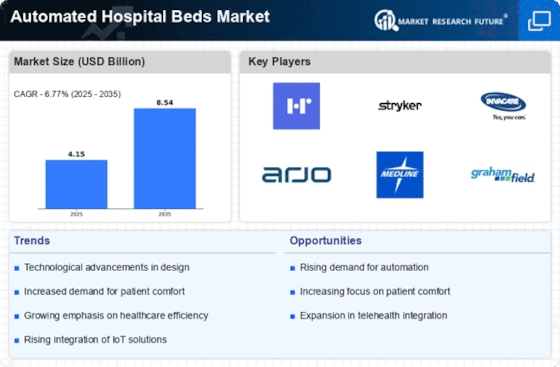

Rising Demand for Advanced Healthcare Solutions

The Automated Hospital Beds Market is experiencing a notable increase in demand for advanced healthcare solutions. This trend is driven by the growing need for efficient patient management systems that enhance comfort and safety. As healthcare facilities strive to improve patient outcomes, the integration of automated beds is becoming essential. According to recent data, the market for automated hospital beds is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is indicative of a broader shift towards technology-driven healthcare solutions, where automated beds play a crucial role in optimizing patient care and operational efficiency.

Technological Integration in Healthcare Facilities

The Automated Hospital Beds Market is witnessing a surge in technological integration within healthcare facilities. Hospitals are increasingly adopting smart technologies that facilitate real-time monitoring and data collection, which are essential for improving patient care. Automated hospital beds Market equipped with sensors and connectivity features allow healthcare providers to track patient movements and vital signs more effectively. This integration not only enhances patient safety but also streamlines hospital operations. Market analysis indicates that the adoption of such technologies is likely to increase by over 20% in the coming years, reflecting a strong trend towards automation and digitalization in healthcare settings.

Aging Population and Increased Hospitalization Rates

The Automated Hospital Beds Market is significantly influenced by the aging population, which is leading to increased hospitalization rates. As individuals age, they often require more medical attention, resulting in a higher demand for hospital services. This demographic shift is prompting healthcare providers to invest in automated hospital beds that offer enhanced features such as adjustable positioning and integrated monitoring systems. Data suggests that by 2030, the number of individuals aged 65 and older will reach approximately 1.5 billion, further driving the need for innovative solutions in patient care. Consequently, the market for automated hospital beds is expected to expand as healthcare facilities adapt to these changing demographics.

Government Initiatives and Funding for Healthcare Infrastructure

The Automated Hospital Beds Market is positively impacted by various government initiatives aimed at enhancing healthcare infrastructure. Many governments are allocating substantial funds to improve hospital facilities and patient care services. This financial support often includes investments in advanced medical equipment, including automated hospital beds. As healthcare systems evolve, government policies that promote technological advancements and patient safety are likely to drive market growth. Reports suggest that public funding for healthcare infrastructure is expected to increase by 15% over the next five years, creating a favorable environment for the expansion of the automated hospital beds market.