Top Industry Leaders in the Audit Software Market

Competitive Landscape of Audit Software Market:

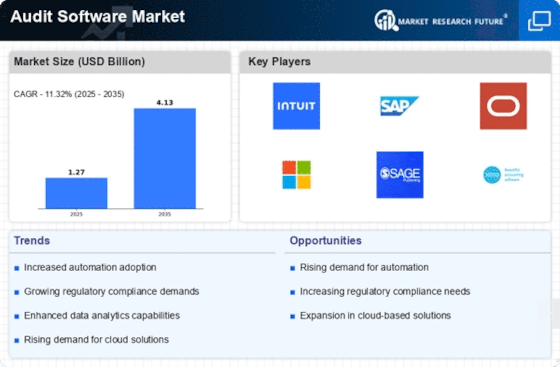

The audit software market is experiencing a period of dynamic growth, driven by factors like rising compliance demands, increasing adoption of cloud-based solutions, and the need for improved efficiency and accuracy in audit processes. This growth has fueled intense competition among established players and attracted the entry of new, innovative companies. Understanding this dynamic landscape is crucial for both existing players and potential entrants.

Key Players:

- Thomson Reuters/Tax & Accounting (Canada)

- SAP SE (Germany)

- Protiviti Inc. (US)

- RiskLogix

- (US)

- Ideagen Plc. (UK)

- Lockpath, Inc. (US)

- AuditBoard, Inc. (US)

- Dell (US)

- (Netherlands)

- Enablon S.A (France)

- MetricStream Inc. (US)

- Compliance Bridge Corporation. (US)

- Resolver (India)

- SAI Pty Limited. (Australia)

- TRONIXSS (US)

- AuditFile, Inc. (US)

Strategies for Market Share Growth:

- Product Differentiation: Established players are constantly enhancing their core offerings with advanced features like AI-powered risk assessment, data analytics dashboards, and integrated workflow management tools. Emerging players are focusing on niche solutions with unique functionalities and user-friendly interfaces.

- Cloud-based Deployment: The shift to cloud-based solutions is accelerating, offering scalability, accessibility, and reduced IT infrastructure costs. Players are aggressively migrating their offerings to the cloud and developing cloud-native solutions for optimal performance.

- Strategic Partnerships: Collaborations with industry leaders, technology providers, and consulting firms are becoming increasingly common. These partnerships allow players to access new markets, expand their solution offerings, and leverage expertise.

- Acquisition and Integration: M&A activity is on the rise, with established players acquiring smaller companies to fill product gaps, expand geographical reach, and access new technologies.

Factors for Market Share Analysis:

- Product Features and Functionality: The breadth and depth of features offered, ease of use, and integration capabilities play a key role in influencing user choice.

- Price and Value Proposition: Pricing models (subscription, licensing, etc.) and the perceived return on investment (ROI) are critical factors for budget-conscious buyers.

- Customer Support and Training: Responsive customer support, comprehensive training programs, and ongoing maintenance services are crucial for building user loyalty.

- Industry Expertise and Compliance: Deep understanding of specific industry regulations and compliance requirements can give players a competitive edge.

- Brand Reputation and Market Presence: Established brands and players with a strong track record have a natural advantage in attracting new customers.

New and Emerging Companies:

- Smaller, agile companies are entering the market with niche solutions focused on specific audit types, like data analytics for fraud detection or continuous controls monitoring.

- Start-ups leveraging emerging technologies like AI and blockchain are offering innovative solutions that automate repetitive tasks and improve audit accuracy.

- Cloud-native audit platforms are gaining traction, offering scalability and cost-efficiency compared to traditional on-premise solutions.

Current Company Investment Trends:

- Research and Development: Players are investing heavily in R&D to develop AI-powered features, automation tools, and data analytics capabilities.

- Cloud Infrastructure and Security: Migrating to secure cloud platforms and investing in robust data security measures are priorities.

- Strategic Partnerships: Collaborations with technology providers and consulting firms are increasing to expand offerings and reach new markets.

- User Experience (UX) and Design: Companies are focusing on user-friendly interfaces, intuitive workflows, and mobile accessibility to improve user adoption and satisfaction.

Latest Company Updates:

In 2023, Wolters Kluwer, a leading global provider of professional information, software, and services, introduced TeamMate® Document Linker, a new offering for accounting firms that automatically links audit samples to supporting documentation, enhancing audit quality and saving significant time on each audit.

2023 saw the announcement by Tel-Aviv-based firm Vendict of its coming out of stealth with $9.5 million in funding and the first generative AI programme in the world that can converse with security and compliance teams.