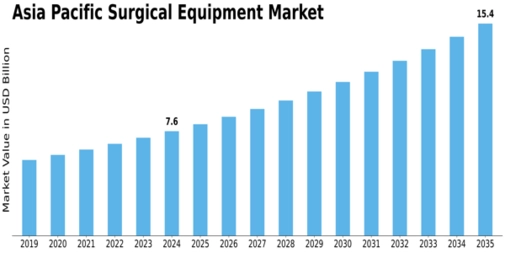

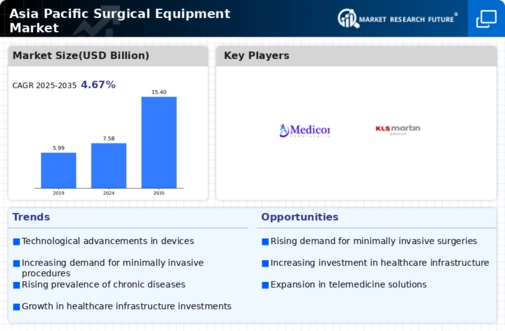

Asia Pacific Surgical Equipment Size

Asia Pacific Surgical Equipment Market Growth Projections and Opportunities

The Asia-Pacific surgical equipment market is fueled by the continuous growth in the number of surgical procedures performed across the region. As healthcare infrastructure expands and access to surgical interventions increases, there is a rising demand for surgical equipment to support various medical procedures, contributing to market expansion. Newer surgical technologies constitute the core of the Asian SURGICAL EQUIPMENT market. It has resulted in surgical equipment innovation that has advanced surgical accuracy, outcomes, and efficiency via robotic-assisted surgery systems, minimally invasive devices, and advanced imaging technologies. With the surge of investments on healthcare infrastructure in this region, the SURGICAL EQUIPMENT market continues to grow. Asian governments and private organizations are investing large amount of fund into the development and modernization of healthcare facilities therefore making it a viable and conductive environment for the acceptance and integration of the use of advanced surgical technologies. The overgrowing of chronic diseases in Asia Pacific region boosts the utilization of surgical interventions and advanced equipment. CVDs, cancer, and orthopedic disorders are most of the time treated with surgical procedures driving the demand for appropriate surgical tools and equipment. Providing Access to Secondary Sources to Empower Writers and Librarians to Make High Decision Making Source From Citations. Supportive policies, reimbursement programs, and also infrastructure development projects promote availability and affordability of surgical equipment, and contribute to the market dynamics. There are also demographic trends that have to do with the demand for the surgical procedures as well as related medical equipment such as population growth and aging. The growing senior population in Asia Pacific has resulted in a rise need of surgical procedures and accordingly, housing sales, as older people often have to be treated with the help of surgical instruments. Among the factors driving up the SURGICAL EQUIPMENT market are the economic factors including healthcare expenditures, GDP increase as well as insurance coverage. The purchasing power for healthcare facilities is influenced by economic stability linked to budget allocations towards health care thus also determining acceptance levels of new and innovative surgical techniques. The current move towards MIS affects the specialized surgical devices market. Minimally Invasive Surgery MIS always remains the preference of both surgeons and patients because of its benefits like rapid recovery and minimal postoperative complications. This trend fuels the need for sophisticated surgical equipment’s and devices that enable minimally invasive surgery. In healthcare, patient-centered approaches with improved outcomes and experience drive the selection of surgical equipment. Most importantly, instruments that lead to better recovery period, less pain, and improved patient contentment are preferred mode, in turn affecting the market of innovative surgical technologies from this standpoint. International standards for application of the surgical techniques and use of recognized equipment all over the world gives the globalized features to the APAC market of surgical equipment. Customs retain the essentiality of regulations guidelines within SURGICAL EQUIPMENT MARKET. The laws are extremely strict, and there are many compliance rules the manufacturers have to keep up with with which to get through the approval process by the market and gain trust among medical professionals. Intense competition among key players characterizes the SURGICAL EQUIPMENT market in Asia Pacific. Market consolidation through mergers, acquisitions, and strategic alliances is a common strategy employed by companies to enhance market presence, impact product innovation, and maintain competitiveness.

Leave a Comment