Top Industry Leaders in the Atomic Layer Deposition Market

The Atomic Layer Deposition (ALD) market is a vibrant and dynamic one, fueled by the relentless march of miniaturization in electronics and the burgeoning demand for high-performance materials. This intricate landscape thrives on fierce competition, with established players battling it out with ambitious startups, all vying for a slice of the pie.

The Atomic Layer Deposition (ALD) market is a vibrant and dynamic one, fueled by the relentless march of miniaturization in electronics and the burgeoning demand for high-performance materials. This intricate landscape thrives on fierce competition, with established players battling it out with ambitious startups, all vying for a slice of the pie.

Strategies adopted by key players:

-

Product Innovation: Leading companies like ASM International, Veeco Instruments, and Cambridge Nanotech are relentlessly innovating, developing advanced ALD equipment with increased precision, deposition speed, and material capability. Recent examples include Veeco's Genesis Max plasma-enhanced ALD system for high-aspect-ratio 3D structures and Cambridge Nanotech's Gemstar 8, capable of depositing multiple materials in a single process. -

Vertical Integration: To secure supply chains and offer comprehensive solutions, established players are acquiring smaller companies with unique expertise. For instance, Applied Materials' acquisition of Picosun expanded its ALD portfolio for 3D NAND and micro-LED applications. -

Regional Expansion: Recognizing the burgeoning demand from Asia-Pacific, particularly China and South Korea, companies are establishing manufacturing and R&D facilities in these regions. Soitec's joint venture with Hanwha for ALD systems for advanced semiconductor memory production is a prime example. -

Partnerships and Collaborations: Collaborations with research institutions and universities, as well as with other industry players, are accelerating innovation and opening up new market opportunities. For instance, TEL and CEA Leti partnered to develop ALD processes for GaN power electronics, a promising segment. -

Focus on Sustainability: Recognizing the growing emphasis on green technologies, companies are developing energy-efficient and environmentally friendly ALD systems. Picosun's use of cold plasma technology in its ALD systems exemplifies this trend.

Factors influencing market share:

-

Technological Expertise: Possessing the know-how to develop highly specialized ALD systems for intricate applications like high-k dielectric gate films for logic devices or high-brightness LEDs grants a significant competitive edge. -

Manufacturing Capability: Efficient production of high-quality, reliable ALD equipment at scale is crucial for capturing market share. -

Customer Service and Support: Providing comprehensive after-sales support and developing strong customer relationships fosters loyalty and repeat business. -

Brand Reputation: Established brands with a long history of innovation and reliability hold an advantage over newer entrants. -

Pricing Strategy: Balancing competitive pricing with the high cost of research and development is a delicate dance that players must master.

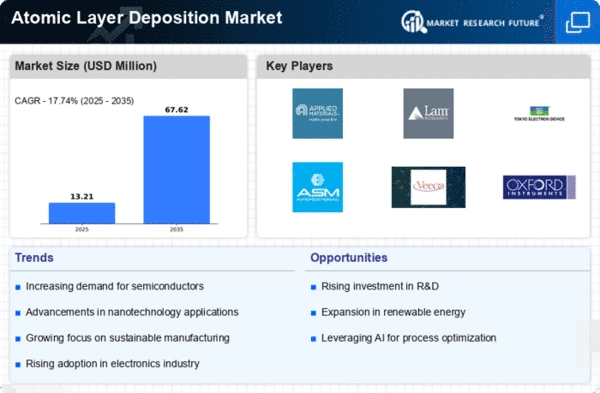

Key Players

- Jiangsu Leadmicro Guide Nano Equipment Technology Co., Ltd (China)

- Denton Vacuum (US)

- CVD Equipment Corporation (US)

- Kurt J. Lesker Company (UK)

- Veeco Instruments (US)

- Tokyo Electron Limited (Japan)

Recent Developments (Last 6 Months):

March 2023: Soitec reports exceeding initial production targets for its ALD equipment in South Korea, showcasing the success of its regional expansion strategy.

April 2023: Cambridge Nanotech and its research partner achieve a new world record for solar cell efficiency using ALD-deposited materials, propelling advancements in clean energy technology.

May 2023: SEMICON China, a major industry event, reports a surge in interest in ALD technologies, reflecting the growing importance of the Asian market.

June 2023: Picosun secures investment from a leading clean-tech venture capital firm, demonstrating the market's